Class 12 Accounting Ratios Formulas - Summary

Accounting Ratios are important tools for understanding the financial health of a company. An accounting ratio shows an arithmetical relationship between two accounting variables. It is calculated based on various accounting information. By analyzing these ratios, one can compare two or more financial data, which helps in assessing the financial statements of different companies.

Understanding the Importance of Accounting Ratios in Class 12

Accounting Ratios serve as an effective tool for stakeholders, including shareholders and creditors, to evaluate a company’s performance. These comparisons are important to get insights into profitability, financial strength, and the overall financial status of firms.

Accounting Ratios Class 12 All Formulas – Types of Ratio

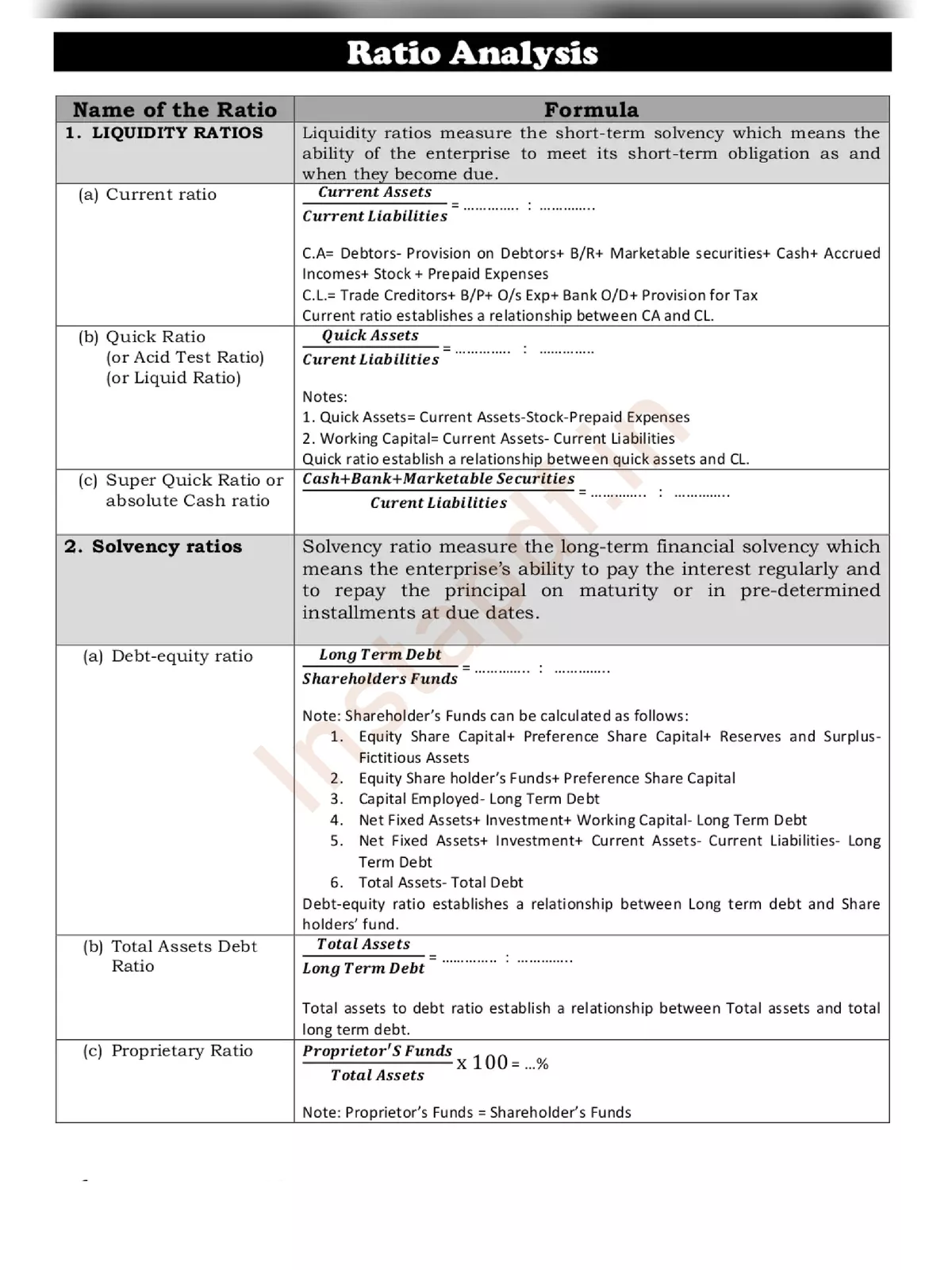

- Liquidity Ratios

- Current Ratio

- Quick Ratio

- Cash Ratio

- Profitability Ratios:

- Gross Profit Margin

- Operating Margin

- Profit Margin

- Earnings Per Share

- Leverage Ratio

- Debt-to-Equity Ratio

- Debt-to-Asset Ratio

- Debt Ratio

- Interest Coverage Ratio

- Activity Ratio

- Receivable Ratio

- Inventory Turnover Ratio

- Asset Turnover Ratio

- Liquidity Ratios

Class 12th Accounting Ratio Formula

- Current Ratio = Current Assets / Current Liabilities

- Quick Ratio = Quick Assets / Current Liabilities

- Operating Margin = (Gross Profit – Operating Expense) / Revenue

- Profit Margin = (Revenue – Operating Expenses + Non-Operating Income – Interest Expense – Income Taxes) / Revenue

- Earnings Per Share = (Net Income – Preferred Dividend) / Weighted Average Outstanding Shares

- Debt Ratio = Total Liabilities / Total Assets

- Receivable Ratio = Annual Credit Sales / Accounts Receivable

- Asset Turnover Ratio = Net Revenue / Assets

Accounting Ratios Class 12 All Formulas

To get the complete details of Accounting Ratios Class 12 All Formulas, you can easily download the PDF using the link given below.