Pradhan Mantri Suraksha Bima Yojana - Summary

Pradhan Mantri Suraksha Bima Yojana is a comprehensive Personal Accident Insurance Scheme that provides a one-year cover, offering essential protection against death or disability due to accidents. It can be renewed annually for continued peace of mind.

The premium for this scheme will be automatically deducted from the account holder’s bank account through the ‘auto debit’ option, which must be consented to during enrollment.

The scheme is managed and provided through Public Sector General Insurance Companies (PSGICs) and other approved General Insurance companies, in collaboration with various participating banks.

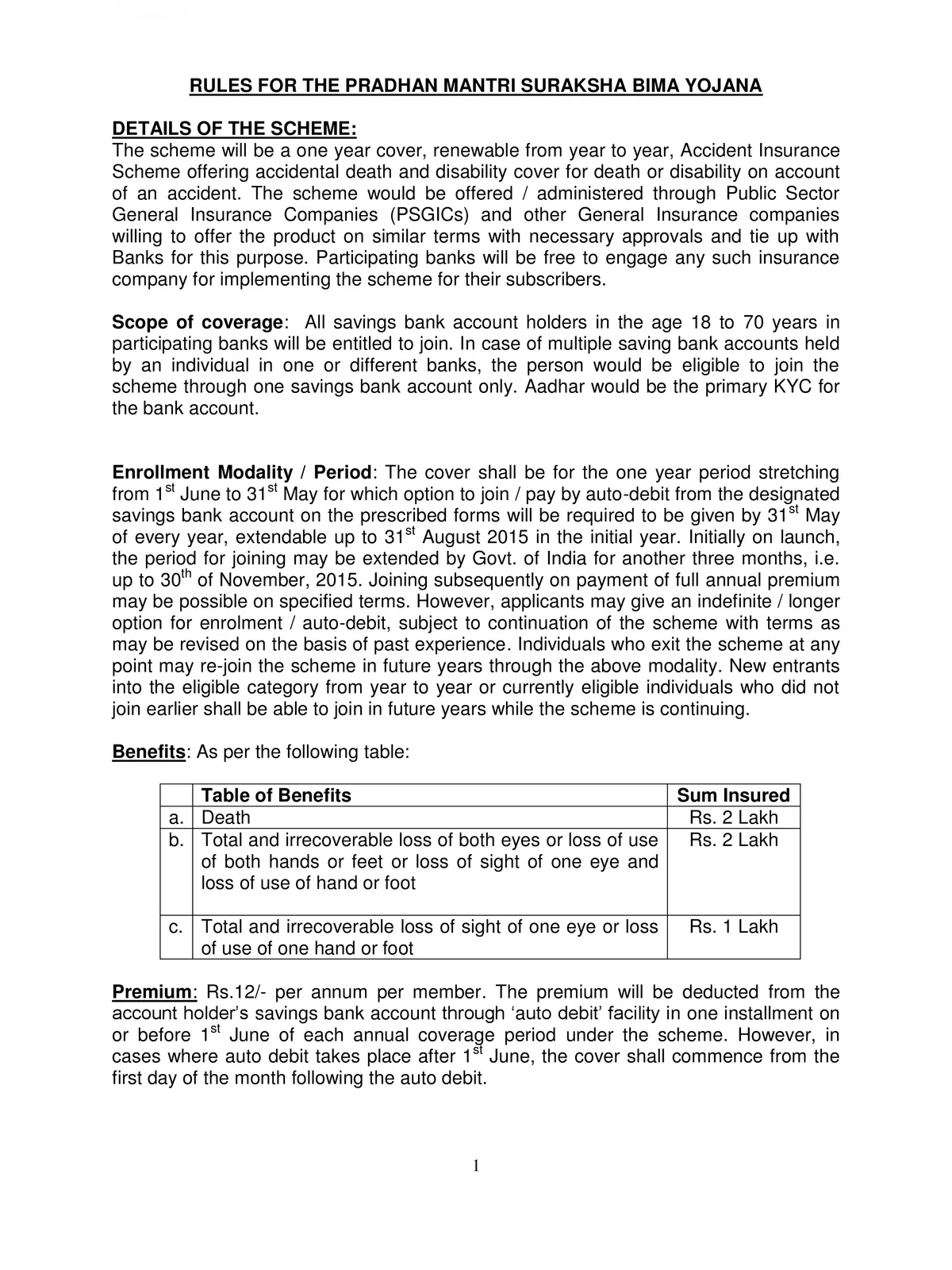

Benefits of Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Pradhan Mantri Suraksha Bima Yojana is designed for individuals aged between 18 and 70 years who have a bank account. Participants must give their consent to enable auto-debit by May 31st each year for coverage from June 1st to May 31st of the following year. Aadhar will serve as the primary Know Your Customer (KYC) document for bank account verification.

Under this scheme, the risk coverage is as follows: Rs. 2 lakh for accidental death and complete disability, and Rs. 1 lakh for partial disability. The annual premium is merely Rs. 12, which will be deducted in one go using the auto-debit facility.

The initiative is available exclusively from Public Sector General Insurance Companies or other General Insurance Companies willing to offer the product under similar conditions and partnership with banks.

Eligibility Criteria

All individual bank account holders, whether single or joint, within the age bracket of 18 to 70 years at the participating banks, can join the scheme. In case an individual holds multiple accounts in the same or different banks, they can enroll through only one bank account.

Premium Amount

- Insurance Premium to Insurance Company: Rs. 10/- per annum per member

- Reimbursement of Expenses to BC/Micro/Corporate/Agent: Rs. 1/- per annum per member

- Reimbursement of Administrative expenses to participating Bank: Rs. 1/- per annum per member

How to Enroll in Pradhan Mantri Suraksha Bima Yojana

To subscribe to Pradhan Mantri Suraksha Bima Yojana, individuals can visit any participating bank or insurance company.

Many well-known banks also allow policy enrollment via their internet banking services. To do this, subscribers need to log into their internet banking account and opt for the scheme.

In addition, subscribers can quickly send a message from their registered mobile number to the toll-free numbers of the banks or insurance companies for assistance.

For more details, you can download the Pradhan Mantri Suraksha Bima Yojana in PDF format using the link given below.