FORM No 10A - Summary

Understanding Form 10A for Income Tax Registration

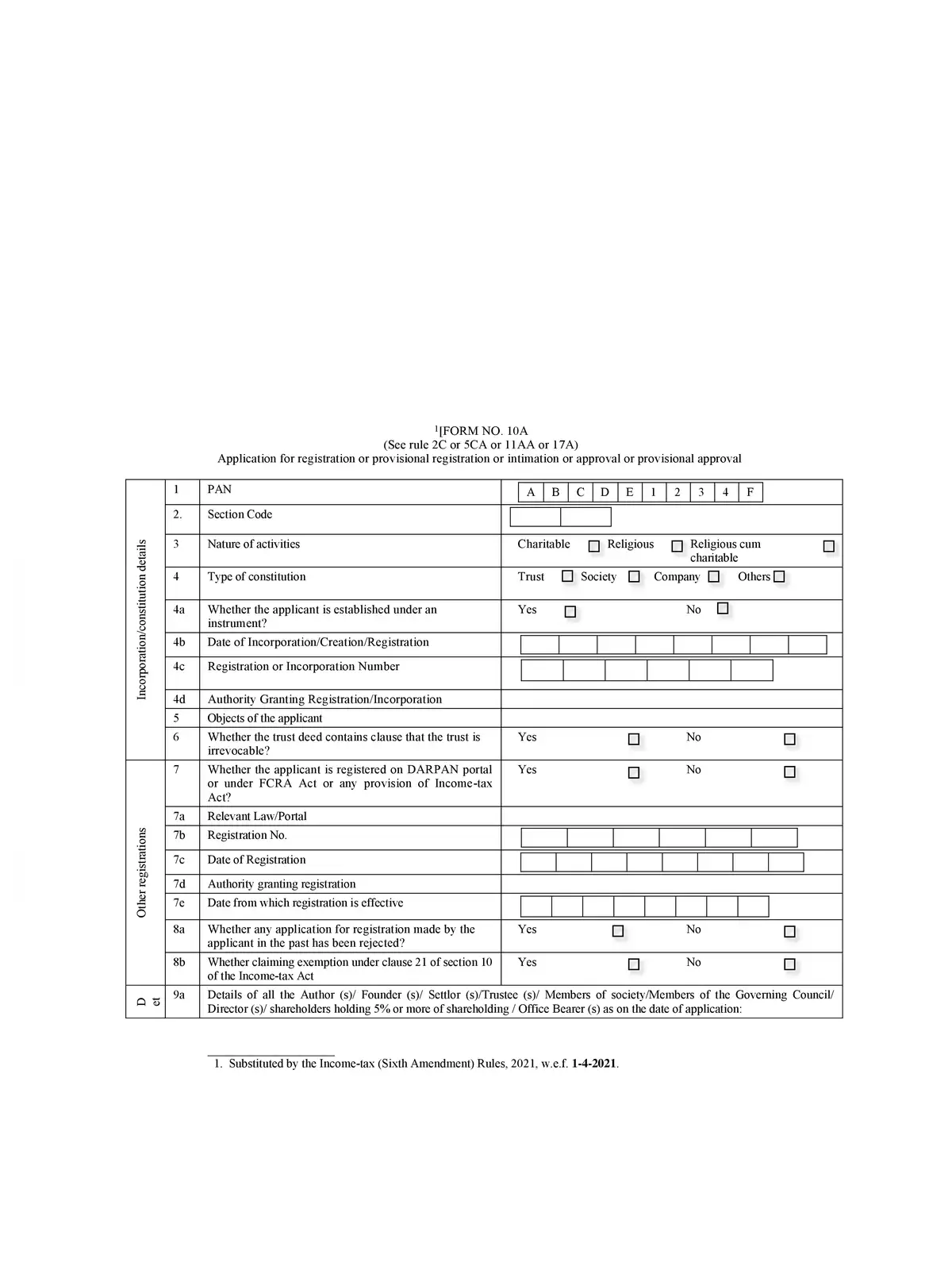

Form 10A is a vital document for any charitable or religious trust in India. This form is mainly used for applying and obtaining 12A registration, which is crucial for these organizations. Gaining this registration allows trusts to enjoy tax exemptions on their income, making it very important for their functioning.

Importance of Form 10A

Registering under section 12A is essential for charitable and religious trusts to ensure that their income is exempt from tax. By filling out Form 10A, trusts can officially request this registration with the Income Tax Department. This helps maintain transparency and legitimacy in their operations.

The process of completing Form 10A is simple, but accuracy is important. Trusts must provide the required information carefully to avoid any registration issues. It is a good idea to seek help from financial experts if there is any confusion during the process.

Furthermore, organizations must keep their records updated and follow the necessary regulations. This not only helps with the successful registration of Form 10A but also ensures smoother operation of their charitable activities.

For those who want to know more about Form 10A or are looking for extra references, a PDF document is available for download. This PDF includes detailed guidelines and necessary steps for filling out the form correctly. It can be a useful resource for organizations and trusts. 📄

The significance of Form 10A cannot be ignored, as it serves as the foundation for the legal standing of charitable and religious trusts in India. By securing the 12A registration through this form, trusts can concentrate more on their noble causes rather than worrying about tax liabilities.

If you are planning to register your charitable or religious trust, make sure you have a good understanding of Form 10A. This will ensure that your organization stays compliant and benefits from the available exemptions.