PAN Card Correction Form & Check Status - Summary

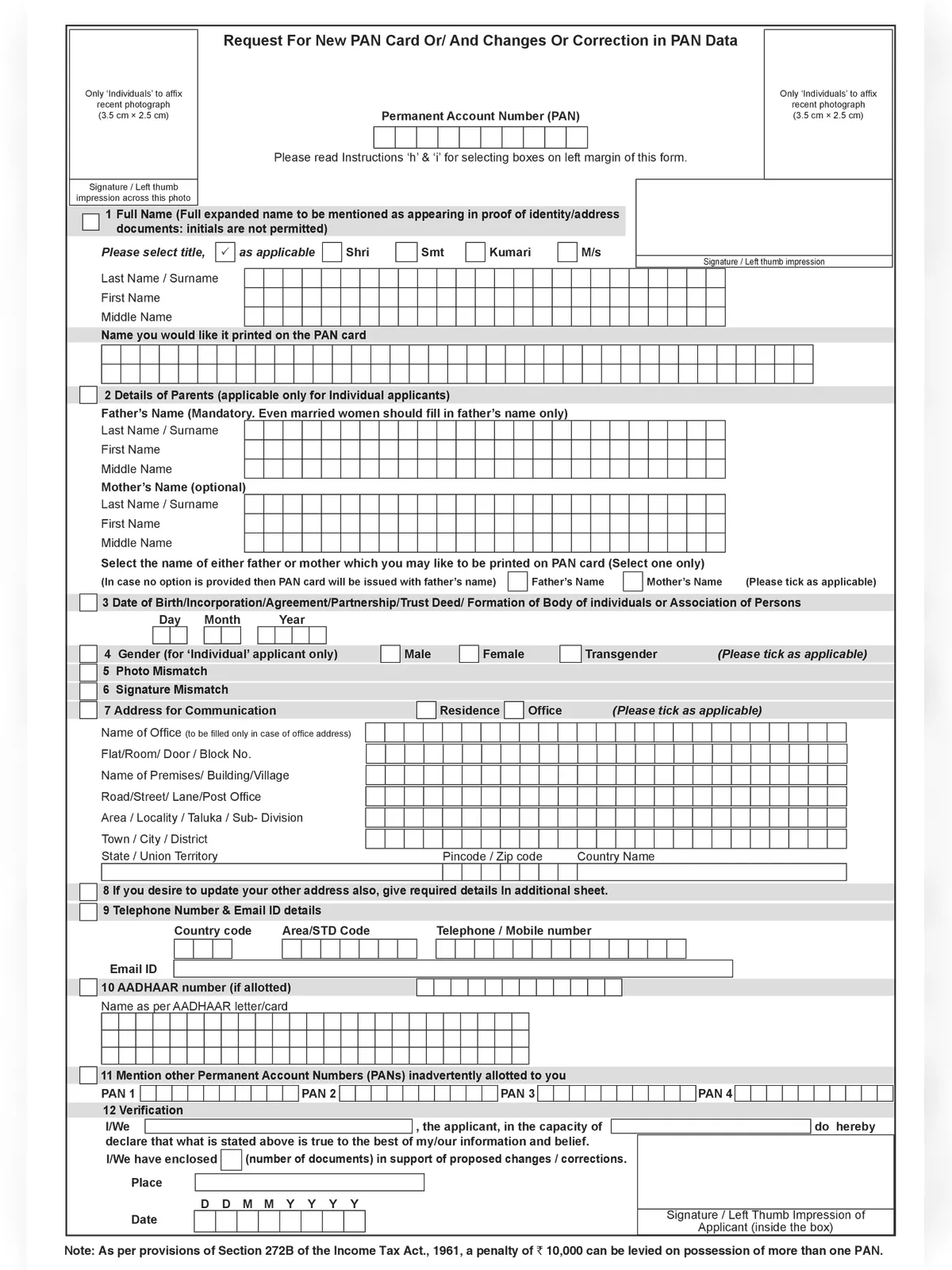

PAN Card Correction Form 2025 is used when you want to correct or update your details on your PAN card. This form can be obtained from any IT PAN Service Centers (managed by UTIITSL) or TIN-Facilitation Centers (TIN-FCs)/PAN Centers (managed by NSDL e-Gov), or any other stationery vendor providing such forms or downloaded from the Income Tax Department website (www.incometaxindia.gov.in) / UTIITSL website (www.utiitsl.com) / NSDL e-Gov website (www.tin-nsdl.com).

After carefully filling out this form attach the necessary documents and submit it to the nearest IT PAN Service Centers (managed by UTIITSL) or TIN-Facilitation Centers (TIN-FCs)/PAN Centers (managed by NSDL e-Gov) and you will get the acknowledged receipt. You can also send it to the following address via speed post or normal post: Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016.

PAN Card Correction Form 49A NSDL

| Name of Form | Form 49A |

| Use of Form | New PAN Card Application for Indian Citizens or Correction |

| PAN Card Form Official website | https://www.tin-nsdl.com/ |

| When to Apply for PAN Card Correction | Surname Name, Date of Birth, and Change in Contact Address, To name a few. |

| Department | Income Tax Department |

| Official Website of Department | https://incometaxindia.gov.in |

| Application Modes | Online and Offline |

| Application Fee | Rs. 107 for Physical Card, Rs. 72 without a physical card requirement |

