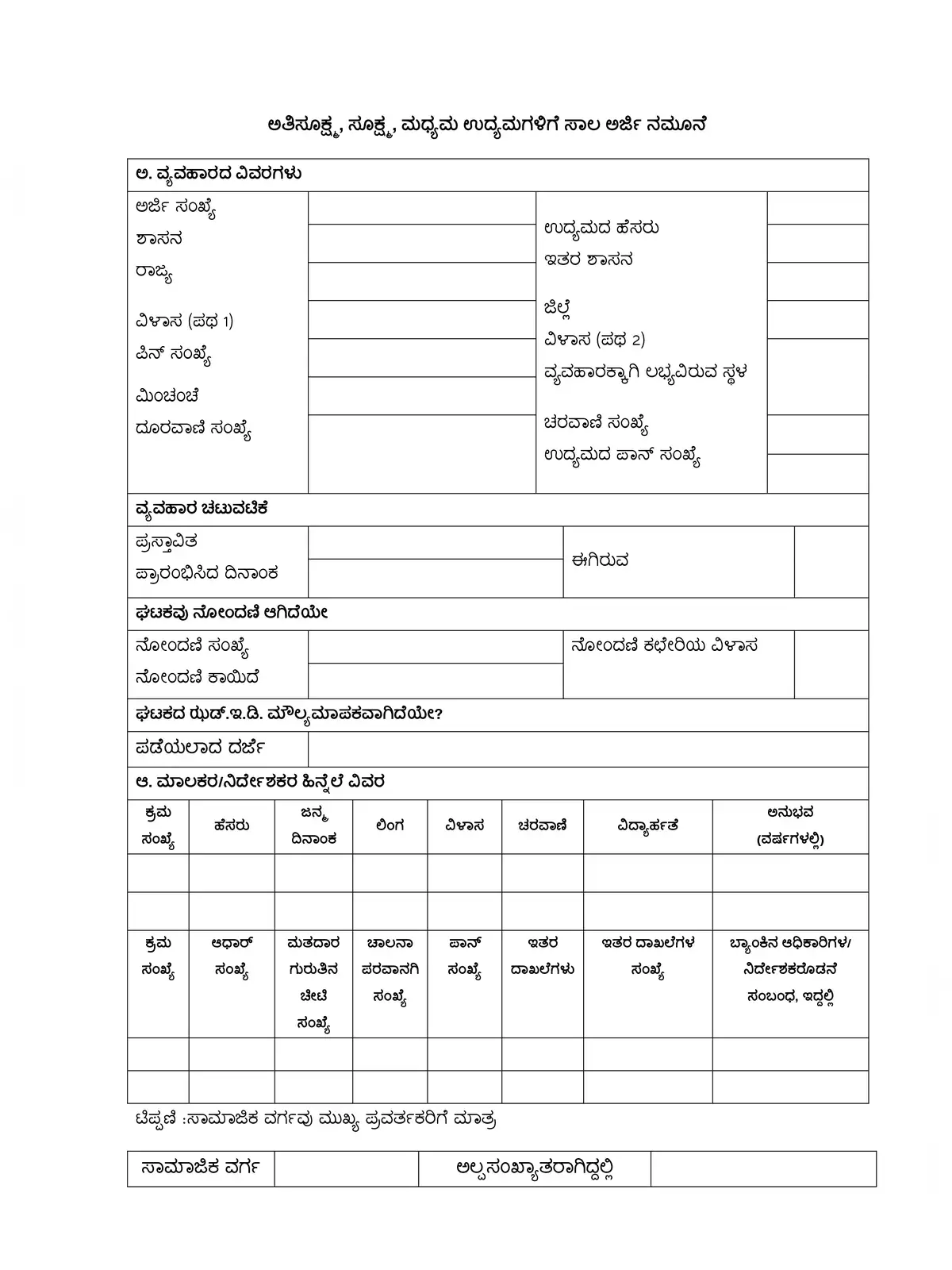

MSME Loan Application Form - Summary

When applying for an MSME loan, understanding the documentation and processes involved is crucial. This guide covers the MSME loan application form and offers a comprehensive checklist to ensure a smooth application experience. You can easily download the MSME Loan Application form in PDF format from the link below.

Essential Checklist for MSME Loans up to Rs.10 crore

Documents Required

- Proof of Identity: Aadhaar Card, Voter’s ID Card, Passport, Driving License, PAN Card, or signature identification from the current bankers of the proprietor, partner, or director (if it is a company).

- Proof of Residence: Aadhaar Card, recent telephone bills, electricity bill, property tax receipt, Passport, or Voter’s ID Card of the proprietor, partner, or director (if it is a company).

- Proof of Business Address.

- The applicant must not have any defaults with any bank or financial institution. Include the Memorandum and Articles of Association for the company or Partnership Deed for partnership firms.

- Statements of assets and liabilities from promoters and guarantors, along with the latest income tax returns.

- Rent Agreement (if the business premises are rented) and clearance from the pollution control board if applicable.

- SSI/MSME registration or Udyog AADHAAR Memorandum, if applicable. Provide projected balance sheets for the next two years for working capital or for the loan’s duration for term loans.

- Copies of lease deeds or title deeds for properties offered as primary and collateral securities.

- Certificate of incorporation from RoC in case of a company (CIN No. and DIN No. of directors).

- Bank account details wherever applicable (including details of outstanding for existing loans/limits).

- GSTN No., if applicable.

- Credit rating details and report, if available.

- ZED rating, if available.

For Cases with Exposure above Rs. 25 lakh

- Profile of the unit (includes names of promoters, other directors, the activities being undertaken, addresses of all offices and plants, shareholding pattern, etc.).

- Last three years’ balance sheets of the associate or group companies, if any.

- Project report for the proposed project if term funding is needed. This should contain details like the machinery to be acquired, supplier information, pricing, machine capacity, utilization assumptions, projected production, sales, profit and loss, and balance sheets for the loan tenor, along with labor and staff assumptions.

- Manufacturing process details (if applicable), profiles of major executives in the company, any collaborations, raw material details and their suppliers, buyer information, and an analysis of major competitors, along with the company’s strengths and weaknesses in comparison.

You can also download the MSME Loan Application form in PDF format online from the link provided below.