Post Office Savings Bank Account Opening Form - Summary

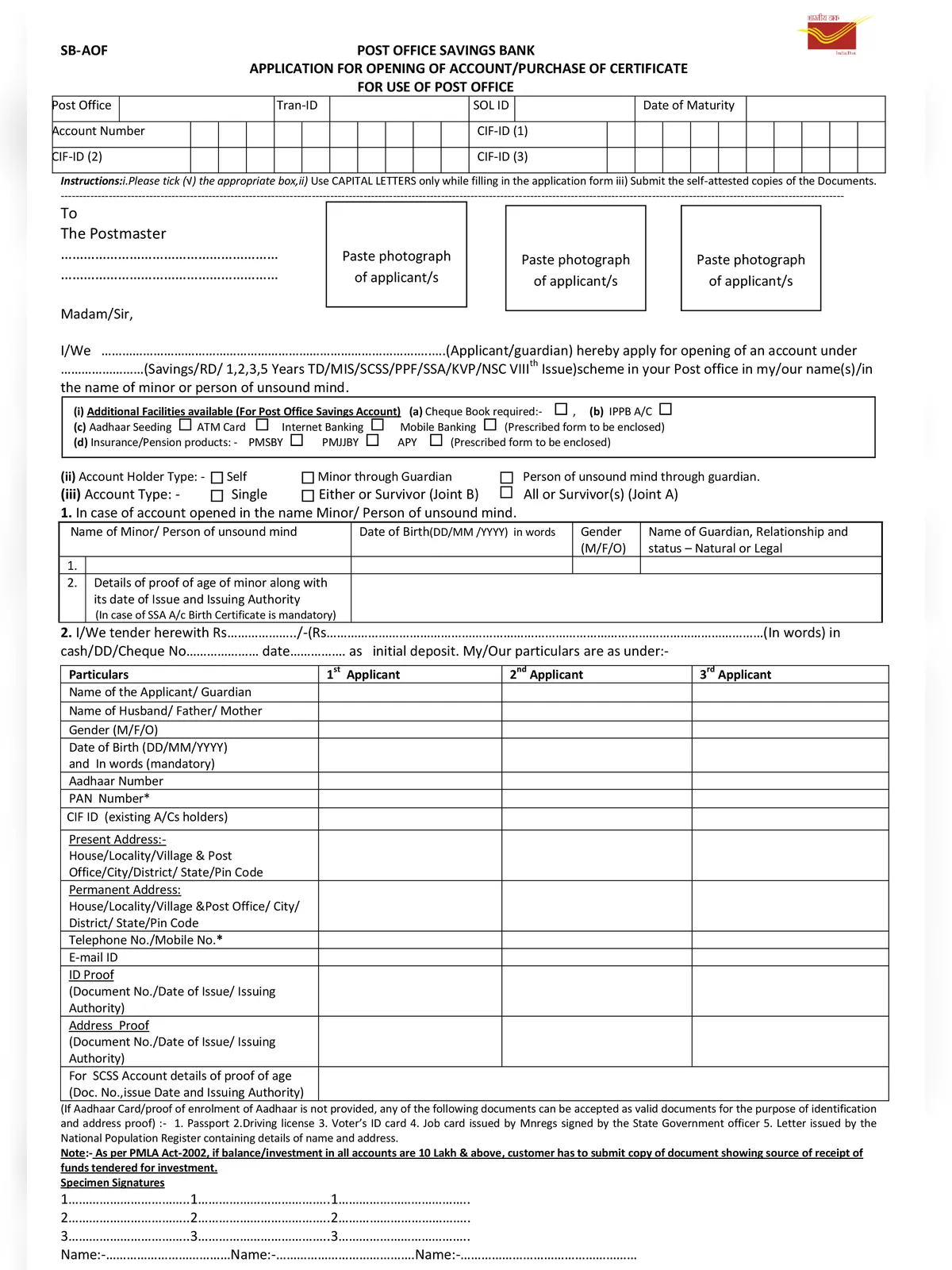

Post Office Savings Bank Account Opening Form can be easily accessed using the Post Office Savings Bank Account Opening Form PDF. You can get this form at your nearest post office branch, or you can directly download it from the link provided at the bottom of this page. Please note that an individual can open only one single account.

The Post Office Savings Bank Account functions much like a regular savings account, making it a secure place to deposit your money. This account allows you to withdraw your savings quickly, whether you need all or just part of the funds. It typically provides guaranteed returns, making it a great choice for senior citizens and individuals looking for stable income without taking risks.

Post Office Savings Bank Account Opening Form – Eligibility Criteria

- A single adult

- Two adults only (Joint A or Joint B)

- A guardian on behalf of a minor

- A guardian on behalf of a person of unsound mind

- A minor above 10 years in their own name

- Each individual can open only one single account

- Only one account can be opened under the name of a minor (aged above 10 years or person of unsound mind)

Documents Required for Post Office Savings Bank Account

- ID Proof

- Electoral Photo Identity card

- Aadhaar

- Ration Card with photograph

- Passport

- Driving License

- Photo Identity Card issued by a recognized University, Education Board, College, School, or Identity card from Central/State Government or PSU.

- Address Proof

- Bank or Post Office Passbook/Statement with a current address

- Passport

- Ration Card with current address

- Electricity Bill

- Telephone Bill not more than three months old

- Salary Slip from a reputed Employer with current address

- Aadhaar

- One (or two in case of EDBO) recent Passport Size Photographs are needed. If it’s a Joint Account, photographs of all joint holders should be provided.

Post Office Savings Bank Account Benefits

- Cheque facility: You can request a cheque book for existing accounts.

- ATM/Debit card: Account holders who maintain the required minimum balance can obtain ATM/Debit cards from CBS Post Offices.

- Minor Accounts: Post Office Savings Accounts are also available for minors. Parents or guardians can operate accounts for minors below 10 years, while those aged 10 and above can manage their own accounts.

- Portability: If you change your address or want to switch branches for better service, you can transfer your Post Office Savings Account to a branch of your choice.

- Nomination: When you open the account, you can nominate someone to receive the account’s funds in case of your passing away.

- Joint Holdings: You can open a joint account with two or three adults. Single accounts can also be changed to joint accounts and vice versa.

- Tax Exemptions: Joint accounts allow two or three adults to share the account benefits.

- Electronic Facilities: You can make deposits and withdrawals through electronic methods at CBS Post Offices.

- Long period for Inactivity: You just need to complete one transaction every three years to keep the account active. It won’t be marked dormant until there are no transactions for three financial years.

You can download the Post Office Savings Bank Account Opening Form PDF using the link given below.