SBI PPF Deposit Form - Summary

Public Provident Fund (PPF) is an excellent long-term investment scheme in India that many people choose for its benefits. This government-supported plan is known for attractive interest rates, safety, and returns that are fully tax-exempt under Section 80C of the Income Tax Act. Investors can save tax from as low as Rs. 500 up to a maximum of Rs. 1,50,000 in one financial year. The PPF scheme also provides additional benefits like loans, withdrawals, and account extensions.

Features of the PPF Scheme

- Investment Limits: A minimum of Rs. 500.00 and a maximum of Rs. 1,50,000 can be deposited annually.

- Duration: The original account duration is 15 years, which can be extended in blocks of 5 years upon request.

- Interest Rate: The interest rate is set by the Central Government quarterly. Currently, it is 7.90% per annum effective from 01.10.2019.

- Loans and Withdrawals: These are allowed based on the account’s age and balance as of specific dates.

- Tax Benefits: Income Tax deductions are available under Section 88 of the IT Act.

- Nomination: You can nominate one or more persons, and specify their shares.

- Transfer: The account can be transferred to different branches, banks, or Post Offices upon subscriber request, free of charge.

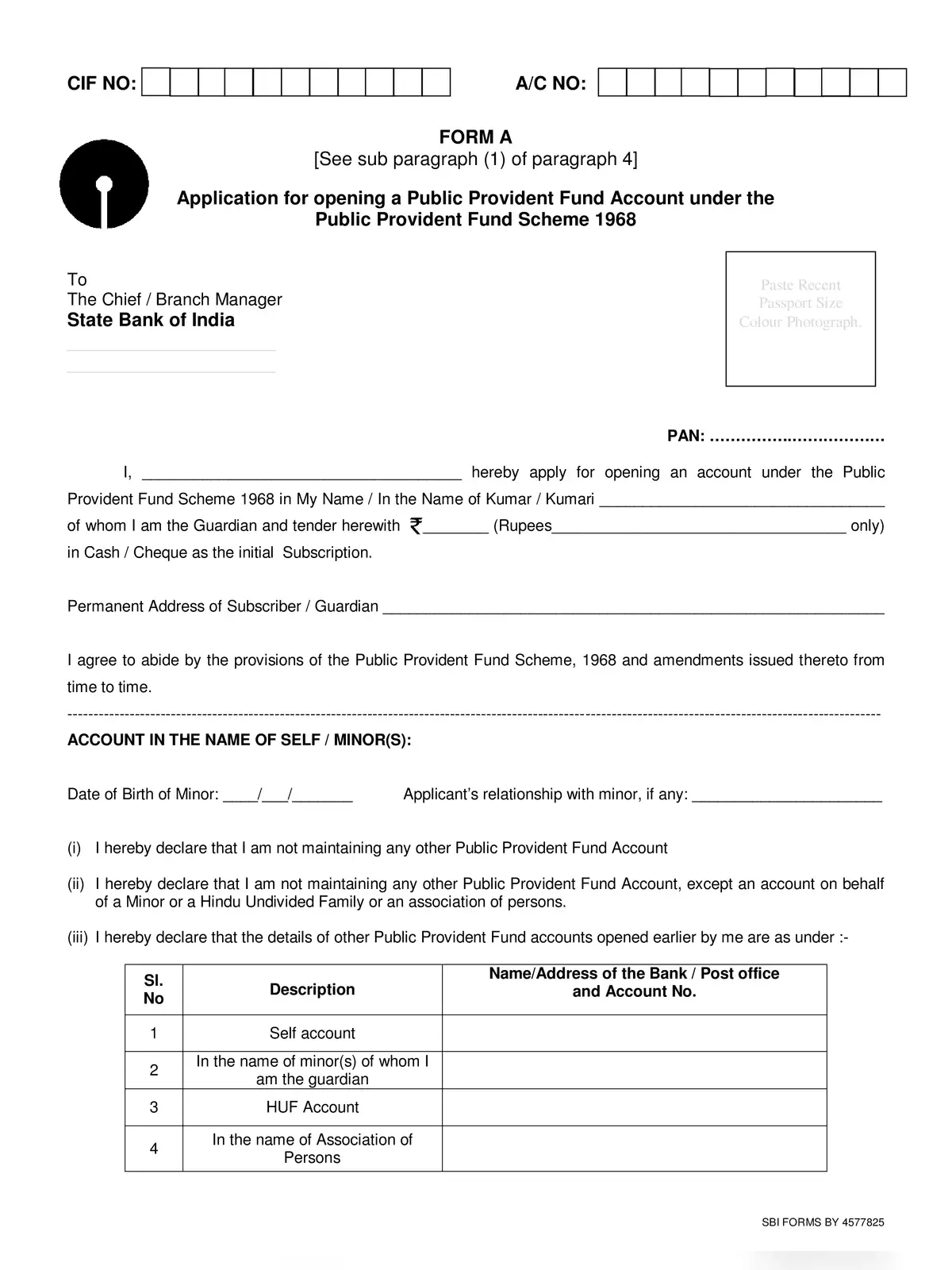

How to Open an SBI PPF Account Online:

1) Log in to your SBI online account. Click on the ‘Request and inquiries’ tab at the top right corner.

2) From the drop-down menu, select ‘New PPF Account’.

3) You will be directed to a page containing the necessary account details.

4) If you wish to open an account for a minor, check the option that says ‘If the account is to be opened in the name of a Minor, click here’.

5) Fill in the minor’s details (name and age) and your relationship with the applicant.

6) For accounts not opened for a minor, enter the branch code where you want the PPF account.

7) After entering the branch code, provide the names of nominees. You can add a maximum of five nominees.

8) Upon submitting, a dialogue box will confirm that ‘your form has been successfully submitted’, along with a reference number.

9) Download the form using the reference number provided.

10) Print and fill out the downloaded form, and submit it at your branch within 30 days along with KYC documents.

Terms & Conditions

- The maximum deposit per annum is Rs. 1,50,000. Any excess amount will not earn interest or receive tax benefits. You can make deposits in a lump sum or in parts.

- Interest is calculated on the minimum balance in the PPF account between the 5th day and the end of the month. It is credited annually on 31st March.

- The interest income is completely exempt from Income Tax, and the account balance is exempt from Wealth Tax.

- An account holder can request premature closure on valid grounds through an application in Form-5, such as:

- i) Treatment for a life-threatening disease of the account holder or dependent family members, supported by medical documents.

- ii) Higher education expenses for the account holder or children, confirmed by admission documents.

- iii) Change in residency status, supported by passport and visa copies or tax returns.

Download the SBI PPF Deposit Account Opening Form in PDF format using the link given below to get started!