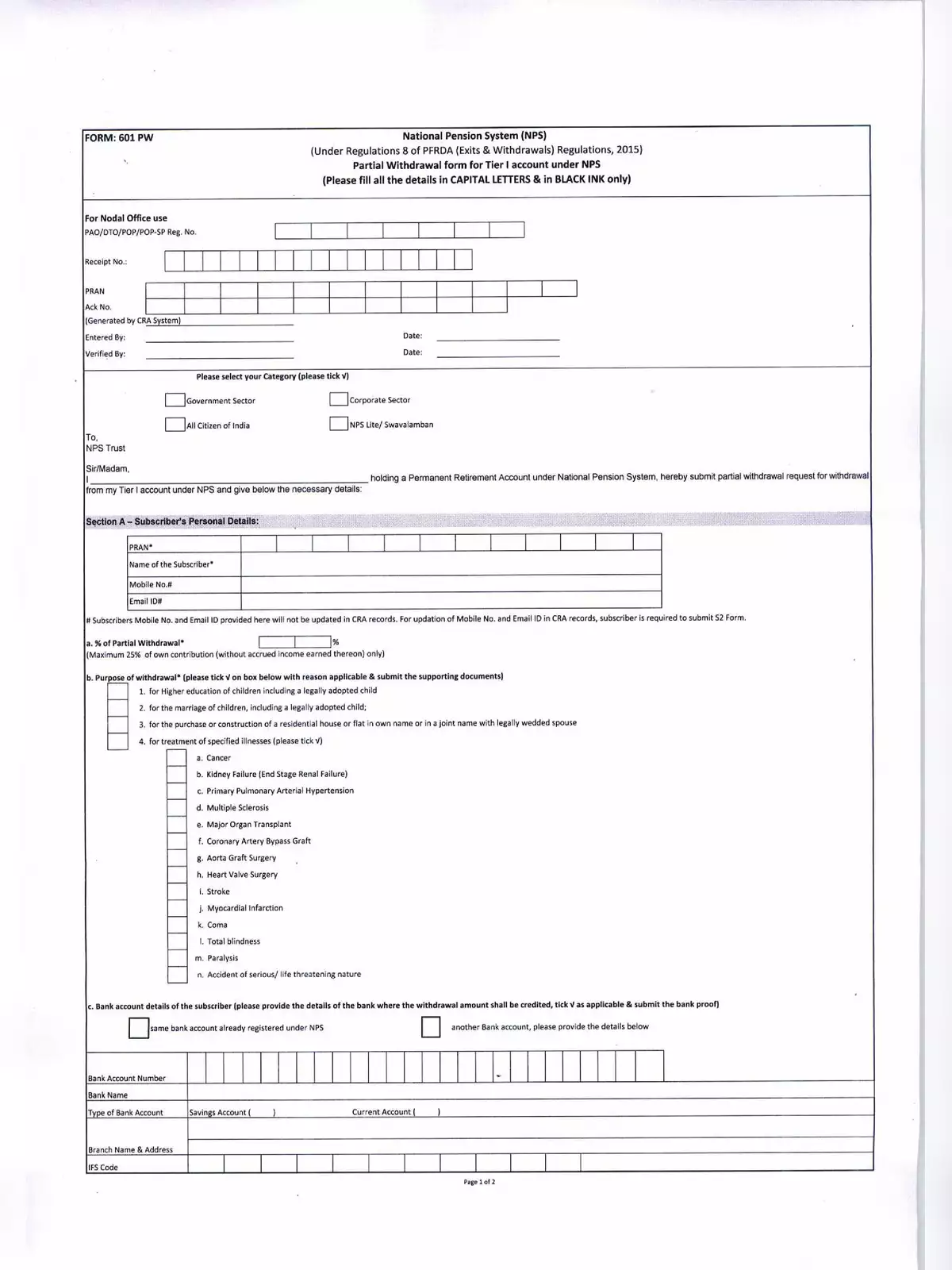

NPS Partial Withdrawal Form Under Tier 1 Account - Summary

The NPS partial withdrawal form under the Tier 1 account is an important document that helps you understand how to manage your investments effectively. Knowing the NPS withdrawal limits is key for smart financial planning and making the right choices for your retirement savings. These limits depend mainly on the type of withdrawal and how much you take from your NPS Tier 1 account.

Key Withdrawal Guidelines

When it comes to partial withdrawal, here are the important guidelines you should keep in mind:

Form Guidelines

- For a member to be eligible for a partial withdrawal, they must have been part of the scheme for a minimum of three years.

- There should be a gap of at least 5 years between two withdrawals for a membership. This gap can be shortened only in medical emergencies.

- A member can withdraw up to 25% of their own contributions to the NPS. Partial withdrawal is allowed only in special situations such as for children’s education, wedding expenses, home construction, or medical emergencies.

- Throughout their membership, a member is allowed to make only three partial withdrawals.

Reasons for Withdrawal

- Funding higher education for a child.

- Expenses related to a child’s marriage.

- Medical treatment for critical illnesses affecting oneself, a spouse, children, or dependent parents.

- Buying or constructing your first home.

- In cases of accidents leading to death.

Withdrawal Timing

Withdrawals are permitted only after a period of ten years. You can make a total of three partial withdrawals, but there is a mandatory 5-year waiting period between each one.

To download the NPS Partial Withdrawal Form in PDF format, simply click the link below. This will help you access the information easily and manage your NPS withdrawals wisely!