| Document Required | Identity Proof, Address Proof & Date of Birth Proof |

| Application Processing Duration | 15 Days to 20 Days |

| Pan Correction Form Fillable PDF | Download PDF |

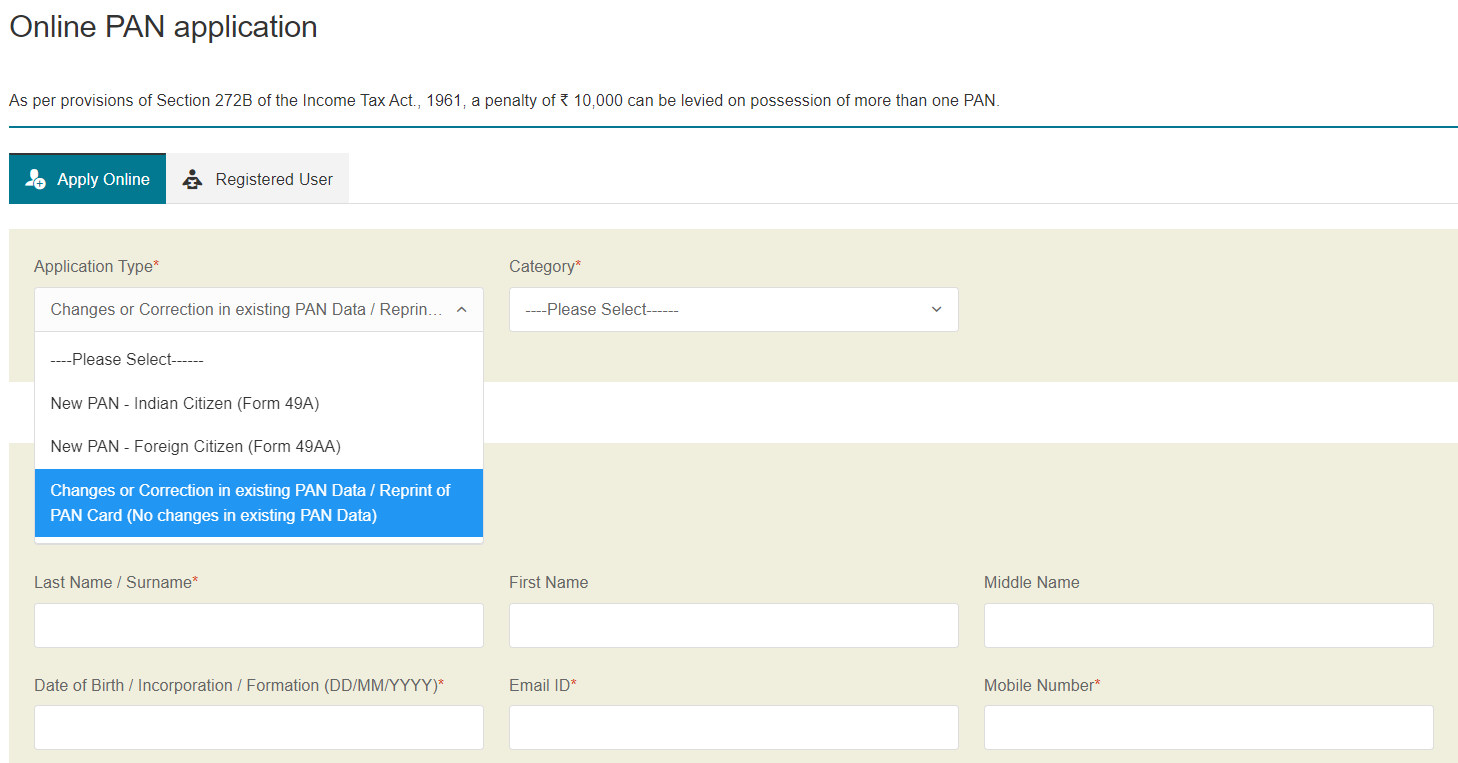

How to Make Correction in PAN Card Form Online

Step 1: Applicants must visit the NSDL official website https://www.onlineservices.nsdl.com/, or they can directly click this link.

Documents Required for PAN Card Correction Form NSDL

The applicant shall be required to provide further documentary proof to support the request for correction or change in PAN data like name, father’s name, and date of birth, for example:

- Change request (marginal correction like spelling correction, expansion of initials, etc.,) in the applicant’s or father’s name will have to be supported with a suitable proof of identity containing corrected data.

- The request for change (significant change) in the applicant’s or father’s name will have to be supported with such proof that it will contain proof of a change of name from the old to the new in addition to the proof of identity. The documents that shall be accepted as proof in this case are:

- For Married ladies – change of name on account of marriage – marriage certificate, marriage invitation card, the publication of ‘name-change in the gazette, copy of passport showing husband’s name (or vice versa).

- For Individual applicants other than married ladies – publication of `name-change in the gazette.

- For Companies – ROC’s certificate for the name change.

