SBI Application for Cash Credit / Term Loan Under SME - Summary

State Bank of India (SBI) provides a wide variety of loans, specifically designed to meet the financial needs of the Small and Micro Enterprises (SME) sector. If you’re involved in income-generating activities within the manufacturing, trading, or services sectors, you can apply for loans ranging from Rs. 5 lakh to Rs. 500 crore.

Easy Loan Options for SMEs

With SBI’s range of loan products, small business owners can find the right financial support for their operations. Whether you are looking for a cash credit facility or a term loan, SBI has flexible options to help you grow your business. These loans are designed to ensure that you can manage your expenses effectively and invest in your business’s future.

How to Download the Application Form

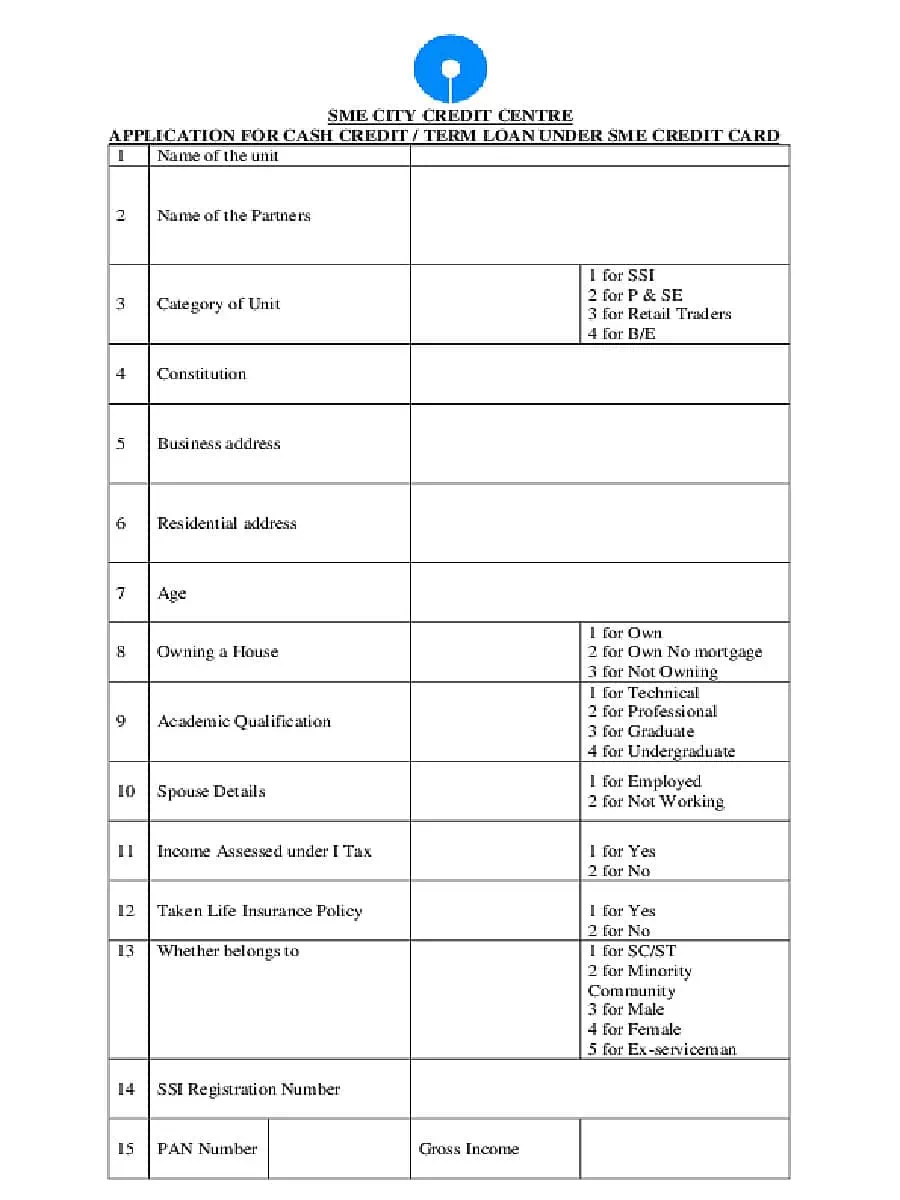

You can easily download the SBI application for Cash Credit / Term Loan Under SME in PDF format using the direct link provided below. This allows you to fill out the form at your convenience and submit it as per the guidelines.

Make sure to prepare all necessary documents and understand the terms associated with the loans before applying. This will help streamline your application process and increase your chances of approval. 🌟

Download SBI Application for Cash Credit / Term Loan Under SME Credit Card Form in PDF format using the direct link provided below.