Home Loan Documents List - Summary

Hello, Friends! Today we are excited to share the Home Loan Documents List PDF to assist you in your home loan journey. If you are looking for the Home Loan Documents List 2023 in PDF format, you’ve come to the right place! You can easily download it from the link provided at the bottom of this page. This Home Loan Documents List is essential for anyone planning to take a home loan from a bank.

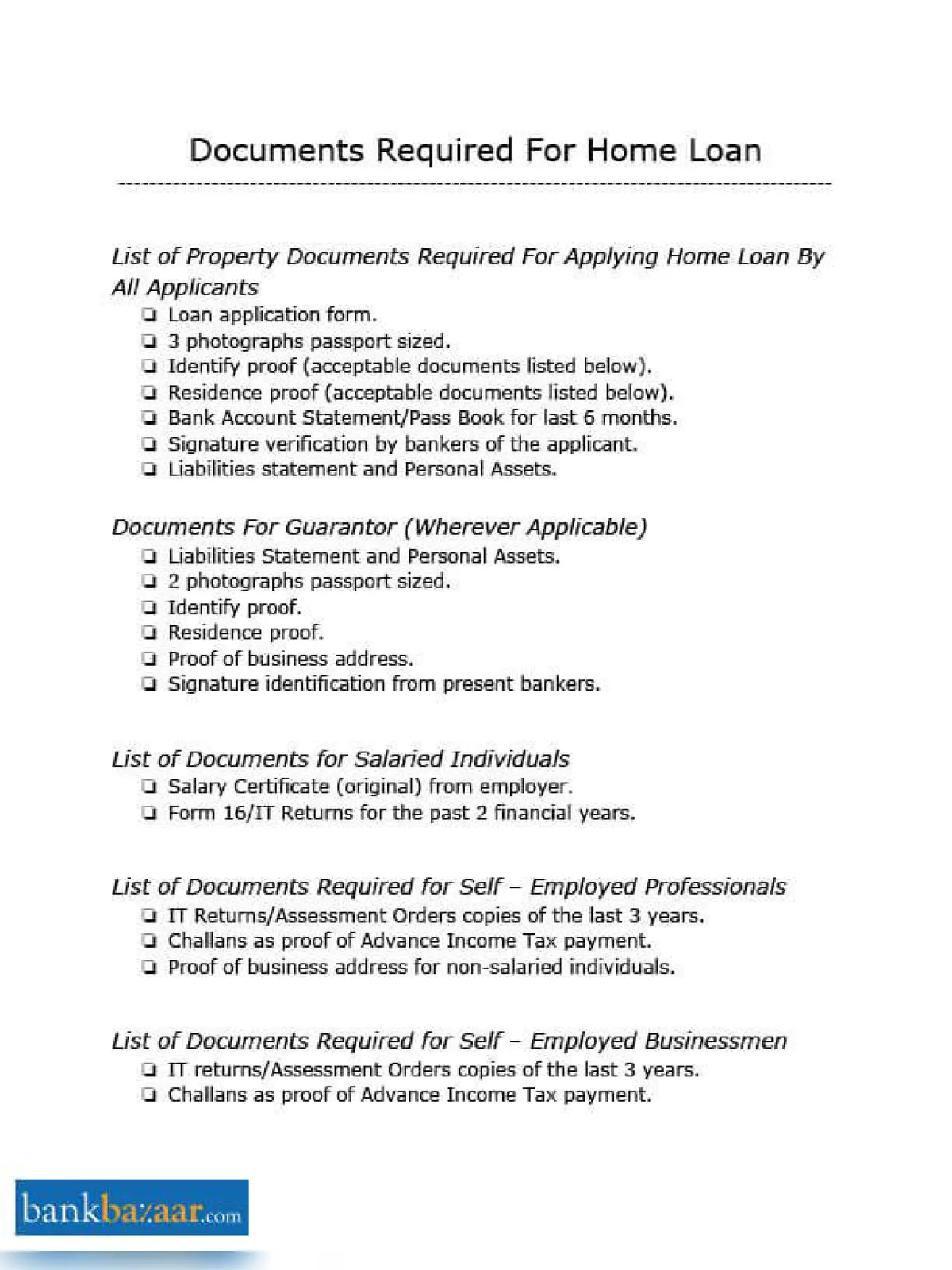

To secure a home loan, an applicant must submit various documents. These documents help verify their KYC (Know Your Customer), confirm the ownership details of the property they wish to purchase, and showcase their income background. The required documents may differ based on the applicant’s category, such as salaried, professional, businessman, or NRI.

Essential Home Loan Documents List

- A duly-filled loan application form

- Three passport-size photographs of the applicant

- A government-issued photo identity proof (such as Voter ID, passport, or driving license)

- Proof of residence (for example, telephone or electricity bills)

- For non-salaried applicants, proof of business is required

- Bank statement for the past six months

- Statement of personal liabilities

- Personal assets statement

- Signature identification from the current bank

- Documents for the guarantor, if applicable

- Statement of personal assets and liabilities

- Two passport-size photographs for the guarantor

- Identity proof for the guarantor (Voter ID, passport, driving license, etc.)

- Proof of current and permanent residence for the guarantor

- Address of the firm, if the guarantor is self-employed

- Signature identification from the guarantor’s current bank

Additional Documents Required For Guarantor (If Needed):

- Statement of personal assets and liabilities

- Two passport-size photocopies

- Proof of identification, as mentioned above

- Proof of residence, as mentioned above

- Proof of business address, if applicable

- Signature identification from the guarantor’s current bank

Extra Documents Required for Salaried Home Loan Applicants

In addition to the documents listed above, salaried home loan applicants need to submit the following:

- Salary certificate from the current employer (original copy)

- TDS certificate or Form 16 or copies of tax returns for the last 2 years

You can download the Home Loan Documents List 2023 in PDF format using the link provided below.