LIC Maturity Form 2026 - Summary

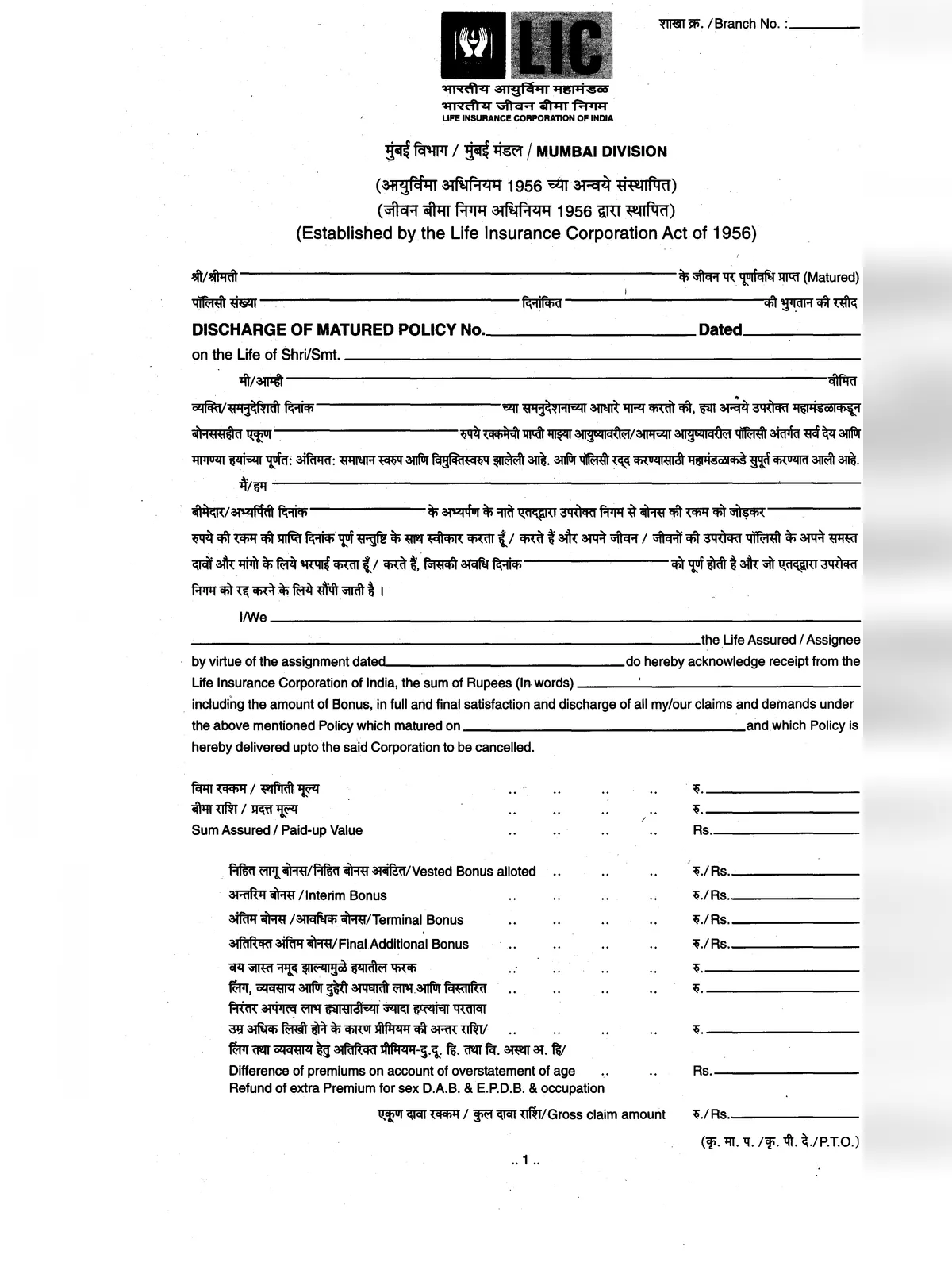

LIC Maturity Form is an important document provided by the Life Insurance Corporation of India (LIC) that policyholders need to submit in order to claim the maturity benefits of their life insurance policy. When a policy reaches its maturity date, the insured is entitled to receive the sum assured along with bonuses (if applicable), and this form helps in initiating the claim process smoothly.

The form generally requires policy details, personal information of the policyholder, bank account details for payment, and submission of supporting documents like the original policy bond, identity proof, and a cancelled cheque. By filling out and submitting the LIC Maturity Form correctly, policyholders can ensure quick settlement of their maturity claim without any delays.

Important Submission Guidelines

To ensure a smooth experience, make sure to submit your Discharged Receipt in Form No. 3825 along with the original policy document at least one month before the due date. This step will help guarantee that you receive your payment before the maturity claim due date.

LIC Maturity Form – Claims

- We strive to settle your maturity claim on or before the due date. Typically, the servicing Branch will send you notifications about your maturity claim two months before the due date.

- Kindly ensure to submit your Discharged Receipt in Form No. 3825 together with the original policy document at least one month before the due date, so the payment can be processed on time.

- If you do not receive any notifications regarding your claim that is due in the next two months, it is essential to contact the servicing Branch as soon as possible.

Remember, you can download the LIC Maturity Form PDF using the link provided below.