Axis Bank RTGS Form - Summary

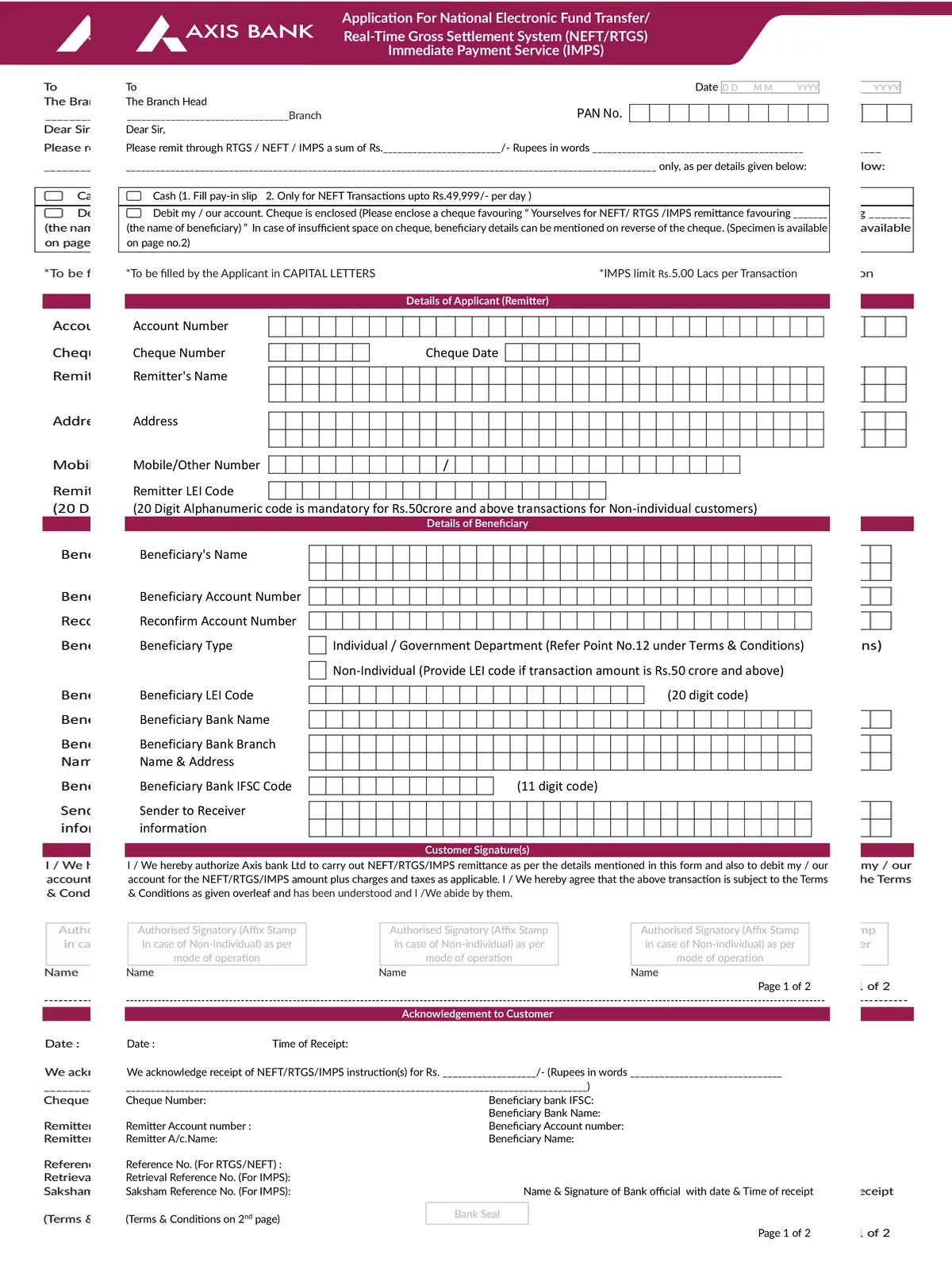

Axis Bank RTGS Form is used when a customer wants to send a large amount of money from one bank account to another. RTGS (Real Time Gross Settlement) is a fast and secure method for transferring funds, usually above ₹2 lakh. This form helps the bank get the correct details needed to complete the transaction safely.

By filling out the RTGS form, customers provide information such as the sender’s account number, the receiver’s bank details, and the amount to be transferred. Once the form is submitted, the bank processes the payment quickly in real time. This makes RTGS a reliable option for urgent and high-value money transfers.

Axis Bank RTGS Form – Highlights

| Type of Form | Axis Bank RTGS/NEFT Application Form 2026 |

| Name of Bank | Axis Bank |

| Official Website | https://www.axisbank.com/ |

| Uses of Form | Online Transfer of Funds |

| Minimum Limit | The minimum limit is Rs. 2 lakhs for RTGS, No minimum limit for NEFT |

| Maximum Limit | No limit |

| Beneficiary | Bank Customers |

| Form Language | English, Hindi |

| Axis Bank RTGS Form PDF | Download PDF |

Details to be Mentioned in Axis Bank RTGS Form

- On the bank RTGS form, there are two sections where each is defined differently. In the top section, the applicant should enter beneficiary details and, in the next part, enter the remitter details.

- Remitter Bank Account Details

- Beneficiary Bank Account Details

- Cheque leaf details

- Amount

- Date

- Mobile & E-mail ID

- And any other details

Axis Bank Online RTGS NEFT Procedure

The account holders of Axis Bank can use their internet banking login ID and password to log into their account and make payments via NEFT or RTGS depending upon the timing and transaction amount. – https://retail.axisbank.co.in

Axis Bank NEFT Timings

The NEFT services have a specific time for Axis bank transfers as follows: Monday to Friday from 10 am to 4:30 pm, and Saturdays except on the 2nd and 4th Saturday.

Axis Bank RTGS Timings

The RTGS official transfer timings are Monday to Friday from 10 am to 3:30 pm, and Saturdays excluding the 2nd and 4th Saturdays.The bank AXIS RTGS services transfer amount higher than Rs.2,00,000.

Axis Bank NEFT/RTGS Charges

The charges for Axis Bank’s NEFT and RTGS services are shown below in Table,

| NEFT Outward | Outward Up to Rs. 10,000/- | Rs.2.50/- per transaction |

| Rs. 10001 to Rs 1 Lakh | Rs. 5/- per transaction | |

| Rs 1 Lakh to Rs 2 lakh | Rs. 15/- per transaction | |

| Above Rs.2 Lakh | Rs.25/- per transaction | |

| RTGS Outward | Outward Rs.2 Lakh to Rs.5 Lakh | Rs.25/- per transaction |

| Rs.5 Lakh & Above | Rs.50/- per transaction |

Difference between RTGS and NEFT and other Information

| Difference | NEFT | RTGS |

| Transfer time | Half an hour | Same time |

| Minimum transfer limit | Rs. 1 | Rs. 2 lakh |

| Maximum transfer limit | No limit However, you cannot transfer more than ₹ 50,000 in a single transaction. | No limit |

| Service Available Timings | 8:00 AM – 7:00 PM Monday to Saturday (Except 2nd and 4th Saturdays of the month) Not available on Sundays and Bank Holidays | 8:00 AM – 6:00 PM Monday to Saturday Not available on Sundays and Bank Holidays |

| fee | Depends on the bank and the transfer amount. | Rs 25 for Rs 2 lakh to Rs 5 lakh Rs 50 for more than 4 lakhs GST is also applicable |

| Payment Option | Online & Offline | Online & Offline |

You can download the Axis Bank RTGS/NEFT Form PDF format using the link given below.