NPS Withdrawal Form - Summary

There are specific NPS (National Pension Scheme) withdrawal limits for each type of exit from the National Pension System.

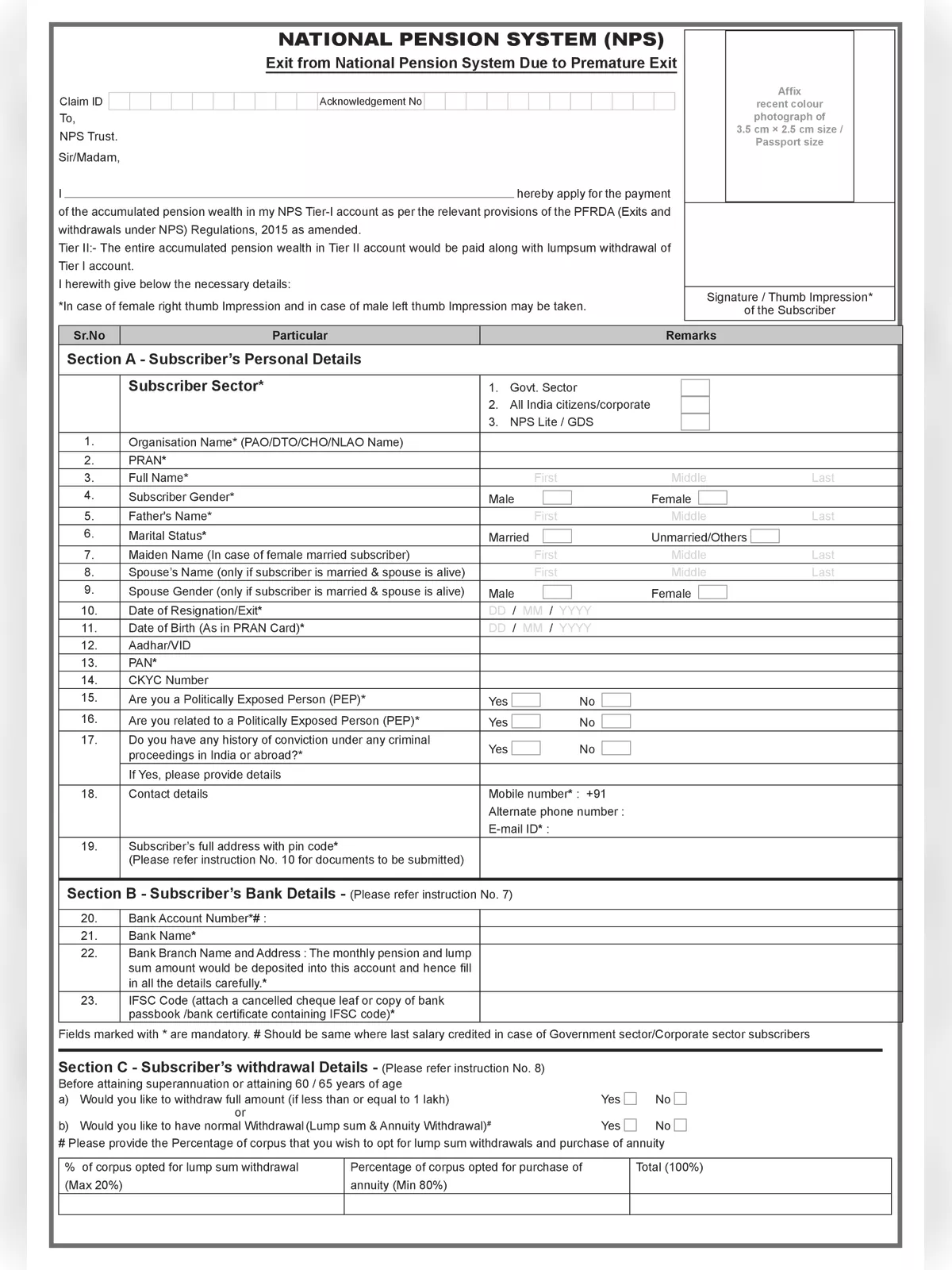

NPS Withdrawal Form PDF can be used by government employees who wish to withdraw their accumulated pension before retirement. Form 302 – This form can be used by corporate employees and other citizens who wish to withdraw their accumulated pension before retirement.

