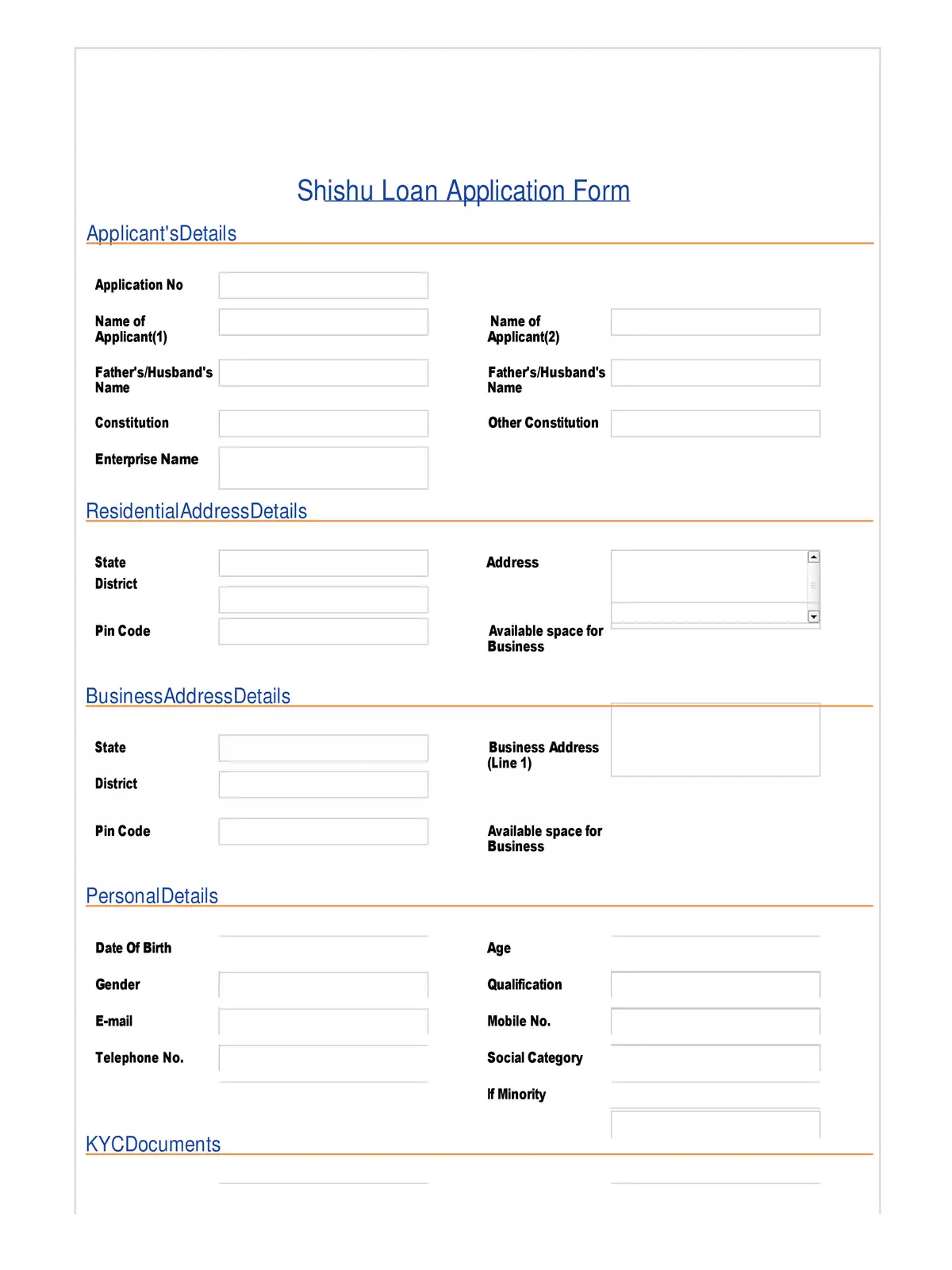

Shishu Loan Application Form - Summary

CHECKLIST: (Documents to Submit with the Shishu Loan Application)

- Proof of identity – A self-certified copy of your Voter’s ID card, Driving License, PAN Card, Aadhar Card, Passport, or any Photo ID issued by a Government authority.

- Proof of Residence – A recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID card, Aadhar Card, Passport of the individual, Proprietor, or Partners, a bank passbook, or the latest account statement duly attested by bank officials, a domicile certificate, or a certificate issued by a Government authority or Local Panchayat/Municipality.

- Two recent photographs of the applicant, not older than 6 months.

- A quotation for the machinery or other items you wish to purchase.

- Name of the supplier, details of the machinery, and the price of the machinery and/or items to be purchased.

- Proof of identity and address of the Business Enterprise – Copies of relevant licenses, registration certificates, or other documents that pertain to the ownership, identity, and address of the business unit, if applicable.

- Proof of category such as SC/ST/OBC/Minority, etc.

NOTE:

- No processing fee is required.

- No collateral is needed.

- The repayment period for the loan is extended up to 5 years.

- Applicants should not be a defaulter with any Bank or Financial Institution.

For your convenience, you can easily download the Shishu Loan Application Form in PDF format from the link provided below. It’s simple and will help you get started on your loan application process!