State Code of “Tax Payers Identification” (TIN) - Summary

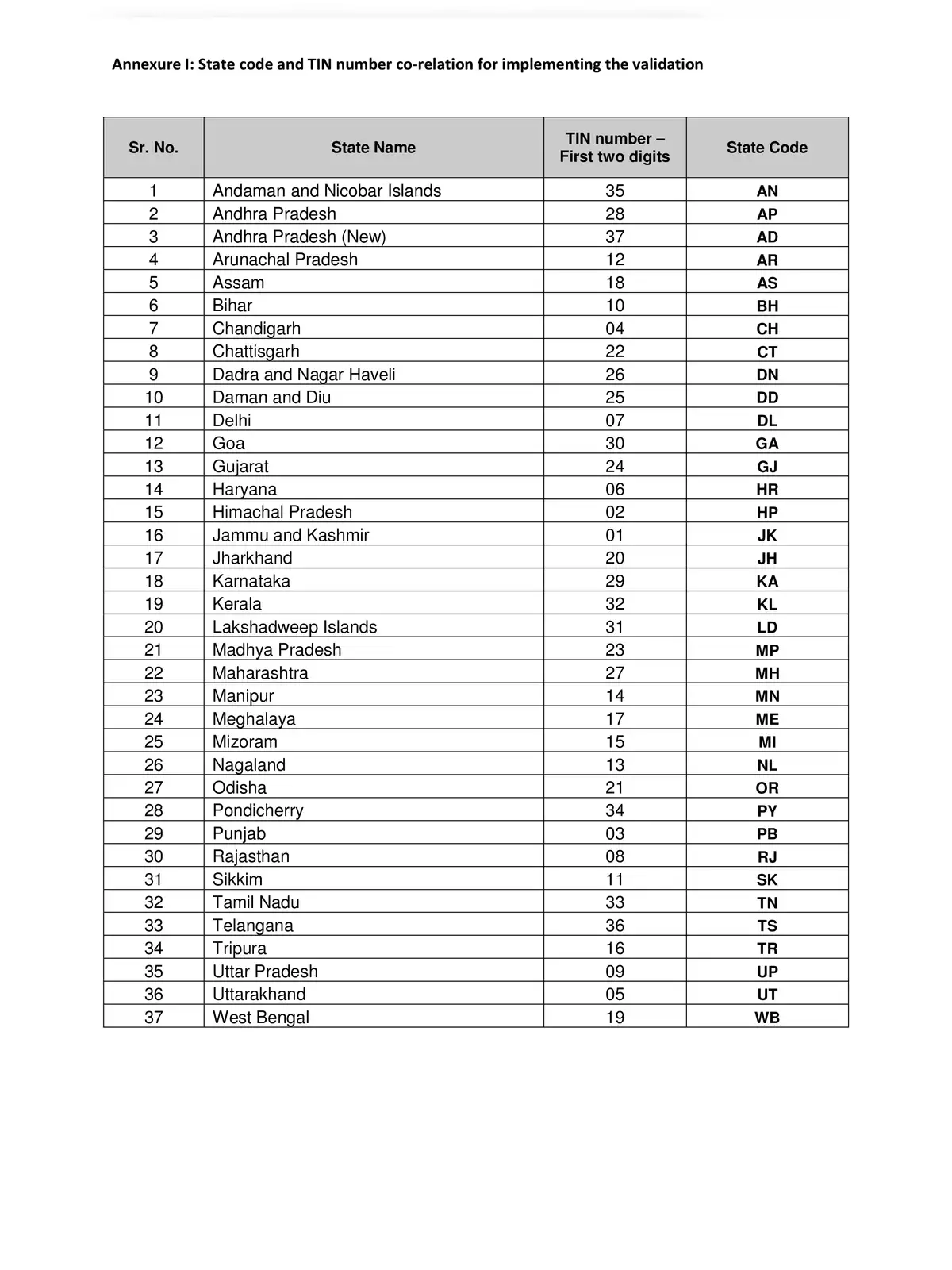

The Tax Payer’s Identification Number (TIN) is a crucial identification number that is uniquely assigned to dealers registered under VAT. This 11-digit number is designed to ensure that each TIN is unique across India. The first two digits of the TIN represent the State Code, which plays an important role in tax identification and management.

Understanding Your TIN

Your TIN is not just a number; it is essential for performing various transactions related to tax compliance. It serves as your official identity within the tax system. By having a TIN, all dealers are properly registered, which helps in maintaining an accurate record of taxation.

Why is the State Code Important?

The State Code within the TIN is significant as it helps tax authorities to easily identify where registered dealers are located. This is crucial for local tax administration and enforcement, making sure that taxes are collected correctly and efficiently.

If you’re seeking more information about the Tax Payer’s Identification Number and its impact on your dealings, we recommend downloading our detailed PDF available on this page. This PDF download will provide you with a clearer understanding of the TIN, its role in VAT, and why it is important for your business operations. Be sure to click below to download the PDF and boost your knowledge!