Income Tax Form 2022-23 - Summary

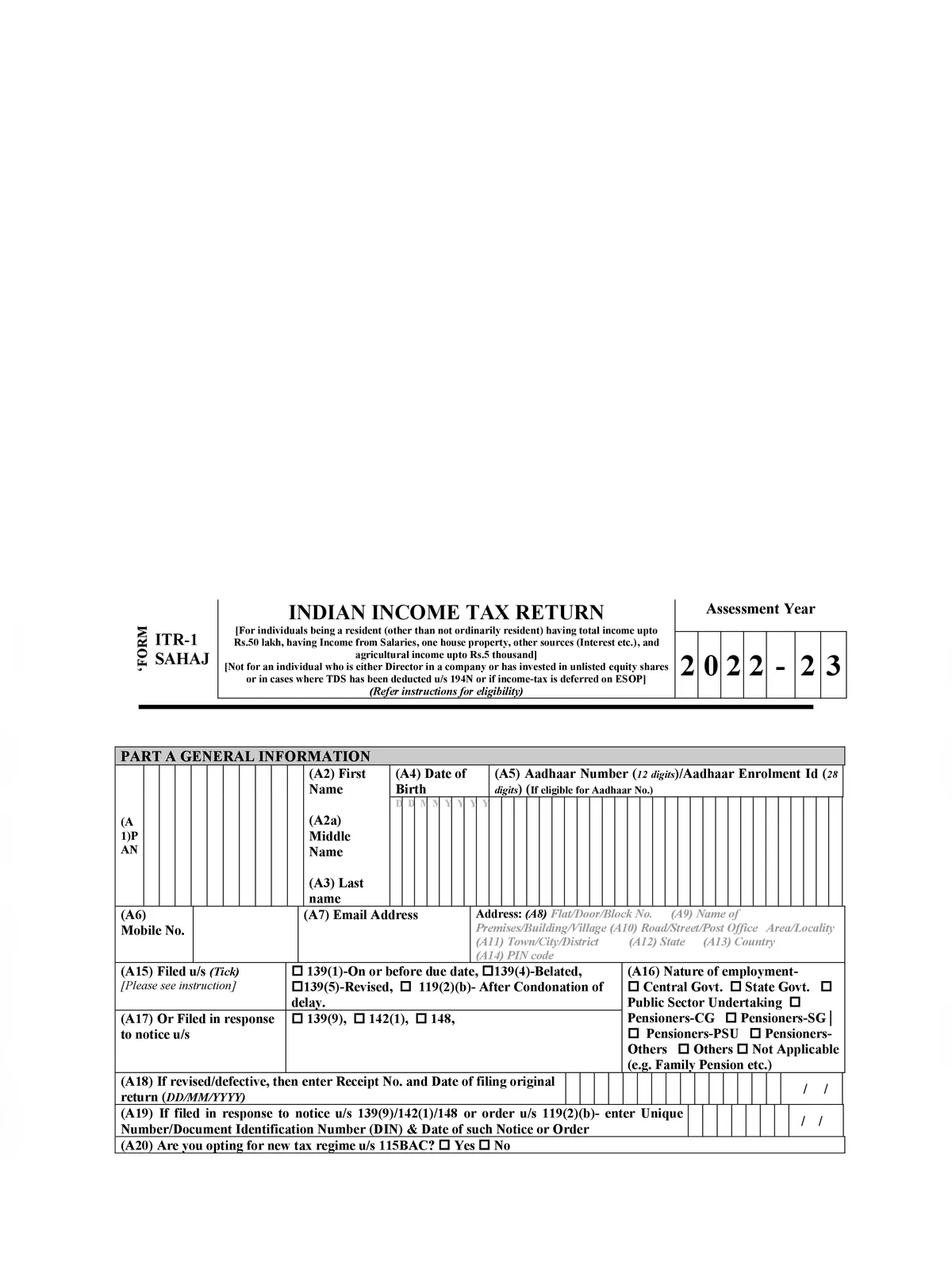

Hello, Friends today we are sharing with you Income Tax Form 2022-23 PDF to help taxpayers. If you are searching for Income Tax Form 2022-23 in PDF format then you can download it from the official website https://www.incometaxindia.gov.in or it can be directly downloaded from the link given at the bottom of this page.

