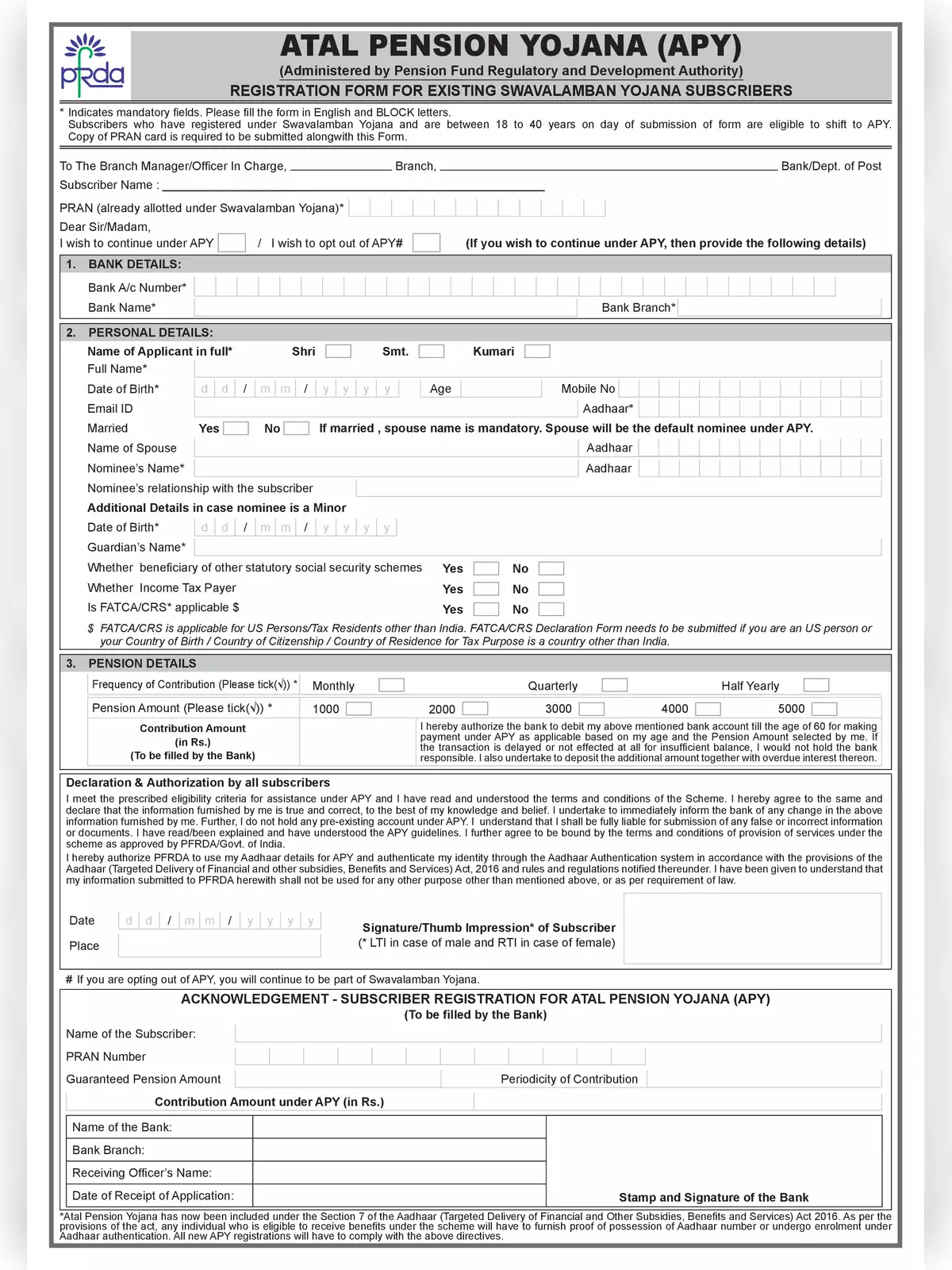

APY Swavalamban Yojana Subricerbers Form - Summary

Essential Information to Include in the APY Swavalamban Yojana Subscribers Form

- Applicant’s Name

- Date of Birth (DOB)

- Mobile Number

- Email ID

- Nominee’s Name & details

- Aadhaar Number

- Any other necessary details

Who is Eligible for Atal Pension Yojana?

1. You must be an Indian citizen.

2. You should have a valid bank account.

3. You should be between 18 and 40 years of age.

Benefits of Atal Pension Yojana

The APY provides a guaranteed pension between Rs 1,000 to Rs 5,000 for subscribers. You also have the flexibility to adjust your pension amount once a year during the accumulation phase.

In the unfortunate event of the subscriber’s death, the spouse is entitled to receive the same pension amount until their own death. After both the subscriber and spouse have passed away, the nominee will be eligible to receive the pension amount accumulated until the subscriber reaches 60 years of age.

Additionally, if the subscriber dies before turning 60, the spouse can choose to exit the scheme and claim the accumulated funds or continue the account under the subscriber’s name for the remaining years. In this case, the spouse will receive the same pension amount as the subscriber until their own demise.

You can easily download the APY Swavalamban Yojana Subscribers Form in PDF format using the link below.