Limited Liability Partnership Agreement - Summary

Understanding Limited Liability Partnership Agreements

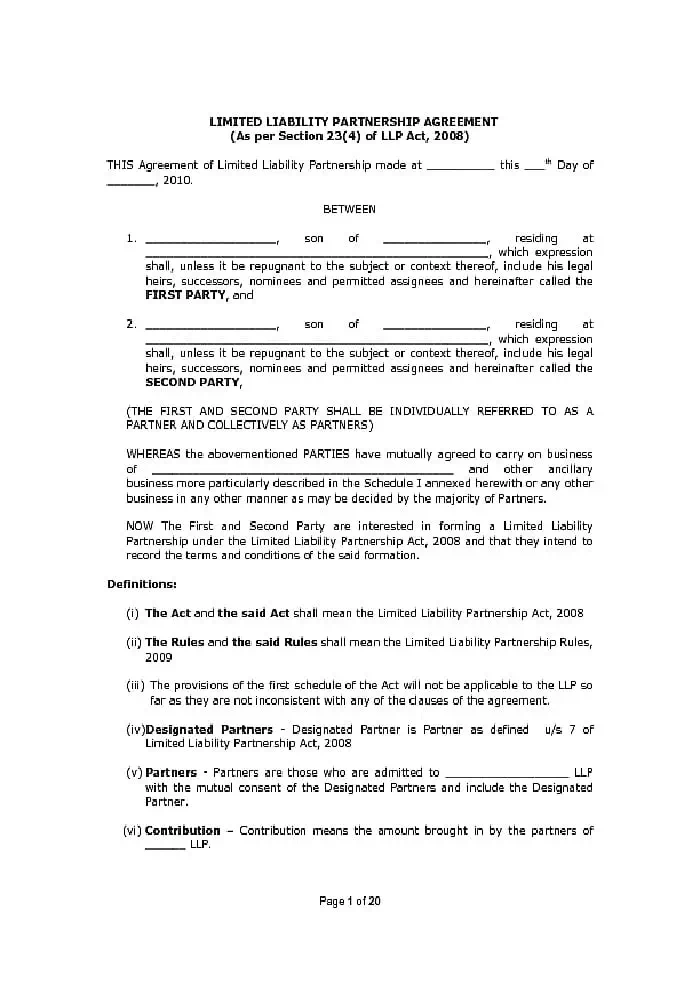

Limited Liability Partnership (LLP) Agreements are crucial documents that define the relationship among partners in an LLP. These agreements serve as a formal contract between the members of an LLP, ensuring a fair relationship is established and safeguarding their investments. Notably, the LLP itself is recognized as a party to the agreement, which adds an essential layer of protection for all stakeholders involved.

The Importance of LLP Agreements

In the current business landscape, Limited Liability Partnership Agreements play a pivotal role. They help clarify the duties, rights, and obligations of each partner, thus minimizing potential disputes that can arise in the course of business operations. By outlining profit-sharing ratios, decision-making processes, and the procedure for adding or removing partners, these agreements foster transparency and trust among members.

Moreover, these agreements also define the terms under which the LLP operates, providing a framework that adheres to the laws governing partnerships in India. This ensures that the LLP is managed effectively while complying with legal requirements, making the LLP agreement a vital aspect of starting and running a successful business.

When forming an LLP, it is imperative that partners work collaboratively to draft a comprehensive agreement that addresses all possible scenarios. This can help avert misunderstandings and ensure that all partners are on the same page. ⚖️

The benefits of having a well-structured Limited Liability Partnership Agreement cannot be overstated. Not only does it protect individual investments, but it also enhances the credibility of the partnership in the eyes of stakeholders and potential investors. By laying down clear guidelines and expectations, LLP agreements contribute significantly to the growth and sustainability of the partnership. 🌱

For a deeper understanding of creating and managing your Limited Liability Partnership Agreement, it is advisable to consult legal professionals with expertise in this area. This can help in drafting an agreement that truly reflects the interests of all partners while adhering to the necessary legal stipulations.

In conclusion, investing time and resources into a well-articulated Limited Liability Partnership Agreement can lead to a successful journey for all partners involved. 🗝️ Take the essential steps to ensure your LLP is built on a strong foundation through a comprehensive agreement.