Punjab & Sind Bank PPF Form - Summary

The Public Provident Fund (PPF) form is essential for anyone looking to save and invest wisely in India. The PPF is one of the most popular savings-cum-investment options available, allowing individuals to deduct investments up to Rs. 1,50,000 from their taxable income. Not only is the interest earned non-taxable, but the total maturity amount you receive after 15 years is also exempt from taxes. This makes the PPF an excellent choice for those wishing to grow their savings while enjoying significant tax benefits.

Advantages of Opening a PPF Account

Here are five key advantages of having a PPF account that you should be aware of:

Guaranteed, risk-free returns: The Public Provident Fund is supported by the Government of India, making it completely safe. Your money is secure, and creditors or courts cannot claim these funds to pay off debts, ensuring a guaranteed return from your investment.

Multiple tax benefits of PPF: One of the standout features of a PPF account is its exempt-exempt-exempt (EEE) tax status. This means that the money you invest, the interest you receive, and the amount at maturity are all free from tax! PPF truly stands out as one of the most tax-efficient investments one can make.

Small investments with high returns: You can start a PPF account with just Rs. 100. Each year, you are allowed to contribute a minimum of Rs. 500, with a maximum limit of Rs. 1,50,000. You can make this contribution in up to 12 installments or as a one-time payment. As of June 30, 2018, the PPF offers an interest rate of 7.6%, which is compounded annually.

Tip: Always aim to invest before the 5th of every month to enhance your returns. Investing the full Rs. 1,50,000 at the beginning of the financial year (by April 5) will ensure you gain the maximum benefit.

Access to funds through loans and partial withdrawals: Despite the PPF’s 15-year lock-in period, you still have options to access your money. You can avail a loan (up to 25% of the balance available two years prior to your application) between the third and sixth years. This loan must be returned within 36 months, with an interest charge of 2% above the interest you earn from the account.

From the seventh year onwards, partial withdrawals begin to be allowed. If you need money for critical medical treatment or to fund education, you can also close your PPF account before the maturity date.

Flexible tenure options: After your PPF account matures at the end of 15 years, you can either take out the entire amount or extend your account for an additional five years at a time.

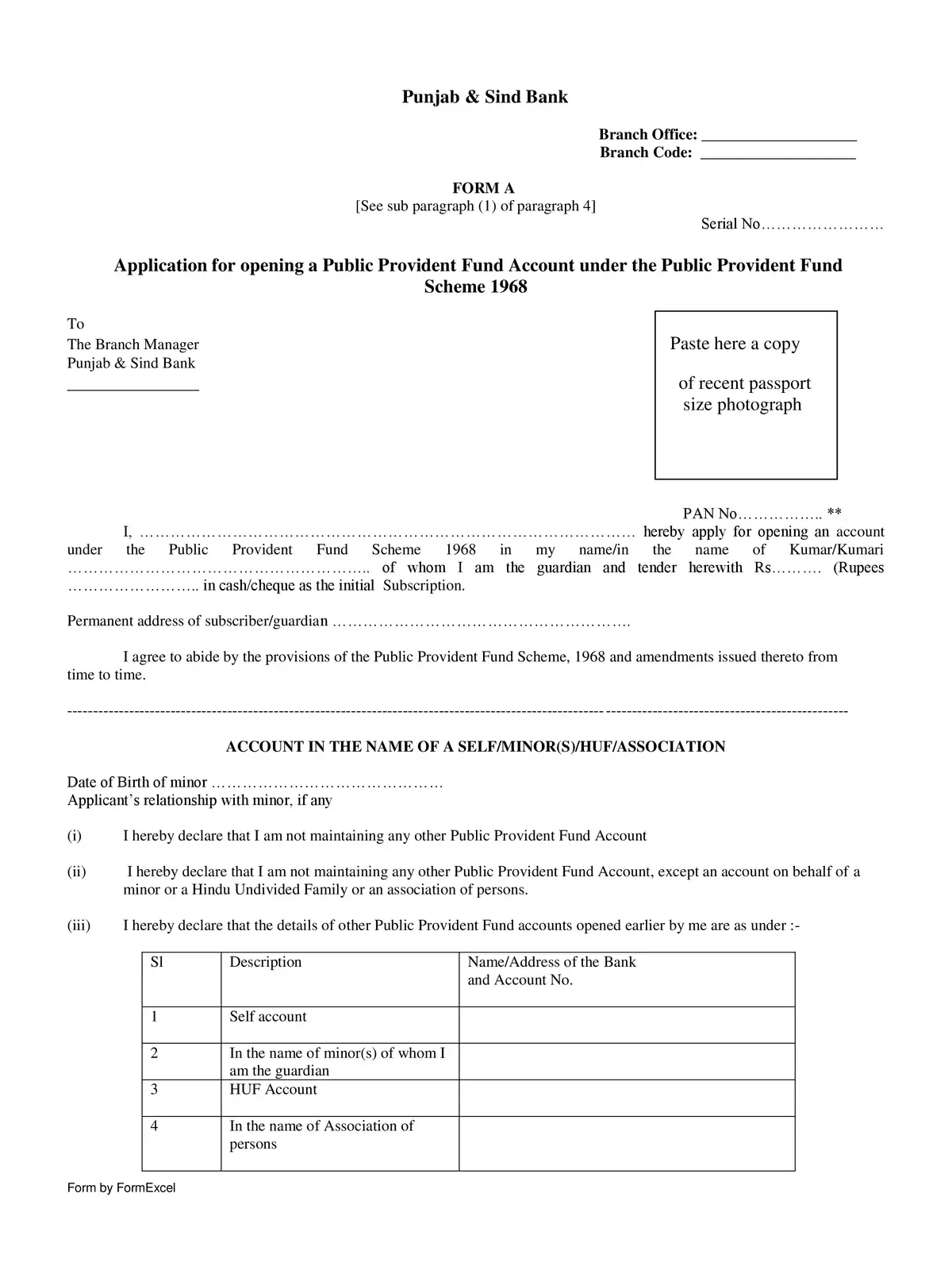

Required Documents for Opening a PPF Account

- An Identity proof (Voter ID/PAN Card/Aadhar Card)

- Proof of residence.

- Passport size photographs.

- Pay-in-slip (available at the bank branch/post office)

- Nomination form.

For more information, you can easily download the PPF form PDF below! Make sure to download it so that you can begin your journey towards smart saving and investment with PPF today.