- For Partnership firms – revised Partnership Deed

- For Other categories which are registered organizations (AOP/Trust/BOI/AJP, etc.) – the revised registration/deed/agreement.

- For Limited Liability Partnership – Registrar of LLPs certificate for the name change

- For Foreign Citizens:- Passport, Person of Indian Origin (PIO) Card, Overseas Citizen Card. Bank Statement, NRE Bank account, Citizenship identification number of the applicant (if they are a citizen of another country), Taxpayer identification number attested by Apostille, the Indian Embassy, the Indian High Commission, the Indian Consulate, or authorized officials of scheduled banks registered in India which have branches overseas

- Request for correction of date of birth (for individuals) and date of incorporation (non-individuals) will have to be supported with documents issued by competent authority containing the correct date.

PAN Card Address Change/Update Procedure

- For Address Update in PAN card as mentioned in the Aadhaar Number use the link – Address Update

- In this link, you can update your Address Update facility through Aadhaar-based e-KYC

- This facility can be used by those users who want to update their addresses in the PAN database as per Aadhaar.

- To avail Address Update facility, Aadhaar is mandatory and a Mobile number/email ID should have been registered in Aadhaar.

- A one-time password (OTP) would be sent to your mobile number/email ID linked with your Aadhaar to generate an Aadhaar-based e-KYC.

