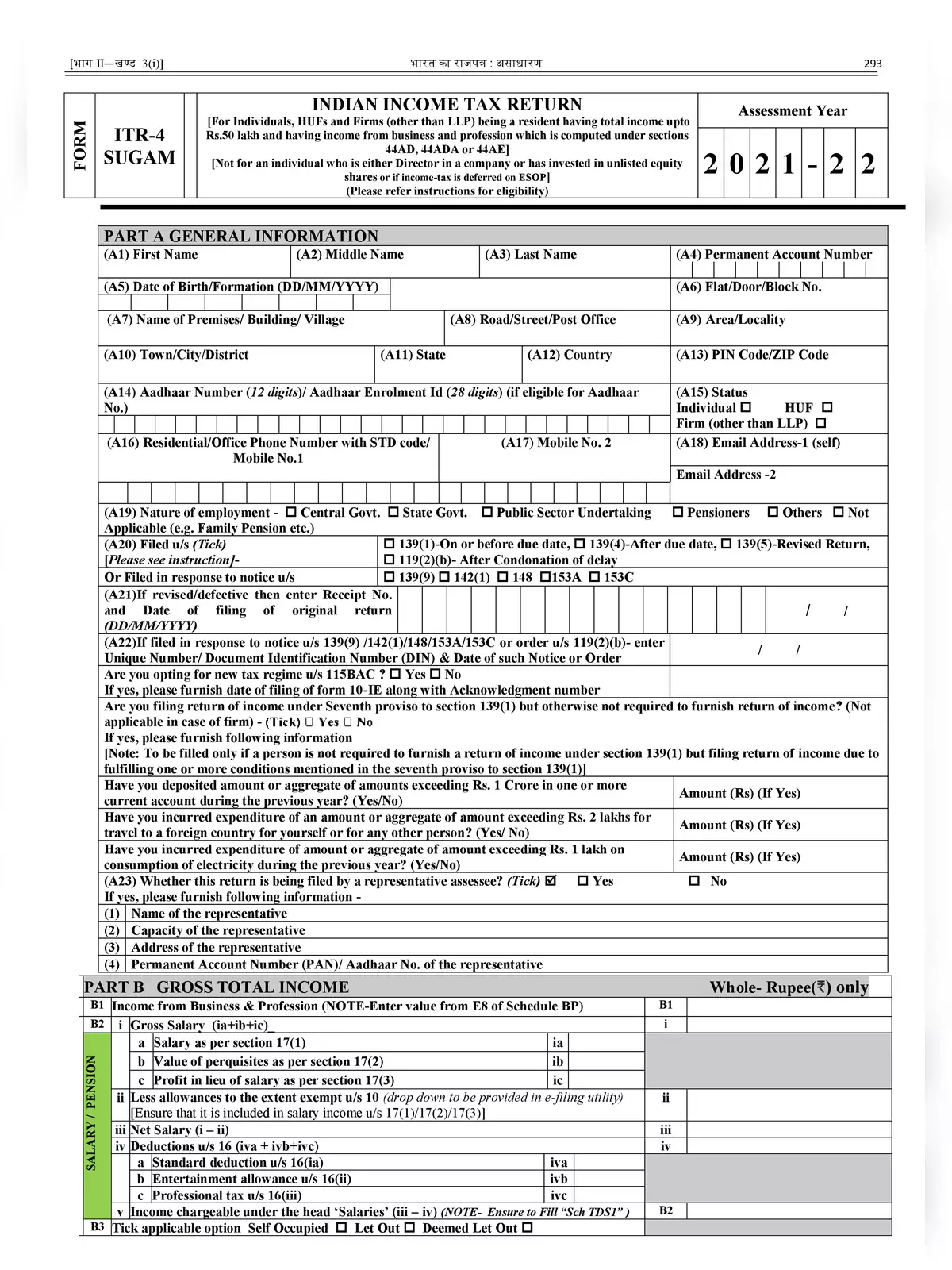

ITR Form 4 Sugam AY 2021-22 - Summary

The Central Board of Direct Taxes has notified Income Tax Return Forms (ITR Forms) for the Assessment Year 2021-22 vide Notification no.21/2021 in G.S.R. 242(E) dated 31.03.2021. Keeping in view the ongoing crisis due to COVID pandemic and to facilitate the taxpayers, no significant change have been made to the ITR Forms in comparison to the last year’s ITR Forms. Only the bare minimum changes necessitated due to amendments in the Income-tax Act, 1961 have been made.

ITR 4 Sugam is to be filed by the individuals/HUF/ partnership firm whose total income of AY 2021-22 includes

- Business income under section 44AD or 44AE

- Income from profession calculated under section 44ADA

- Salary/pension having income up to Rs 50 lakh

- Income from One House Property having income up to Rs 50 lakh (excluding the brought forward loss or loss to be carried forward cases under this head);

- Income from Other Sources having income up to Rs 50 lakh (Excluding winning from lottery and income from horse races). Note : 1. Freelancers engaged in the above profession can also opt for this scheme if their gross receipts don’t exceed Rs 50 lakhs.

You can download the ITR Form 4 Sugam AY 2021-22 in PDF format using the link given below or an alternative link for more details.