HDFC Bank Account Closure Application Form - Summary

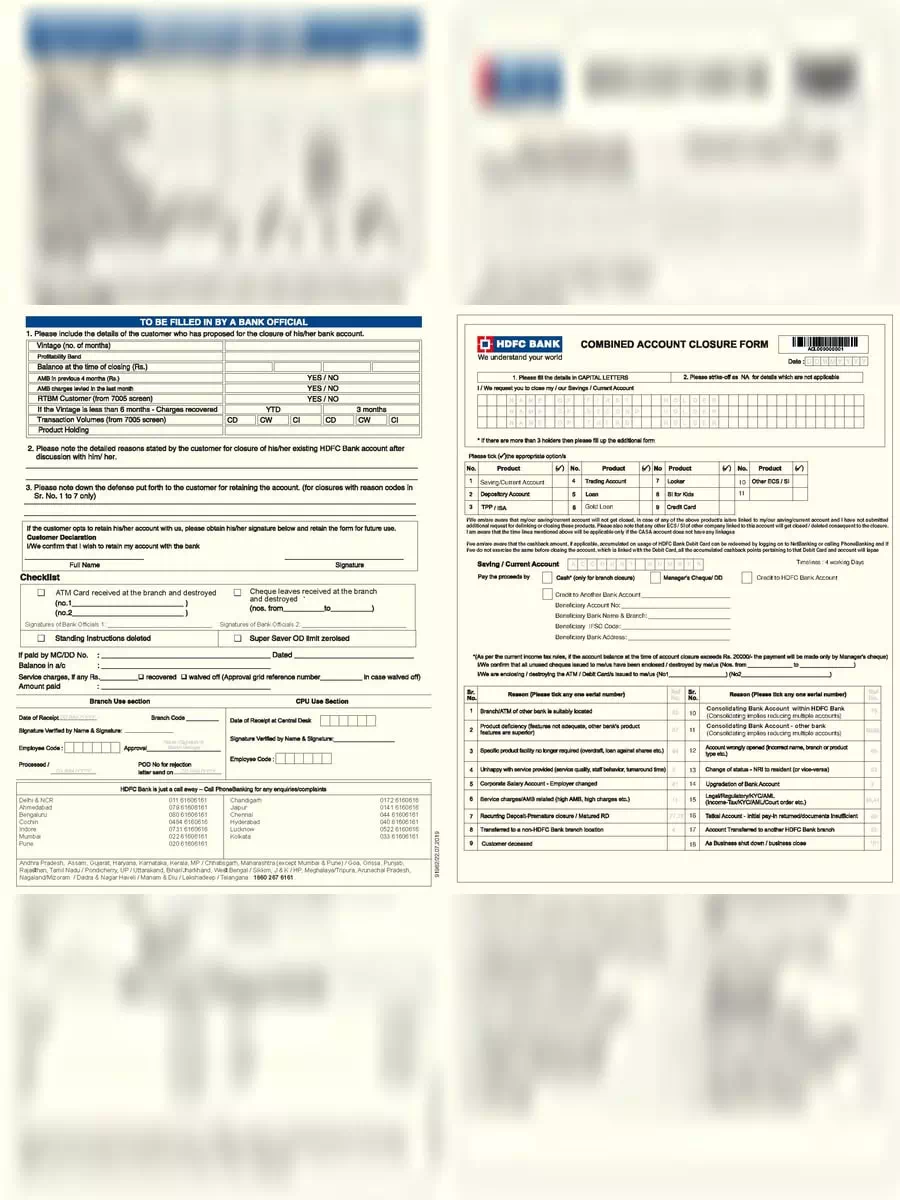

HDFC Bank Account Closure Application Form

If you are considering closing your HDFC Bank account, you’ve come to the right place! HDFC is one of India’s leading private sector banks that offers a wide range of banking services like savings accounts, current accounts, internet banking, mobile banking, fixed deposits, recurring deposits, and much more. If you are not happy with the services and want to proceed with closing your account, this guide will help you every step of the way.

When you decide to close your HDFC Bank account, you can do it anytime you want. Just keep in mind that the bank charges a nominal closure fee of Rs 500 for this process.

Step-by-Step Guide to Close Your HDFC Bank Account

It’s important to know that you cannot close your HDFC Bank account online. To start the closure process, the account holder must visit the nearest HDFC Bank branch in person. To make things easier, you should download the HDFC Account Closure Form and take it with you to your local branch.

- After you download the HDFC Closure Form, fill in all the necessary details correctly.

- Submit the completed form along with your passbook, debit card, and checkbook to your branch manager.

- You will receive a Request Acknowledgment Slip that serves as proof of your closure request.

- The bank will verify all the documents you submitted along with the HDFC Closure Form.

- Your account closure request will be processed within 7 to 10 working days once everything is verified successfully.

Important Points to Remember

Before you close your HDFC Bank account, it’s a good idea to open a new account with another bank. This will ensure a smooth transition. After your new account is active, transfer all your funds from the HDFC Bank account to the new one.

Another crucial step is to unlink any automatic payments associated with your old account. Make sure to cancel all insurance payments and also disconnect from any UPI-enabled applications linked to your HDFC Bank account.

Always keep copies of your old bank statements. You never know when you might need them in the future. It’s best to back up important statements and keep a printed copy safe.

To close your account, simply visit your nearest HDFC Bank branch and follow the steps mentioned above. For easy reference, you can also find this information in a convenient PDF format. Download it for free today! 🌟🏦