- After the generation of Aadhaar-based e-KYC, the address as per Aadhaar will be updated in PAN Database.

- After the update of the address in the PAN Database, an intimation of the same will be sent via email to the mobile number and e-mail ID mentioned by the user while using this facility.

- Mobile number & e-mail ID would be updated in the PAN database of the Income Tax Department.

How to Apply for PAN Card with Name Change

- Visit the official UTI website.

- On the left-hand side of the screen, click on ‘For change/correction in PAN card click here.

- Now, click on ‘Apply for Change/Correction in PAN Card details (CSF)‘

- This will take you to a page wherein you will be allowed to enter details you would like to change.

- Upload the documents as requested in the form and click on ‘Submit‘.

- Your changes will then be reflected in a few days.

Pan Card Correction Form (49A) Fee

The fee for processing PAN applications is as under:

- If a physical PAN Card is required: 107/- (including goods & service tax) will have to be paid by the applicant. In case, the PAN card is to be dispatched outside India, then an additional dispatch charge of ` 910/- will have to be paid by the applicant.

- If a physical PAN Card is not required: ` 72/- (including goods & service tax) will have to be paid by the applicant. PAN applicants will have to mention on the top of the application form “Physical PAN Card not required”. In such cases, an email ID will have to be mandatorily provided to receive an e-PAN Card.

How to Change Name in PAN Card

- In the case of offline applications, the PAN card form download link is provided here

- The PAN card Form has to be duly filled keeping in mind to provide all details correctly

- The photograph has to be affixed and the form has to be signed before submitting

- In case of offline application, a demand draft in the name of NSDL has to be sent along with the application form to the registered address of NSDL

- For online applications, the request can be placed through TIN-NSDL or UTIITSL.

- In the case of the online application, the payment has to be made online using debit card or credit card or net banking

- A 15-digit acknowledgment number is generated which can be used to check PAN card status

- Once submitted successfully, the updated PAN card is delivered to the applicant within 45 days of the application

Pan Correction Form Status

Visit the “Track your PAN/TAN Application Status” page on the NSDL‑Protean website.

Choose “PAN – New / Change Request” as the application type.

Enter your 15‑digit acknowledgement number.

Fill in the captcha shown.

Contact Details

Website www.incometaxindia.gov.in, www.tin-nsdl.com

Call Center 1800-180-196,1 020-27218080

Email ID [email protected]

PAN Card Correction form

You can download the PAN Card Correction form in PDF format online from the official website at the link provided below.

FAQs on PAN Card Correction Form 2025

Can I change my PAN number online?

There is no provision to change PAN numbers online or offline. However, you can update other details mentioned in the PAN card.

How to request corrections in my PAN card details online?

You can fill out the form online and place a request to make modifications in the PAN details either through the NSDL portal or the UTIITSL portal.

Who can request changes or corrections in PAN data?

You can apply to make changes in the PAN data if you have adequate proof to support your claims.

Do I need to pay any fee while requesting corrections in my PAN card details?

Yes, you need to pay the applicable PAN Card correction fees depending upon whether you want a physical PAN Card or not, how you apply for PAN Card correction/update- online or offline, and whether your communication address is an Indian or foreign address.

Are the PAN card form and the PAN card correction forms different?

Yes, you need to fill out the same form 49A at the time of applying for a fresh PAN card if you are an Indian citizen. For people who are not citizens of India, they have to fill out form 49AA for the same. However, when you are applying for updating details in the PAN card you need to fill in the ‘Request for New PAN Card or/and Changes or Correction in PAN Data Form’.

How to request a new PAN card online without any changes in details?

You can place a request for a duplicate PAN card using the same form 49A. You have to mention all the information as mentioned in the PAN card and not tick it in front of any field. The payment for the reprint will also remain the same.

How much time does it take to get a PAN Card at the address proof?

It usually takes 15 working days to get a PAN Card at the address proof.