The income tax Department released the New Income Tax Form 2022-23 for the taxpayers to file their income tax returns. It is important that every taxpayer should file his/her Income Tax Return on or before the specified due date. An Income Tax Return or ITR as we may call it is a form in which all the taxpayers have to declare their taxable incomes from all sources.

Income Tax Form 2022-23 Download Link

| Form Type | PDF Link | Who Filed |

|---|---|---|

| ITR-1 Sahaj | PDF Download | For individuals being a resident (other than not ordinarily resident) having total income up to Rs.50 lakh, having Income from Salaries, one house property, other sources (Interest, etc.), and agricultural income up to Rs.5 thousand |

| ITR-2 | PDF Download | For Individuals and HUFs not having income from profits and gains of business or profession |

| ITR-3 | PDF Download | For individuals and HUFs having income from profits and gains of business or profession |

| ITR-4 Sugam | PDF Download | For Individuals, HUFs, and Firms (other than LLP) being a resident having total income up to Rs.50 lakh and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE |

| ITR-5 | PDF Download | For persons other than- (i) individual, (ii) HUF, (iii) company, and (iv) person filing Form ITR-7 |

| ITR-6 | PDF Download | For Companies other than companies claiming exemption under section 11 |

| ITR-7 | PDF Download | For persons including companies required to furnish returns under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) only |

Income Tax Form 2022-23 – Income Tax Filing Due Date for AY 2022-23

| Category of Taxpayer | Due Date for ITR filing for FY 2021-22 | Due date to file audit report for FY 2021-22 |

|---|---|---|

| Businesses (Audit cases including Private Limited Company, OPC, LLPs, and firms) | 31st October 2022 | 30th September, 2022 |

| Business (Non-Audit cases including Private Limited Company, OPC, LLPs, and firms) | 31st July 2022 | – |

| Association of Persons (AOP) | 31st July 2022 | – |

| Body of Individuals (BOI) | 31st July 2022 | – |

| Individual | 31st July 2022 | – |

| Trusts, colleges, political parties (Audit Cases) | 31st October 2022 | 30th September, 2022 |

| Trusts, colleges, political parties (Non-Audit Cases) | 31st July, 2022 | – |

| Report to be filed u/s 92E | 31st October 2022 | – |

| Furnishing of Income Tax Return in case of Transfer Pricing | 30th November, 2022 | – |

| Revised Return | 31st December, 2022 | – |

| Belated/Late Return | 31st December, 2022 | – |

Income Tax Basic Salb Rate FY 2022-23 (AY 2023-24)

| Net Income Range | Rate of Income Tax |

|---|---|

| 1.1 Individuals (Other than senior and super senior citizens) | |

| Up to Rs. 2,50,000 | – |

| Rs. 2,50,000 to Rs. 5,00,000 | 5% |

| Rs. 5,00,000 to Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

| 1.2 Individuals (Senior Citizen) | |

| Up to Rs. 3,00,000 | – |

| Rs. 3,00,000 to Rs. 5,00,000 | 5% |

| Rs. 5,00,000 to Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

| 1.3 Individuals (Super Senior Citizen) | |

| Up to Rs. 5,00,000 | – |

| Rs. 5,00,000 to Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

New Tax Regime Slab Rate for Ay 2023-24

The Finance Act, 2020, has provided an option to Individuals and HUF for payment of taxes at the following reduced rates from Assessment Year 2021-22 and onwards:-

| Total Income (Rs) | Rate |

|---|---|

| Up to 2,50,000 | Nil |

| From 2,50,001 to 5,00,000 | 5% |

| From 5,00,001 to 7,50,000 | 10% |

| From 7,50,001 to 10,00,000 | 15% |

| From 10,00,001 to 12,50,000 | 20% |

| From 12,50,001 to 15,00,000 | 25% |

| Above 15,00,000 | 30% |

You can download the Income Tax Form 2022-23 PDF using the link given below.