SBI Form 15G - Summary

If you are searching for SBI Form 15G, you can easily download the SBI Form 15G PDF, which is essential for self-declaration of income to avoid tax deduction at source (TDS). By completing this form, eligible individuals can ensure that their income is below the taxable limit, thus claiming exemption from TDS.

Accessing the SBI Form 15G Made Easy

Now you can download and print the SBI Form 15G from the comfort of your home or office using the link provided below. Just follow the simple instructions, fill out the form, and submit it to the relevant authorities for a smooth TDS exemption process.

Save time and effort by accessing the SBI Form 15G directly from our website. Take charge of your finances and enjoy the benefits of tax savings with ease. Don’t wait—download the SBI Form 15G today!

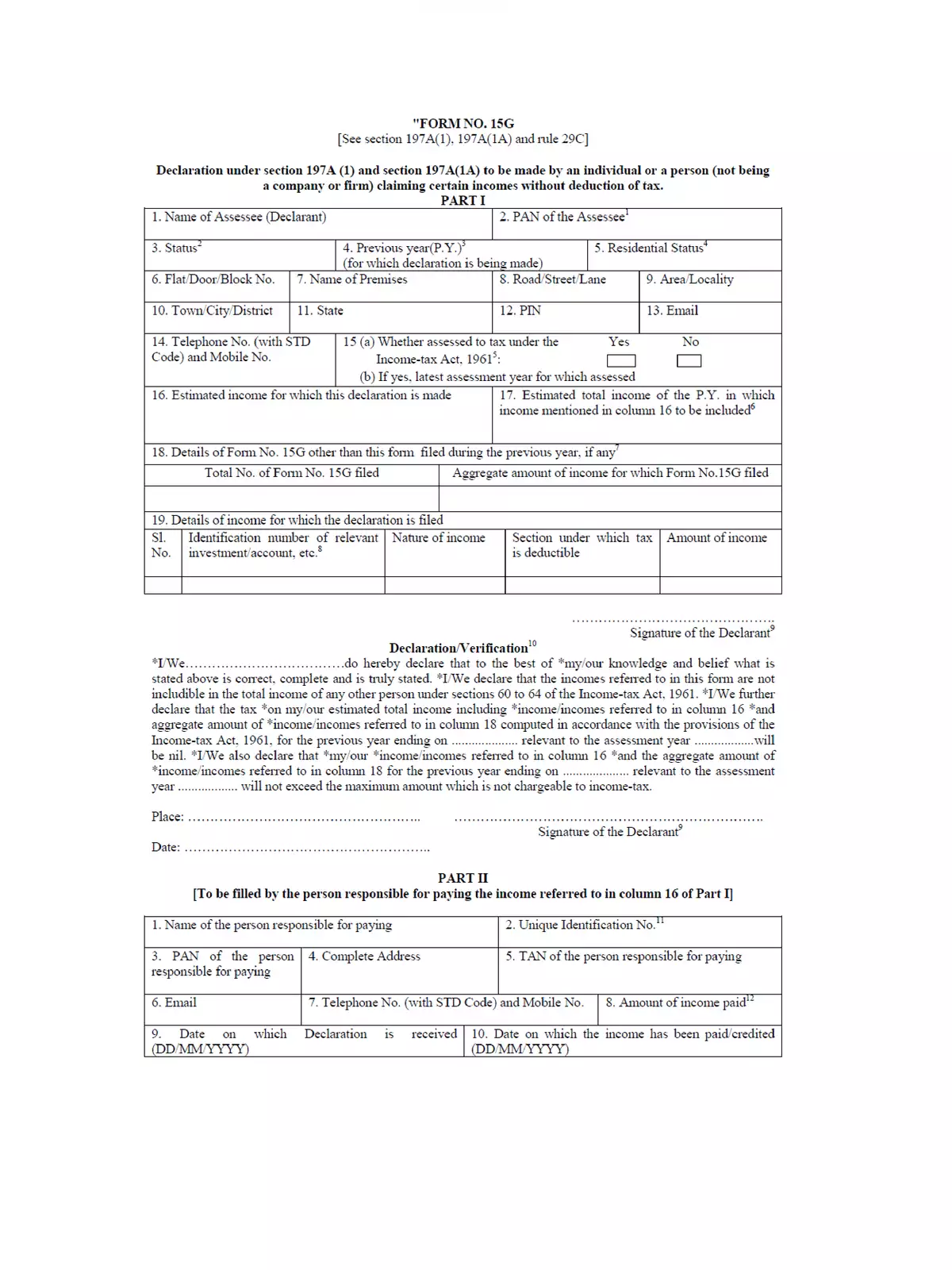

Declaration under sub-section (1) and (1A) of section 197A of the Income-tax Act, 1961, is to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax.

Mandatory Fields for SBI Form 15G

- Name of Assessee

- Pan of Assessee

- Status

- Name of Premises

- Address

- Telephone Number

- Amount of Income

- Nature of Income

- Section under which tax is deductible

- Signature of Declarant

Details of Person Responsible for Paying the Income Referenced in Column 16 Part 1

- Name of the Person

- Unique Identification Number

- PAN Number

- Complete Address

- TAN Number

- Mobile

- Amount of Income Paid

- Signature

You can download the SBI Form 15G PDF using the link given below. 📥