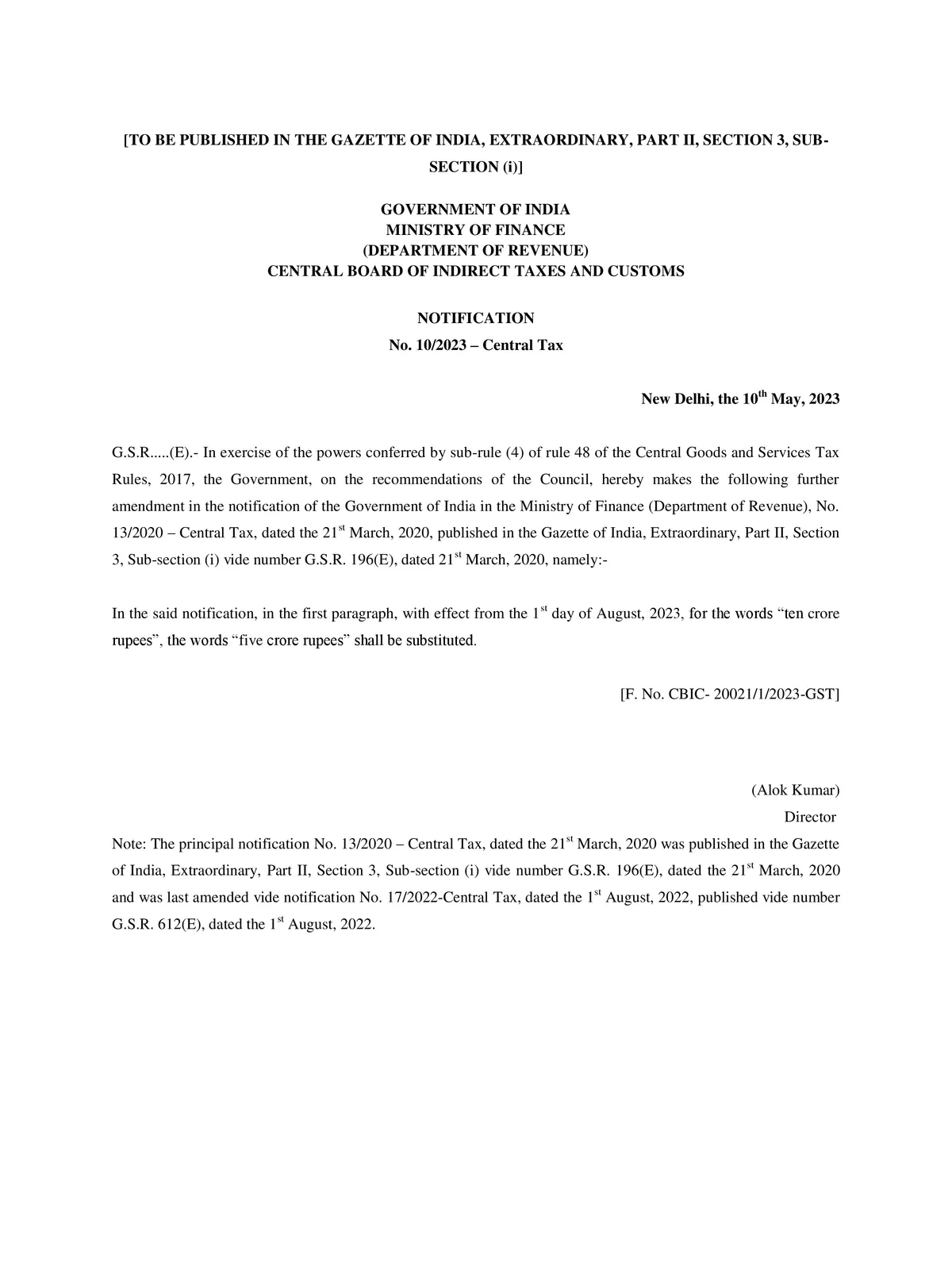

E Invoice Limit 5 Crore Notification - Summary

5 Crore from 01st August 2023. Notification No. 10/2023-Central Tax Dated: 10th May, 2023 related to Central Goods and Services Tax Rules, involving a reduction in threshold limit for GST E-Invoicing from ten crore rupees to five crore rupees, effective from August 1, 2023. This rule will come into effect from August 1, 2023. The e-invoicing turnover limit has been reduced to Rs 5 crore by the CBIC from Rs 10 crore. At present, all businesses with a turnover of over Rs 10 crore are mandated to generate e-invoices for all B2B transactions.

The electronic invoicing system for B2B transactions was implemented on a mandatory basis for all those with turnovers above Rs 500 crore from October 1, 2020. The e-invoicing system was launched to plug GST evasion. EY Tax Partner Saurabh Agarwal told PTI that the industry needs to review their vendor masters and ensure that any vendor supplying goods or services and crossing the threshold turnover of Rs 5 crore is necessarily issuing an e-invoice from August 2023 to avoid any dispute with respect to availing of input tax credit (ITC).

E-Invoice Limit 5 Crore Notification

You can download the E-Invoice Limit 5 Crore Notification PDF using t the link given below.