Candlestick Patterns - Summary

A candlestick pattern is a visual representation of price movements on a candlestick chart, which many believe can forecast market trends. Recognizing these patterns can be subjective, and charting software often depends on predefined rules to identify them. There are 42 known candlestick patterns, which can be categorized into simple and complex types.

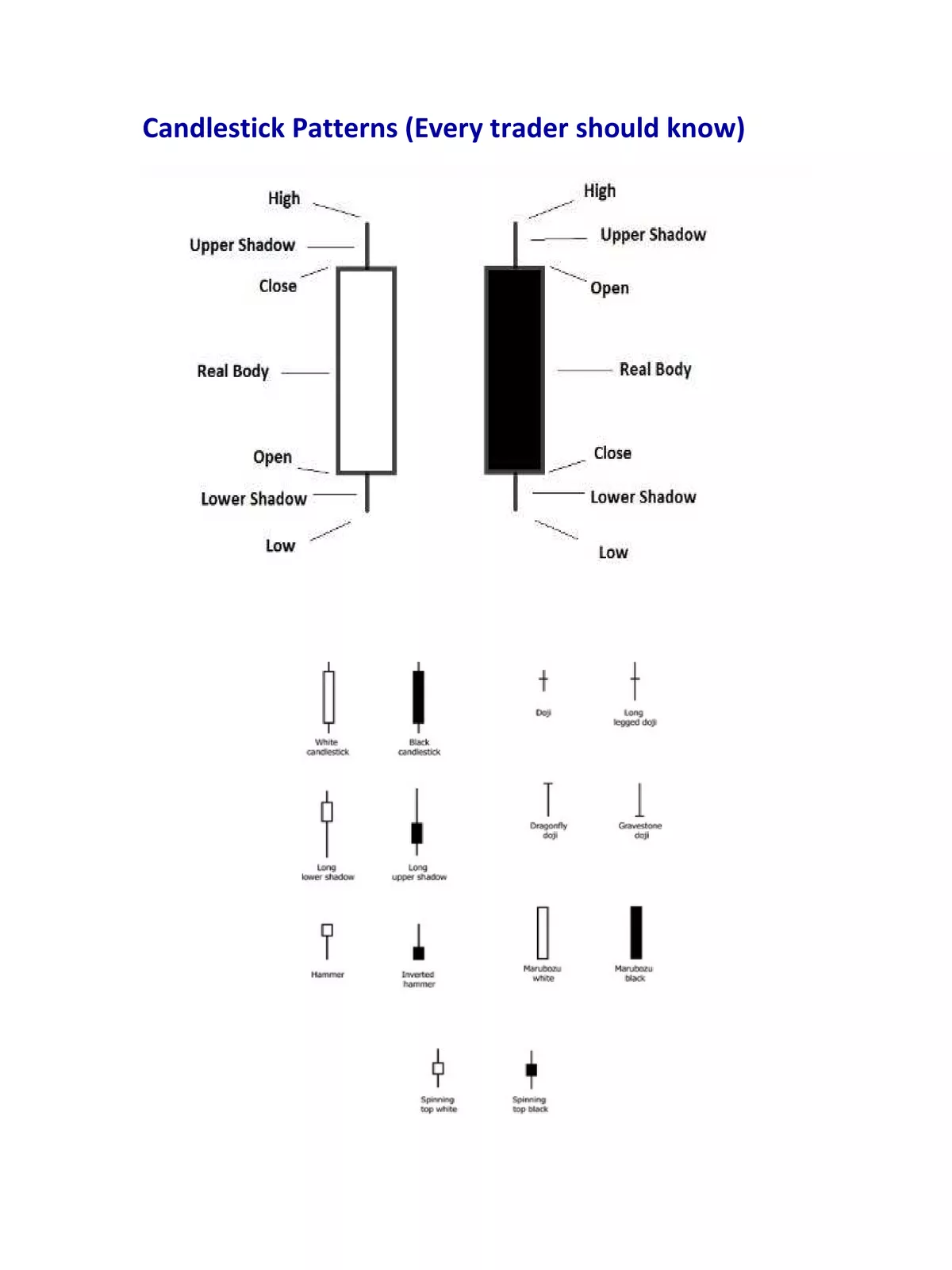

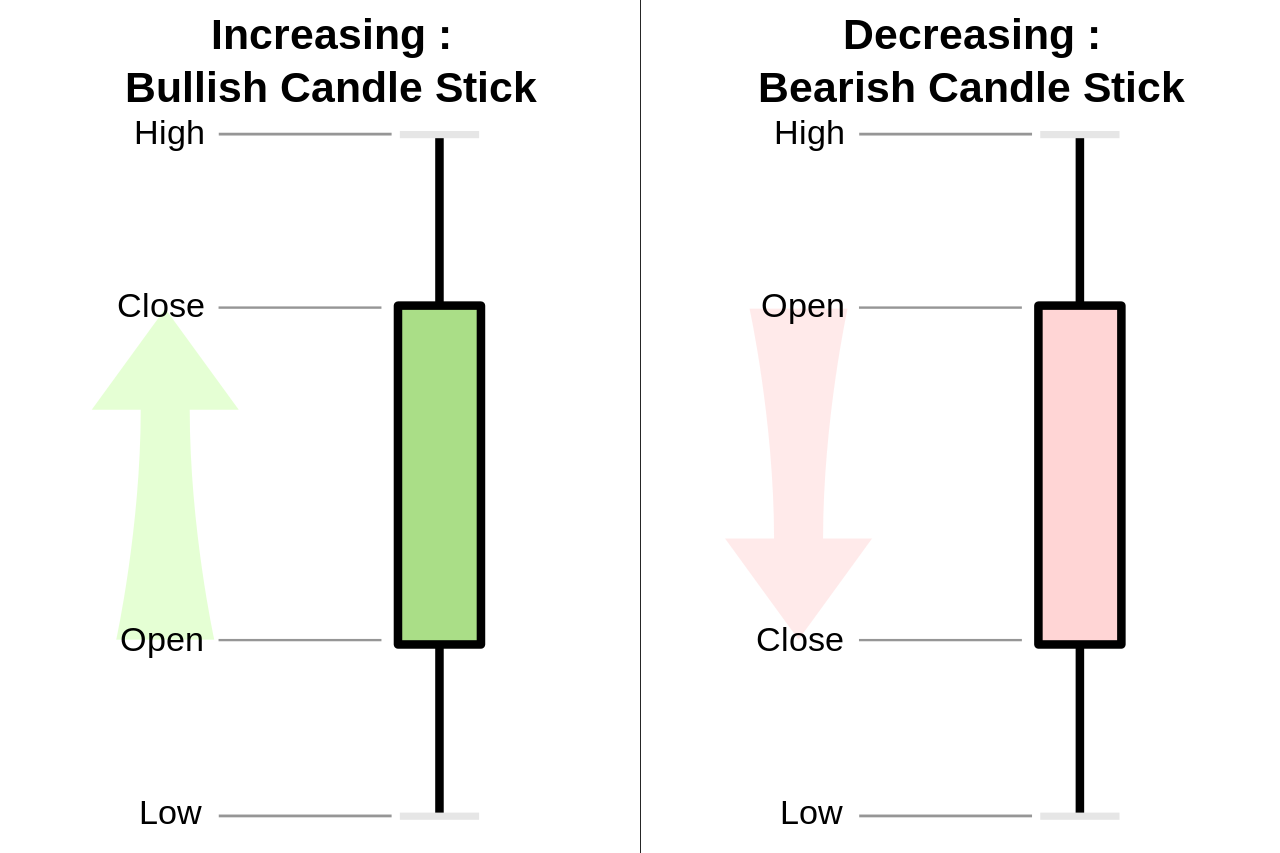

Candlesticks depict the movement of prices for a specific period, showing the opening, high, low, and closing prices of a financial asset. If the opening price is higher than the closing price, a filled candlestick (typically red or black) is drawn. Conversely, if the closing price is higher than the opening price, a hollow or green candlestick (white with a black outline) is displayed. The filled or hollow section of the candle is known as the body or real body, which can vary in length based on its size relative to the lines above and below it. These lines, known as shadows, tails, or wicks, illustrate the high and low price ranges over the chosen time frame. It’s worth noting that not all candlesticks feature shadows.

Candlestick Patterns

Candlestick Chart[/caption>

Candlestick Chart[/caption>

Bullish Candlestick Patterns

- Morning Doji Star: This is a bullish candlestick pattern similar to the morning star. It consists of a long bearish candle and shows a gap down between candlesticks. This pattern includes three bodies: the first stick has a long black body, the second opens near the lower point, and the last represents the midpoint of the candlestick formation.

- Shooting Star: This candlestick pattern appears when a security opens during a bearish trend. Although the price may rise during the day, sellers push it back down to its initial level.

- Evening Star: This candlestick pattern indicates a potential price reversal. It also consists of three bodies: a large body, a small body, and a red body candle. It helps in recognizing future price movements and is a reliable technical pattern. The evening star is the bearish counterpart to the morning star, which is bullish.

You can download the All Candlestick Patterns PDF using the link provided below.