Citibank RTGS/NEFT Form - Summary

Understanding the Citibank RTGS/NEFT Form

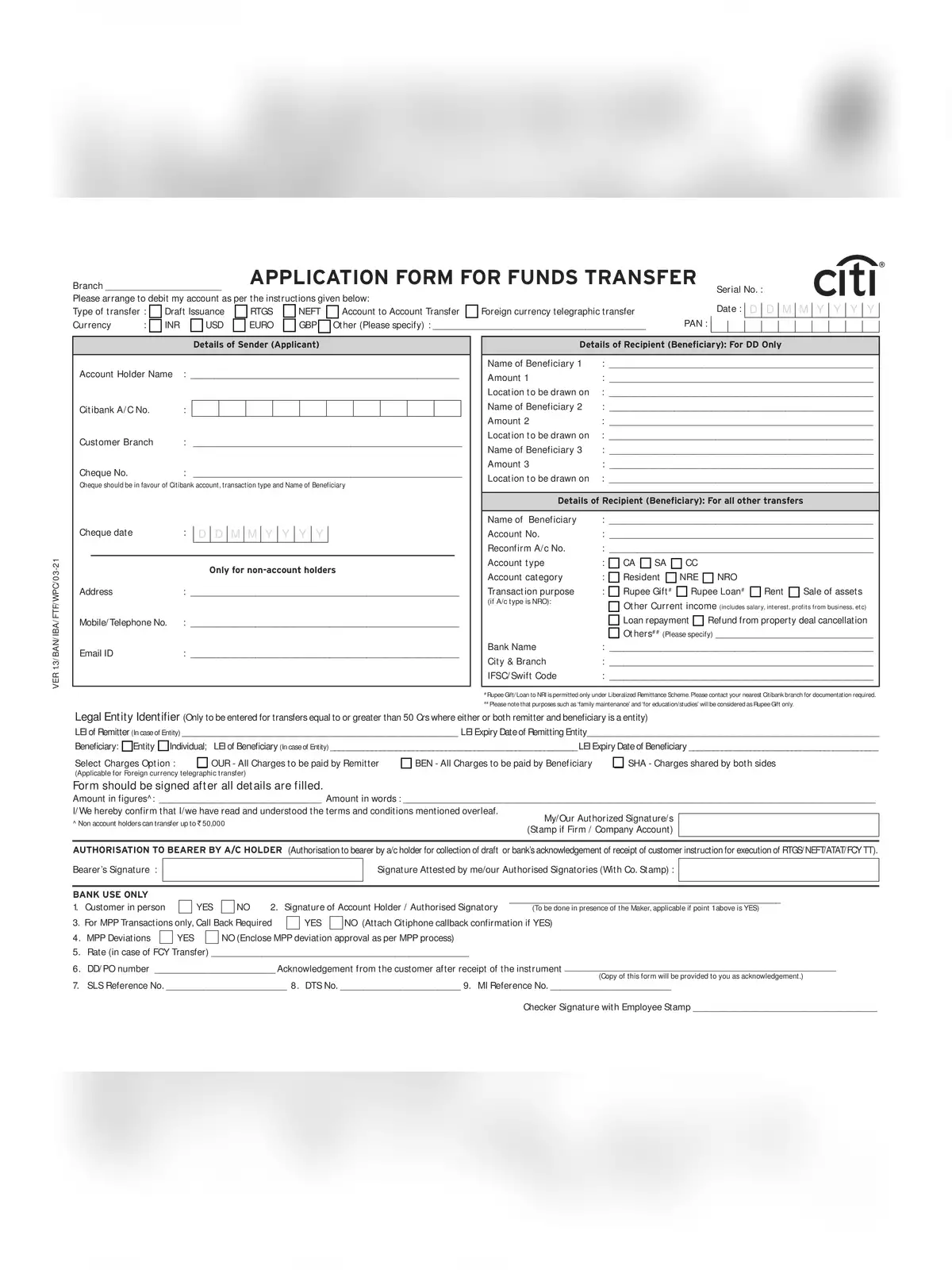

When it comes to electronic fund transfers, the Citibank RTGS/NEFT form plays a crucial role. RTGS (Real Time Gross Settlement) and NEFT (National Electronic Funds Transfer) are two effective electronic payment systems that allow individuals to send money between different banks. While NEFT processes fund transfers in batches, RTGS provides real-time settlement for immediate transactions.

Both RTGS and NEFT are dependable and secure methods for transferring money. Using Citibank’s services requires filling out the RTGS/NEFT form correctly. Let us delve deeper into these systems and learn how to effectively use the form.

How to Fill the Citibank RTGS/NEFT Form

To begin, ensure you have all the correct details regarding the beneficiary’s account. This includes the account number, IFSC code, and the amount you wish to transfer. By filling out the form accurately, you guarantee that your money will reach the intended recipient without issues.

Next, make sure to select the appropriate option for either RTGS or NEFT based on your urgency for the transfer. Remember, RTGS is ideal for immediate and large transactions, while NEFT is suitable for transferring smaller amounts and does not require instant processing.

If you wish to download the Citibank RTGS/NEFT form, you can conveniently find it in PDF format on their website. This PDF contains all the necessary instructions needed for a successful transaction. After downloading, you can print the form, fill it out, and submit it according to your need.

In conclusion, mastering the Citibank RTGS/NEFT form is essential for anyone wanting to transfer money electronically. Understanding the process will ensure that you complete your transactions smoothly and efficiently. Don’t forget to check the PDF for guidance! 📄