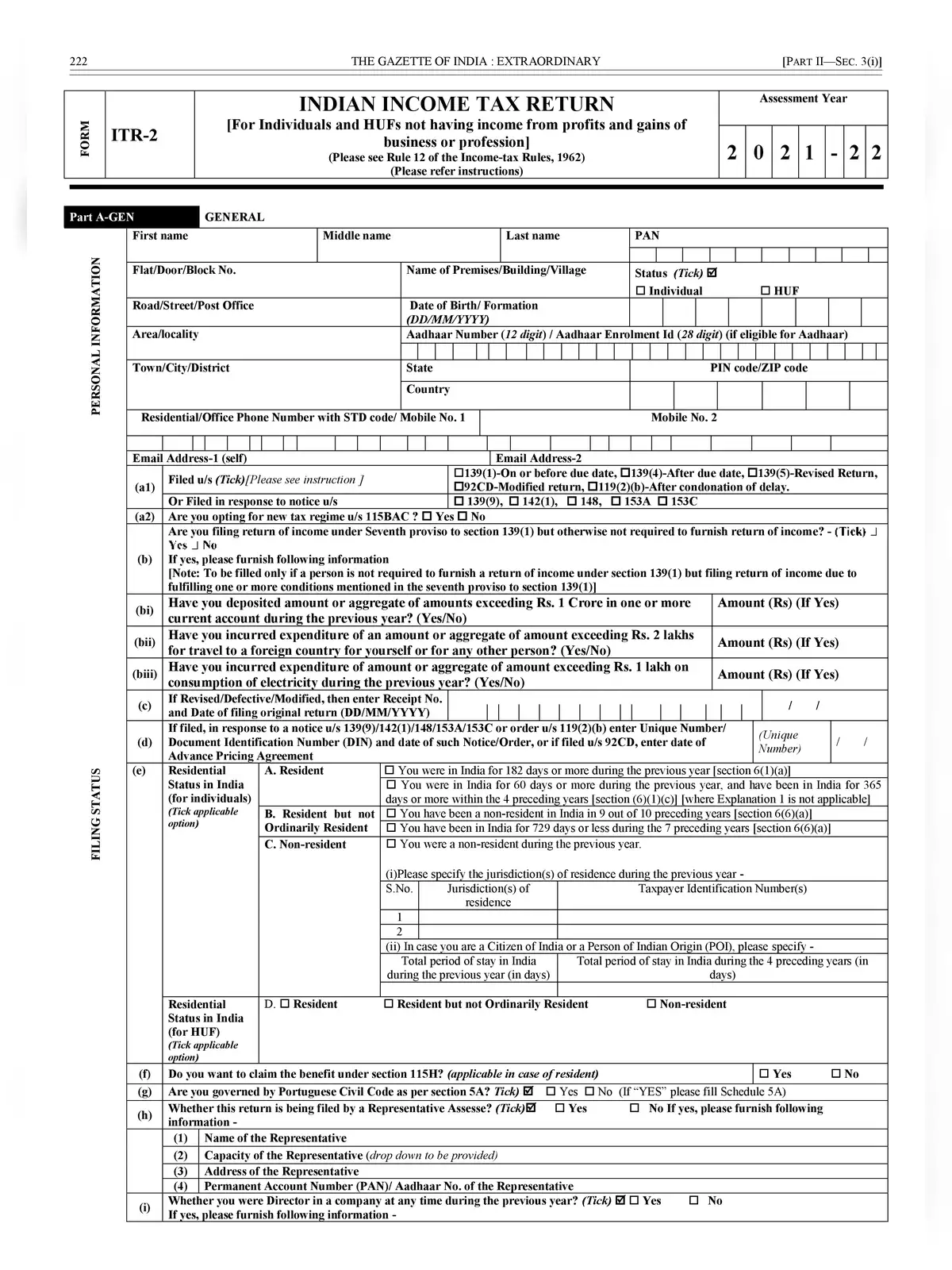

ITR Form 2 AY 2021-22 - Summary

The Central Board of Direct Taxes has notified Income Tax Return Forms (ITR Forms) for the Assessment Year 2021-22 vide Notification no.21/2021 in G.S.R. 242(E) dated 31.03.2021. Keeping in view the ongoing crisis due to COVID-19 pandemic and to facilitate the taxpayers, no significant change have been made to the ITR Forms in comparison to the last year’s ITR Forms. Only the bare minimum changes necessitated due to amendments in the Income-tax Act, 1961 have been made.

ITR Form 2 is required to be filed by the Individuals and HUF receiving income other than income from “Profits and Gains from Business or Profession”. Thus, persons having income from the following sources are eligible to file Form ITR 2:

- Income from Salary/Pension

- Income from House Property(Income Can be from more than one house property)

- Income from Capital Gains/loss on sale of investments/property (Both Short Term and Long Term)

- Income from Other Sources (including winning from Lottery, bets on Race Horses and other legal means of gambling)

- Foreign Assets/Foreign Income

- Agricultural Income more than Rs 5000

- Resident not ordinarily resident and a Non-resident

A Director of any company and an individual who is invested in unlisted equity shares of a company will be required to file their returns in ITR-2.

You can download the ITR Form 2 AY 2021-22 in PDF format using the link given below or an alternative link for more details.