Income Tax Act 1961 - Summary

Understanding the Income Tax Act 1961

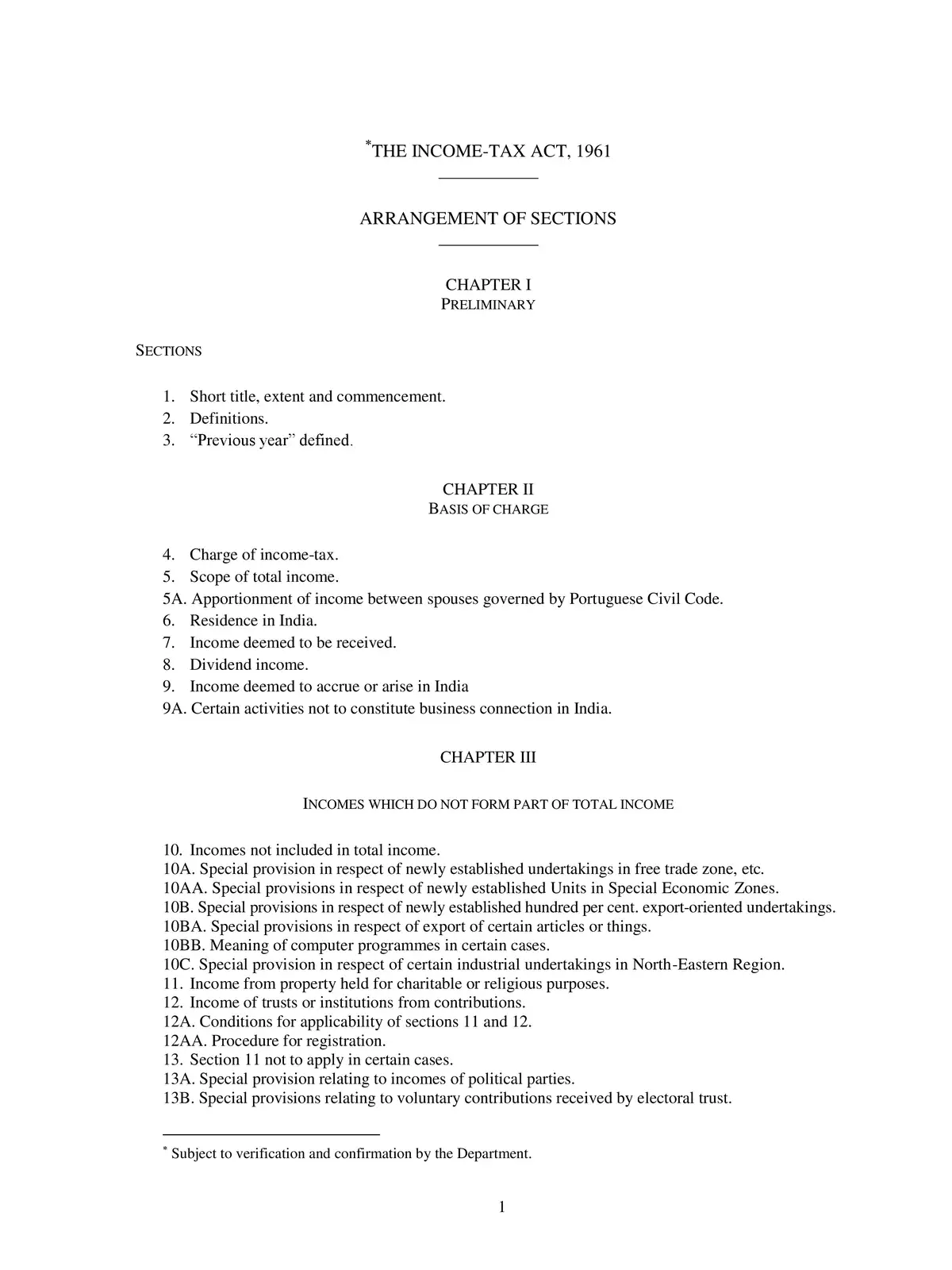

The Income-tax Act, 1961 is the important law that governs Income Tax in India. This act is essential because it talks about how Income Tax is to be charged, managed, collected, and recovered in our country.

Key Features of the Income Tax Act

The Income Tax Act has many important sections and provisions that help in defining how we should pay taxes based on our income. Individuals and businesses must understand this act to comply with tax laws properly.

This act applies to various types of income, including salaries, profits from business, and income from other sources. It includes rules related to deductions, exemptions, and different types of tax relief.

By being aware of the Income Tax Act, you can plan your finances better. It helps taxpayers understand their liabilities and rights concerning taxation.

Many people seek information about the Income Tax Act to ensure they are complying with the law. This is where resources like the PDF on the Income Tax Act can be very helpful. You can download the PDF for detailed study and reference.

Overall, the Income Tax Act, 1961 is crucial for anyone earning an income in India. Understanding its provisions and requirements can lead to better financial planning and compliance. Remember, staying informed about the Income Tax Act is every taxpayer’s responsibility. 🏦