PMFBY Claim Form SBI - Summary

The PMFBY (Pradhan Mantri Fasal Bima Yojana) Claim Form SBI is a vital document for farmers aiming to claim their insurance benefits under the PMFBY scheme through SBI (State Bank of India). By filling out the PMFBY Claim Form SBI, farmers can conveniently access the insurance support they are entitled to. You can download the PMFBY Claim Form SBI PDF from the link at the bottom of this page.

Steps to Claim Insurance under PMFBY with SBI

To successfully claim insurance, follow these general steps while ensuring that you have the required documentation ready.

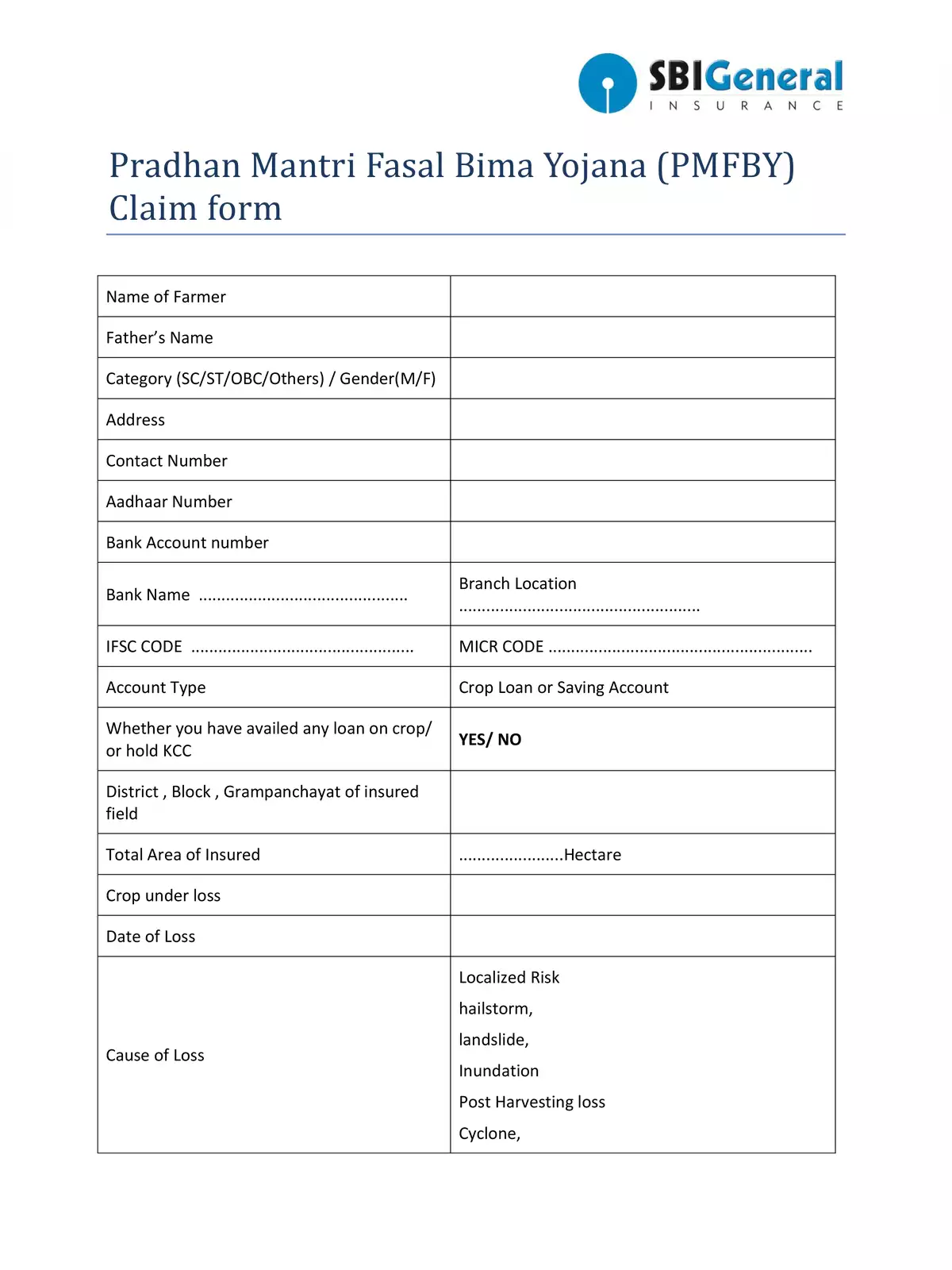

Required Details for PMFBY Claim Form (SBI)

- Name of Farmer

- Father’s Name

- Category (SC/ST/OBC/Others) / Gender (M/F)

- Address

- Contact Number

- Aadhaar Number

- Bank Account Number

- Bank Name

- Branch Location

- IFSC CODE

- MICR CODE

- Account Type

- Crop Loan or Saving Account

- Signature – Farmer

Eligibility Criteria for PMFBY Claim Form

- Compulsory Component: All farmers taking Seasonal Agricultural Operations (SAO) loans from financial institutions (i.e., loanee farmers) for the notified crop(s) are automatically covered under this scheme.

- Voluntary Component: The scheme is optional for non-loanee farmers. Only those who have paid the premium or where the premium has been deducted from their account before specific damages occur (up to 14 days after harvesting) can avail of this benefit.

Coverage of Risks and Exclusions:

The PMFBY scheme covers the following risks that can lead to crop loss.

- Prevented Sowing/Planting Risk: Coverage applies if sowing or planting is hindered due to factors like insufficient rainfall or adverse seasonal conditions.

- Standing Crop (Sowing to Harvesting): This insurance offers extensive coverage for yield losses from non-preventable risks, including Drought, Dry spells, Flood, Inundation, Pests and Diseases, Landslides, Natural Fire and Lightning, Storms, Hailstorm, Cyclone, Typhoon, Tempest, Hurricane, and Tornado.

- Post-Harvest Losses: Coverage is available for a maximum of two weeks after harvesting for crops that are allowed to dry in the field against specific perils like cyclone, cyclonic rains, and unseasonal rains.

- Localized Calamities: Losses and damages from identified localized risks, such as hailstorm, landslide, and inundation, affecting specific farms in the notified area are also covered.

Pradhan Mantri Fasal Bima Yojana (PMFBY) Aim

The goal of the Pradhan Mantri Fasal Bima Yojana (PMFBY) is to support sustainable agricultural production by:

a) Providing financial assistance to farmers impacted by unexpected crop loss or damage

b) Stabilizing farmers’ income to motivate their ongoing participation in agriculture

c) Encouraging the use of modern and innovative farming techniques

d) Ensuring the flow of credit to agriculture, contributing to food security, crop diversification, and boosting the growth and competitiveness of the agricultural sector while safeguarding farmers from production risks.

You can easily download the PMFBY Claim Form SBI in PDF format online from the link provided below.