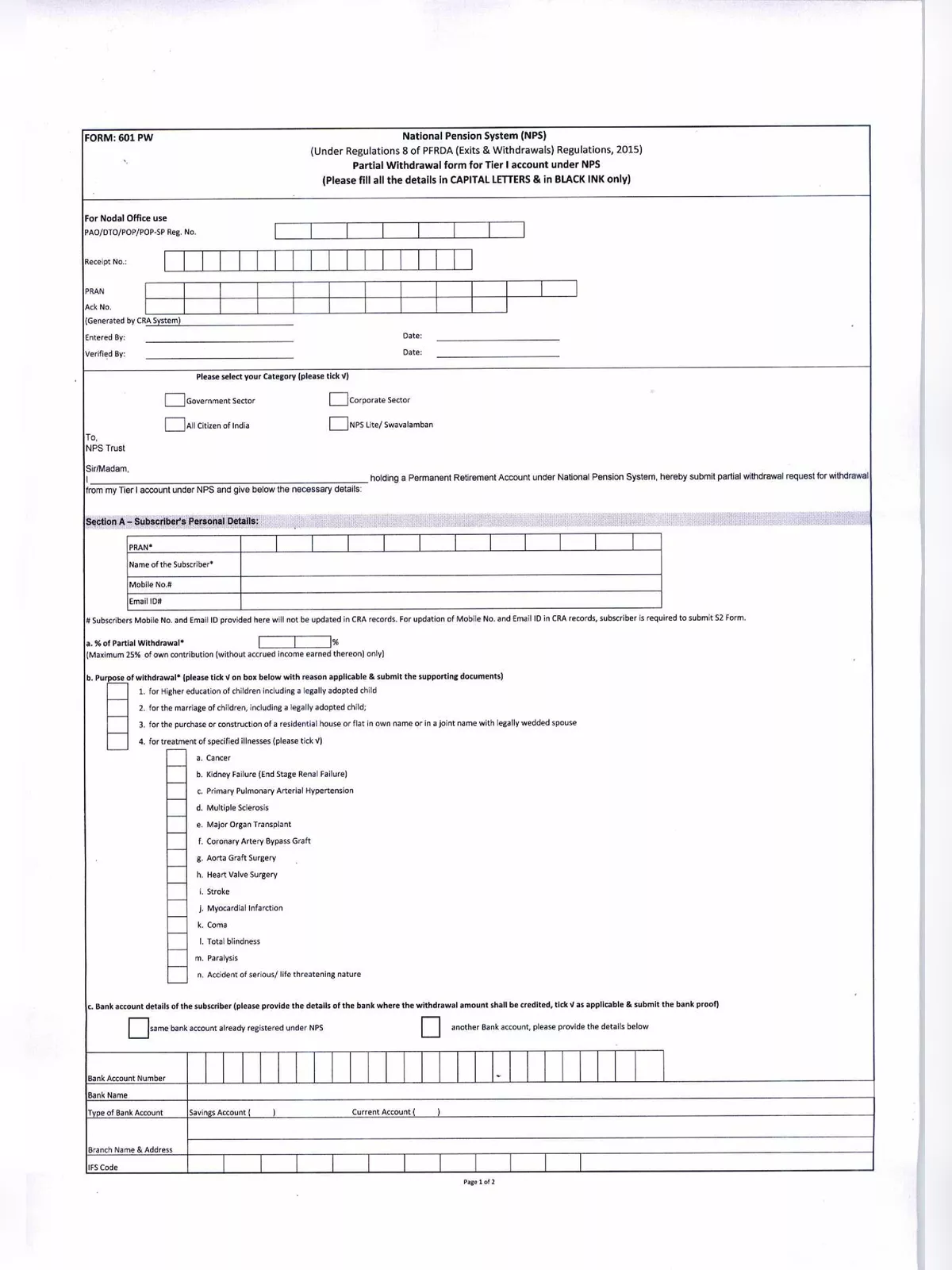

Form 601 pw - Summary

Form 601 PW is specifically designed for use by government employees seeking to withdraw their accumulated pension after retirement through the National Pension System (NPS). This form facilitates the pension withdrawal process for government employees, ensuring a streamlined and efficient procedure for accessing their pension funds post-retirement.

Applicability:

Designed for corporate employees and other citizens eligible for pension withdrawal upon reaching the retirement age.

Instructions:

Instructions for filling up the form:

1. All fields marked with are mandatory. All dates should be in DDMMYYYY format.

2. The Subscriber shall submit the application to the respective Nodal Office/POP/Aggregator for processing of request.

3. Before submitting the withdrawal form, subscriber should ensure that the bank account details are matched from the bank passbook/ bank statement or cheque etc to ensure that the details are correct. Subscriber should also attach the bank proof (cancelled cheque/copy of bank passbook/bank certificate) with the Partial Withdrawal Form submitted.

4. Subscriber should specify the purpose of Partial Withdrawal and a proof need to be submitted for the same.

5. Subscriber should be in the NPS atleast for a period of 10 years. A subscriber shall be permitted to withdraw not exceeding 25% of the contributions made by such subscriber to his/her individual pension account,

6. The Nodal officer/POP/Aggregator must verify the details of the bank account of subscriber.

7. Withdrawal amount received after the execution of the withdrawal request can be different from the requested

amount to the extent of difference in NAV of two different days.

8. The withdrawal amount shall directly be credited to the bank account of the subscriber as mentioned in the withdrawal form.

9. In case, the subscriber already owns either individually or in the joint name a residential house or flat, other than ancestral property, no withdrawal under PFRDA regulations is permitted.

10. Treatment of specific illness covers the subscriber, his legally wedded spouse, children, including a legally adopted child or dependent parents suffer from the specified illness, which shall comprise of hospitalization and treatment.

11. The permitted withdrawal shall be allowed only if the eligibility criteria and limit for availing the benefit are complied with by the subscriber.

12. Frequency: the subscriber shall be allowed to withdraw only a maximum of three times during the entire tenure of subscription under the National Pension System and not less than a period of five years shall have elapsed from the last date of each of such withdrawal. Five years should have elapsed between two withdrawals shall not apply in case of “treatment for specified illnesses or in case of withdrawal arising out of exit from National Pension System due to the death of the subscriber.

13. For more detailed description of Partial Withdrawal option under NPS, please refer Regulation 8 of PFRDA (Exits & Withdrawals) Regulations, 2015.

14. The Nodal office/POP/Aggregator shall capture the details of the subscriber mentioned on the form

and forward the same to NPS Claims Processing Cell (NPS CPC) at address mentioned below:

NPS Claim Processing Cell,

Central Record Keeping Agency, NSDL,

10th Floor, Times Tower, Kamala Mills Compound,

Senapati Bapat Marg, Lower Parel West, Mumbai – 4000013

You can download the Form 601 pw in PDF format by using the given link below.