Form 10C – For Pension Withdrawal - Summary

Understanding Form 10C for Pension Withdrawal

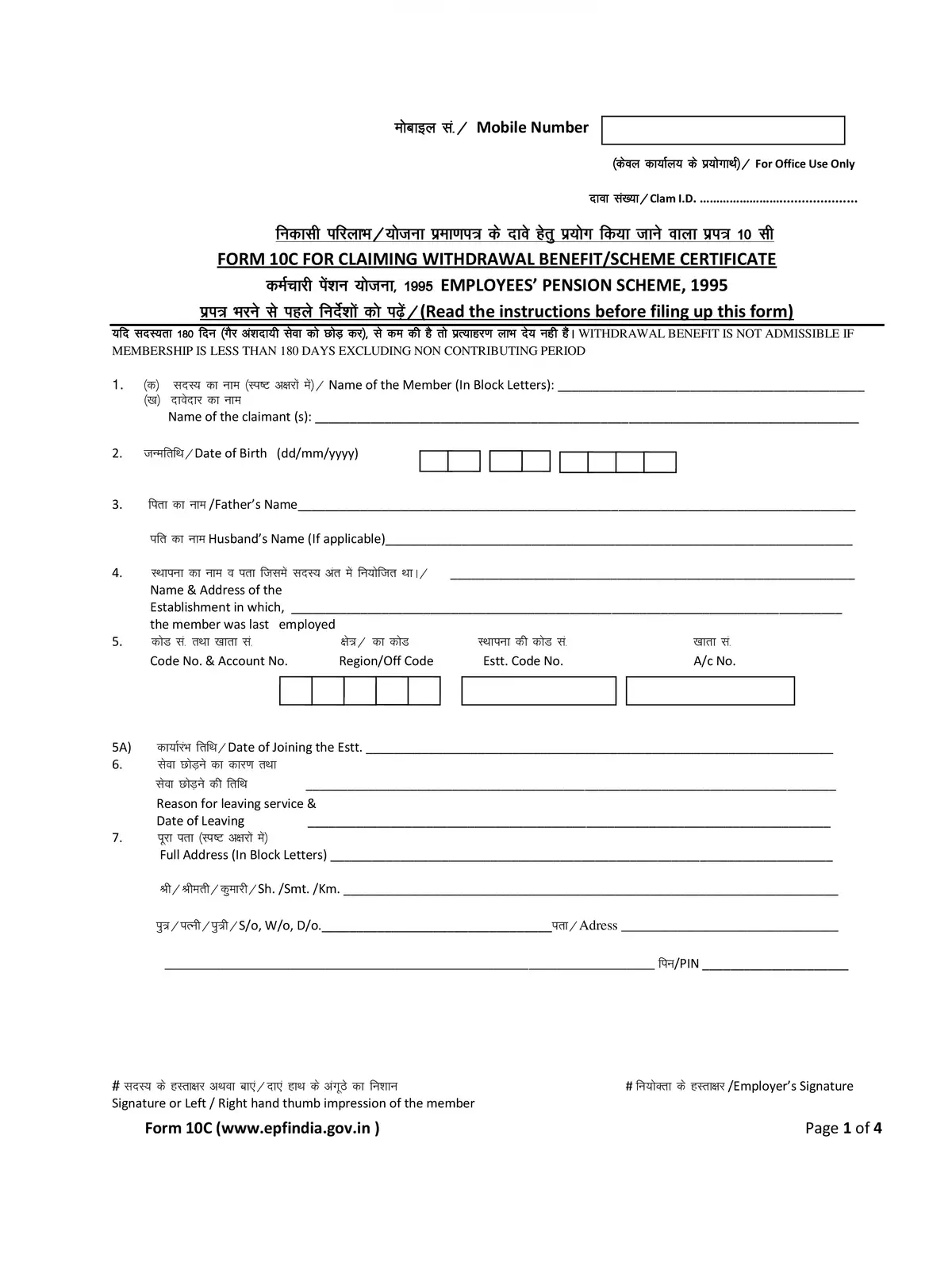

Form 10C (For Pension Withdrawal) is a key document that you need to fill out and submit when claiming your benefits under the Employee Pension Scheme (EPS). This form is essential for helping you access the funds set aside for your pension.

What is Form 10C?

Each month, a share of the total Provident Fund (PF) contributions is directed towards the Employee Pension Scheme. This means a part of your savings is added to your pension account. To withdraw this money, you must use Form 10C. It is very important for anyone looking to benefit from the EPS.

Completing Form 10C is quite easy. You will need to provide details about your job, such as your name, Employee Identification Number, and other necessary personal information. Make sure all your information is correct to avoid any delays in processing your withdrawal.

Once you finish filling out the form, submit it to the relevant authorities along with any required documents. This will help ensure that your pension withdrawal process is smooth and that you receive your money on time.

It is important to know that the Employee Pension Scheme offers financial security for employees after they retire. Form 10C is your key to unlocking these benefits. Keep your PF and EPS details close when filling out the form to make things easier for yourself.

If you want to learn more about the withdrawal process and the requirements, you can find useful resources online or ask your HR department. Having the correct information can make your withdrawal experience hassle-free.

If you’re interested in learning more about the pension withdrawal procedure and related information, consider downloading the PDF for a complete guide. A well-informed approach ensures that you never miss out on your entitled benefits.

In conclusion, Form 10C is essential for securing your financial future through the Employee Pension Scheme. Be sure to follow the right steps for a trouble-free experience when claiming your pension withdrawal. 😊