NPS Withdrawal Form – Details to be Mentioned

- Subscriber Sector

- PRAN

- Applicants Name and personal details

- Aadhar/VID

- PAN

- CKYC Number

- Contact details

- Bank Account Number

- Bank Name & IFSC Code

- Subscriber’s withdrawal Details

- And any other details

NPS Withdrawal Limit for Tier 2 Account

Under these rules of the National Pension System, there are no restrictions on NPS Tier 2 withdrawal, thus the rules of NPS withdrawal and withdrawal limits currently only apply to NPS Tier 1 withdrawals.

NPS Withdrawal Limit for Tier 1 Account

These withdrawal limits for the NPS are primarily defined by the type of withdrawal being made and also on the amount being withdrawn from the NPS Tier 1 account. The following are the key withdrawal rules in the cases of withdrawal before maturity, partial withdrawal and withdrawal after maturity.

- NPS Withdrawal Rules for Premature Withdrawal: NPS Tier 1 holders can withdraw the NPS investment after completed 3 years of NPS account or can withdraw after 60 years old. This type of NPS withdrawal is termed as “premature exit”. You can only withdraw 20% of your corpus at the time of premature exist. The remaining 80% must be used to buy an annuity. Both the 20% withdrawal and the annuity are taxable.

- NPS Withdrawal Rules for Partial Withdrawal: You can make partial withdrawals from the NPS corpus for specified purposes. Under existing NPS withdrawal rules, the maximum amount that you can withdraw is up to 25% of your total contribution (not calculated on the total NPS account balance).

Partial NPS contribution withdrawals can be requested for the following:

- Higher education of children

- Marriage of children

- For the purchase or construction of a residential house or flat either in your own name or jointly with your spouse. However, if you already own or jointly own a house or flat other than ancestral property, this will not be permitted.

- For the treatment of the illnesses mentioned below. The patient can be the subscriber, his spouse, children, or dependent parents.

- Cancer

- Kidney Failure

- Preliminary Pulmonary Arterial Hypertension

- Multiple Sclerosis

- Major Organ Transplant

- Coronary Artery Bypass Graft

- Aorta Graft Surgery

- Heart Valve Surgery

- Stroke

- Myocardial Infarction

- Coma

- Total Blindness

- Paralysis

- Accident of serious/life-threatening nature

- Any other critical illness of a life-threatening nature specified by the PFRDA from time to time

NPS Tier 1 Withdrawal Rules for Withdrawal after Maturity

The NPS Tier 1 account matures after the subscriber attains the age of 60 years, although you can delay the withdrawal of these investments till the age of 70. Under existing NPS withdrawal rules for withdrawal after maturity, you can withdraw up to 60% of your corpus tax-free.

You are mandatorily required to use the remaining 40% of your corpus to buy an annuity. The annuity provides a monthly pension to the NPS subscriber after retirement. The monthly pension received is taxable at the slab rate of the investor.

Documents Required for NPS Superannuation & Pre mature Exit

- Original PRAN card

- Advanced stamped receipt, to be duly filled and cross-signed on the Revenue stamp by the Subscriber.

- KYC documents (address and photo-id proof)

- ‘Cancelled Cheque’ (having Subscriber’s Name, Bank Account Number and IFS Code) or ‘Bank Certificate’ on Bank Letterhead having Subscriber’s name, Bank Account Number and IFS Code required to be submitted as bank proof. ‘Copy of Bank Passbook’ can be accepted, however, it should have Subscriber’s photograph, Name and IFS Code on it and should be self-attested by the Subscriber.

- “Request Cum Undertaking” form if eligible for complete Withdrawal.

NPS Partial Withdrawal Conditions

Following are the conditions of Conditional Withdrawal:

- Subscriber should be in NPS at least for 3 years

- The withdrawal amount will not exceed 25% of the contributions made by the Subscriber

- Withdrawal can happen a maximum of three times during the entire tenure of subscription.

- Withdrawal is allowed only against the specified reasons, for example;

- Higher education of children

- Marriage of children

- For the purchase/construction of a residential house (in specified conditions)

- For treatment of Critical illnesses

Download the NPS Withdrawal Form PDF using the link given below.