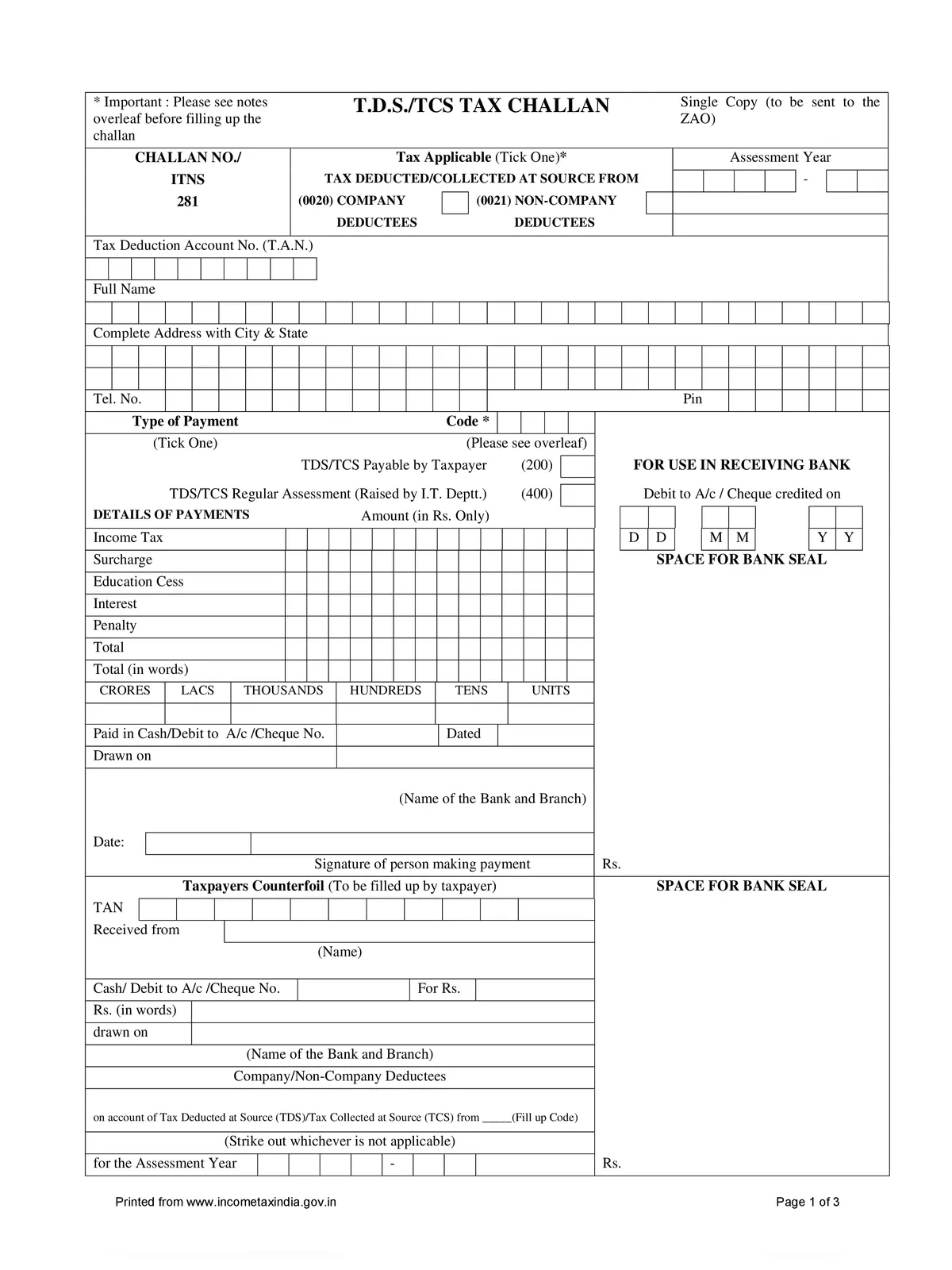

TDS/TCS Tax Challan Form 281 - Summary

Download the TDS/TCS Tax Challan Form 281 in PDF format here. Understanding TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) is important for everyone participating in financial transactions in India. TDS is a system set by the Government where the person making a payment (deductor) must deduct tax at a fixed percentage before paying the person receiving the payment (deductee), and then deposit it with the Income Tax Department.

TCS, on the other hand, is the tax that a seller collects from the buyer when selling certain specified goods. This Tax Challan is essential for both corporate and non-corporate entities to ensure proper deposit of TDS and TCS.💰

Why Use TDS/TCS Tax Challan Form 281?

This form is crucial for individuals and businesses because it helps ensure that taxes are paid accurately and on time. Missing deadlines can lead to penalties and legal problems. Therefore, using the TDS/TCS Tax Challan Form 281 is a responsible choice for all taxpayers.

TDS/TCS Tax Challan Form 281 Download

Here are the three types of challans introduced by the Income Tax Department:

- Challan No. ITNS 280 – This form is for paying Income Tax which can include Self-Assessment Tax, Advance Tax, Tax on Regular Assessment, Tax on Distributed Profits, or other types of income. Payments can be made online or via cheque, DD, etc., at various bank branches. Regardless of the payment method, Challan ITNS 280 must be used.

- Challan No. ITNS 281 – This Challan is specifically for depositing Tax Deducted at Source (TDS) or Tax Collected at Source (TCS).

- Challan No. ITNS 282 – This form is for payments related to Gift Tax, Wealth Tax, Expenditure Tax, Estate Duty, Securities Transaction Tax, and other Direct Taxes.

Due date for payment in case of a government assessee:

- Tax Deposited without challan – Same day

- Tax deposited with challan – 7th of the next month. For example, if TDS is to be deposited for May 2023, the due date would be June 7, 2023.

Download the TDS/TCS Tax Challan Form 281 in PDF format using the link given below to make your tax payments smoothly.