Income Tax Form 2021-22

The Central Board of Direct Taxes has issued Income Tax Return Forms (ITR Forms) for the Assessment Year 2021-22 vide Notification no.21/2021 in G.S.R. 242(E) dated 31.03.2021. Income Tax Form 2021 -22 PDF can be download directly from the link given inside this article.

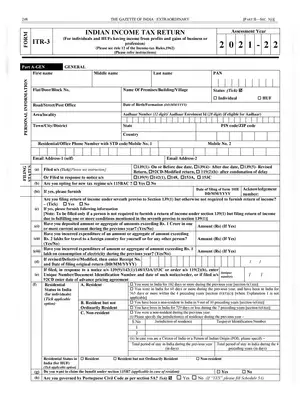

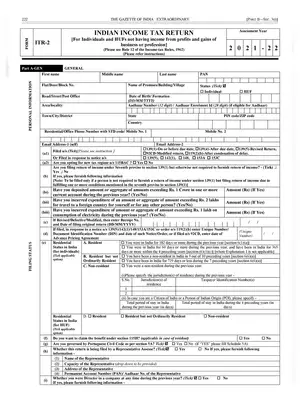

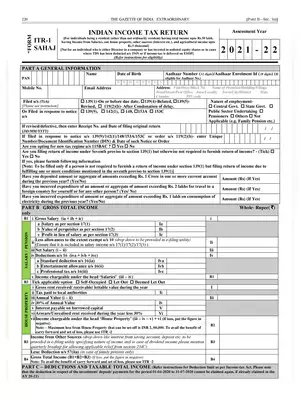

The Income Tax Department has issued this form for the tax payers.There are different types of income tax return forms depending on the taxpayer's category and income type. Such forms are: ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6, and ITR 7. However, one should be cautious before choosing a tax return form to file. You can also download this income tax form pdf by visiting at the official website of Income Tax Department www.incometaxindia.gov.in.

Income Tax Form 2021-22 PDF

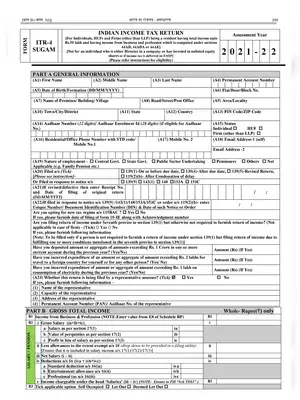

- ITR Form 1- This form is also konwn as Sahaj Form

- ITR Form 2- Those individuals who have their income by selling assets or properties.Individuals having incomes from outside of India can also use this form

- ITR Form 3- Individual taxpayers or HUFs operating as partners in a firm without conducting any business under the firm are eligible to apply for ITR 3.

- ITR Form 4- Individuals who run a business and accrue income from it or other professions can file for IT returns by using this form.

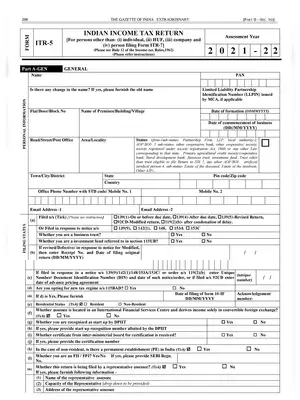

- ITR Form 5- Business trusts, firms, etc., must opt for this form to file ITR. ITR 5 means forms that are eligible for partnership firms or LLPs.

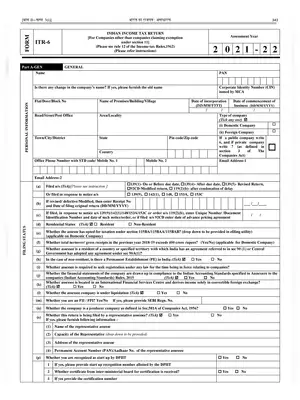

- ITR Form 6- ITR 6 means an income tax return form eligible for companies to file tax returns. Companies can file income tax by this form only electronically.

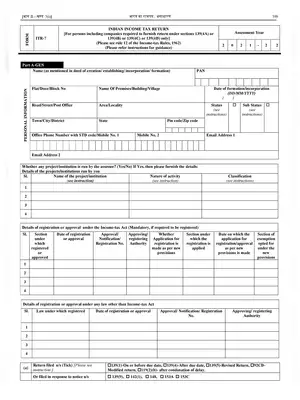

- ITR Form 7- Individuals or companies required to furnish returns under Section 139(4A) or 139(4C) or 139(4D) or 139(4E) or 139(4F) must utilise ITR 7 form to file income tax returns.