HDFC Bank Form 15G - Summary

Understanding HDFC Bank Form 15G

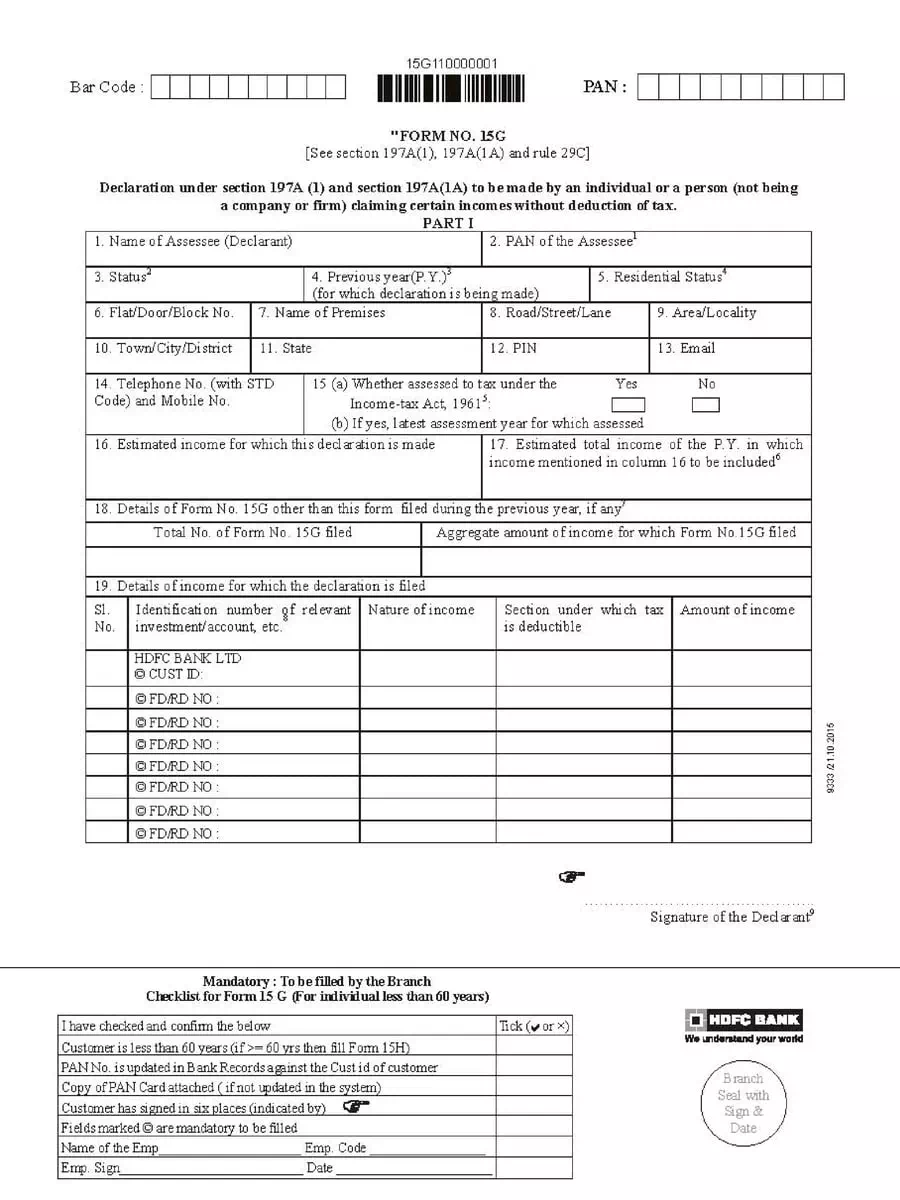

HDFC Bank Form 15G is an important declaration that allows fixed deposit holders (individuals under 60 years old and HUF) to avoid TDS (tax deduction at source) on their interest income for the financial year. This form is a simple, effective way to ensure that you receive your interest without any tax deductions.

What is Form 15G?

Form No. 15G and 15H are self-declaration forms that individuals can use to inform the bank that their total income is below the taxable limit. Therefore, no TDS should be deducted from their interest earnings. It’s crucial to fill out this form correctly to take advantage of this benefit.

Moreover, if you withdraw your provident fund before completing five years of service, a TDS of 10 percent will apply on the withdrawal from June 1, 2015. Thus, submitting Form 15G can help you manage your finances better.

You can easily download the HDFC Bank Form 15G in PDF format from the link given below. This will guide you through the process of filling it correctly and submitting it to avoid unnecessary tax deductions. Remember to keep your income details handy when you fill out the form!