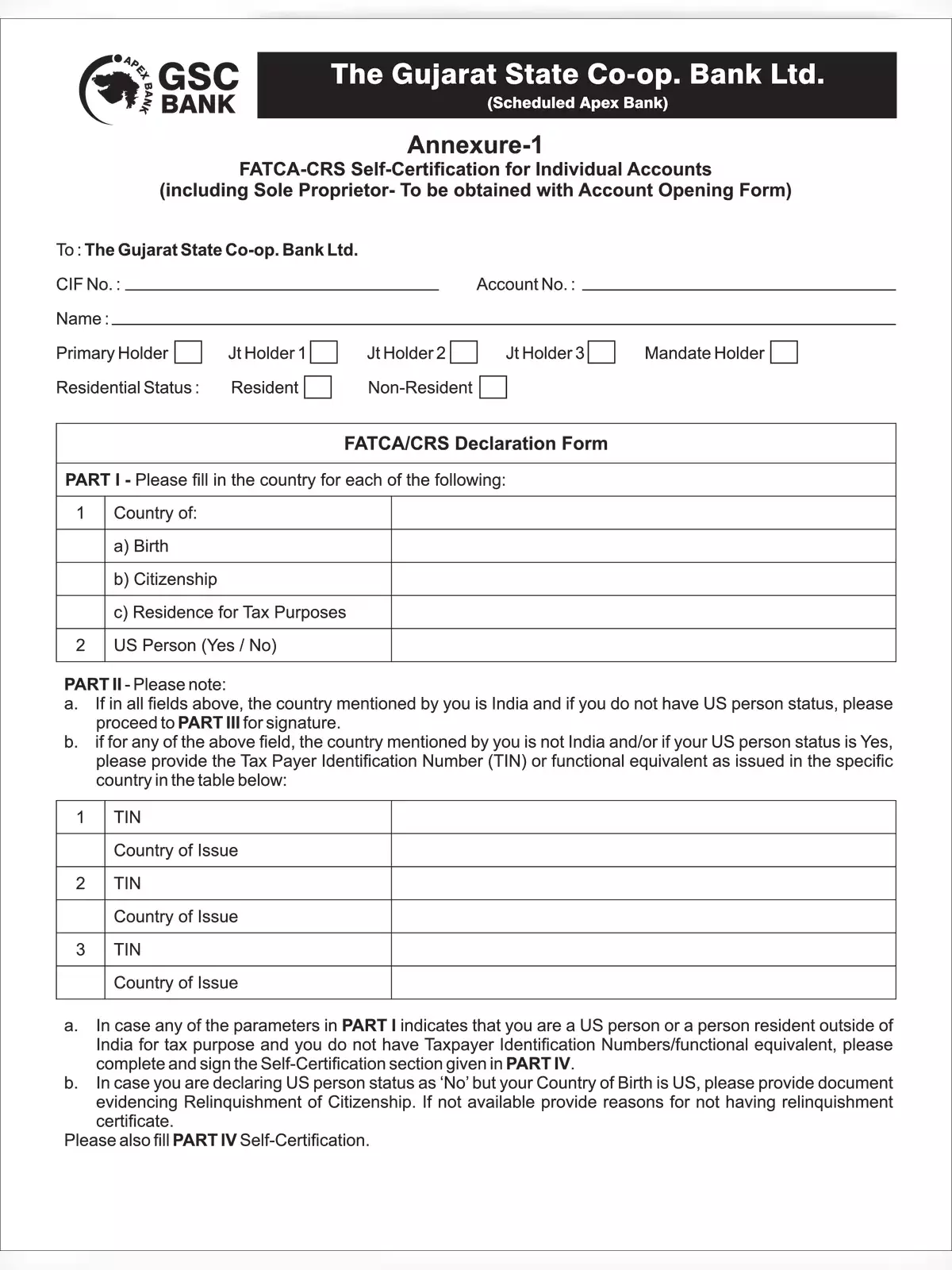

GSC Bank FACTA Individual Form - Summary

An Indian bank is asking for important details related to FATCA (Foreign Account Tax Compliance Act) for tax purposes. This includes your resident address for tax purposes, along with your primary and secondary countries of tax residence. FATCA, or the Foreign Account Tax Compliance Act, helps in the automatic exchange of financial information between India and the US.

Understanding TIN in FATCA

TIN, or Tax Identification Number, is very important in the context of FATCA. When you register for your NPS account online, make sure you provide accurate information. This includes your country of birth, citizenship, and your residence for tax purposes under the ‘FATCA/CRS Declaration Tab’.

How to Prepare for FATCA Compliance

Preparing for FATCA compliance is easy if you gather all required documents and information ahead of time. This preparation will make the process smoother and help you avoid any potential issues in the future.

For more details, you can download our comprehensive PDF that explains the whole process of filling out the GSC Bank FACTA Individual Form easily. Make sure to keep this PDF handy as it will guide you through every step you need to follow. Don’t miss out on making your process simple!