GST Amnesty Scheme 2023 Notification - Summary

Government announces such amnesty schemes time to time for providing benefits to the taxpayers. Especially to those taxpayers, who have not filed returns in time or they have committed any defaults under GST Laws. GST Amnesty Scheme for GSTR-9 and 9C for the year 2023. The scheme provides relief to taxpayers by reducing late fees and penalties for non-filing or late filing of GST annual returns.

GST Department has issued a notification no. 08/2023 dt. 31/03/2023 and provide relief to the taxpayers who have not filed the GSTR-10 (The Final Return after surrender of GST Registration) within the time limit. As per the notification, the taxpayers can file the GSTR-10 from 01/04/2023 to 30/06/2023 by paying a maximum of Rs. 1000/- (Rs. 500/- each for CGST & SGST) as late fees. The department will waive off the amount of late fees which is in excess of Rs. 1000/-

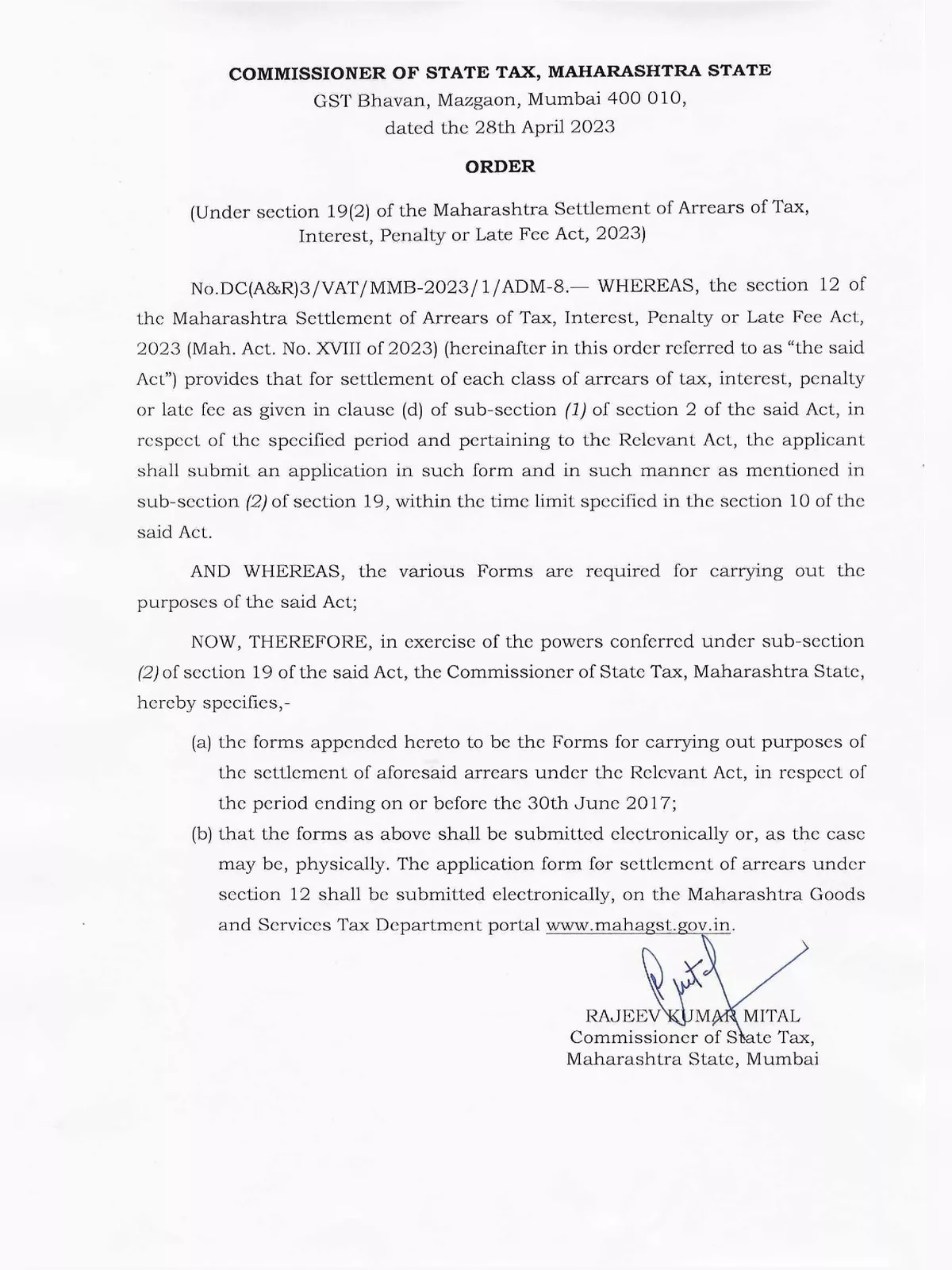

GST Amnesty Scheme 2023 Notification

GST Amnesty schemes are beneficial to the registered person who has committed defaults mistakenly, but on the other hand these schemes are deliberately provoking others to wait for such schemes and not to pay late fees, as there is no benefit to that regular & honest registered person who has already removed their defaults by paying huge late fees.

As per the notification, the taxpayers can file the GSTR-9 from 01/04/2023 to 30/06/2023 by paying a maximum of Rs. 20,000/- (Rs. 10,000/- each for CGST & SGST) as late fees. The department will waive off the amount of late fees which is in excess of Rs. 20,000/-.

You can download the GST Amnesty Scheme 2023 Notification PDF using the link given below.