Section 54, 54EC, 54F Exemption From LTCG Tax - Summary

Understanding Section 54, 54EC, and 54F Exemption From LTCG Tax

The topic of Section 54, 54EC, and 54F exemption from LTCG tax is very important for anyone dealing with Long Term Capital Gains in India. Long-Term Capital Gains (LTCG) on shares and equity-oriented mutual funds in India are taxed at a 12.5% rate (plus surcharge and cess) if they reach Rs. 1.25 lakh in a fiscal year However, the Government of India provides taxpayers with a wonderful opportunity to claim exemptions from this Capital Gains Tax. This is possible if they reinvest the proceeds from the sale into certain eligible investments.

What is LTCG Tax?

Long Term Capital Gains Tax is a tax applied to profits made from the sale of assets that have been held for more than one year. This could be property, stocks, or mutual funds. Given the high rate of taxation, it is beneficial to know how to legally reduce this tax liability.

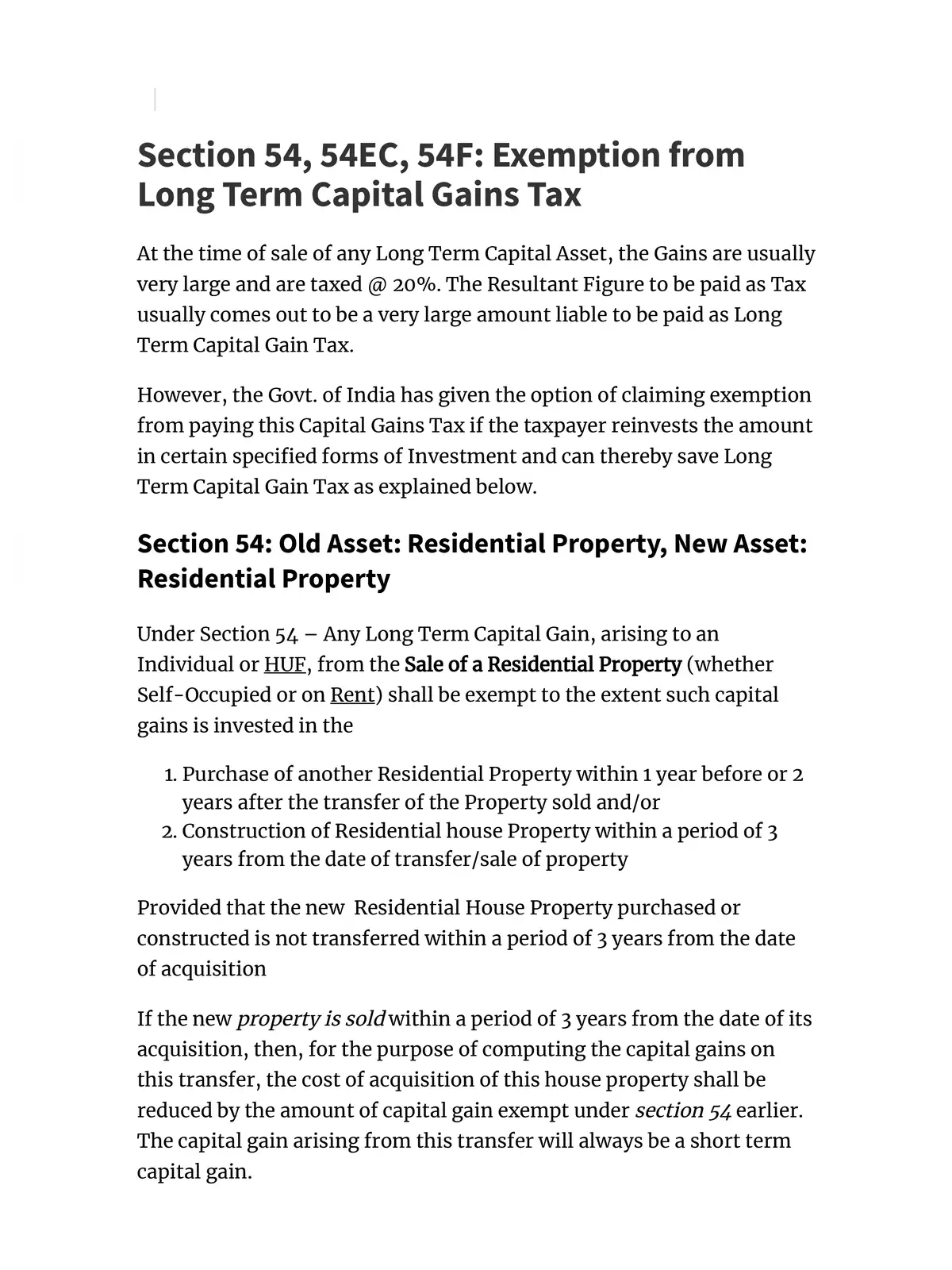

Section 54 allows taxpayers to claim an exemption on LTCG when they sell a residential property and invest the gains into purchasing or constructing another residential property. This means if you reinvest your profits wisely, you may not need to pay any capital gains tax at all.

Similarly, Section 54EC provides an exemption for long term capital gains arising from the sale of any asset, provided the taxpayer invests the amount in specified bonds. The investment must be made within six months of the sale. This section encourages investment in specified bonds of the National Highway Authority of India (NHAI) or the Rural Electrification Corporation (REC), which leads to access to capital in essential public infrastructure.

On the other hand, Section 54F applies when an individual sells any long-term asset other than a residential house. If the taxpayer invests the net sale proceeds in purchasing or constructing a residential house, they can benefit from exemption of LTCG tax.

It is essential for taxpayers to understand the timelines involved for making the investments to avail of these exemptions. Moreover, maintaining proper documentation of the transactions and investments made is crucial to substantiate claims for tax exemption.

To help you better understand these sections and how they can work to your advantage, we have also prepared a detailed PDF. You can access this PDF to learn more about the intricacies of Section 54, 54EC, and 54F exemptions and how to navigate your tax situation effectively. Download the PDF now to get the complete information.

In conclusion, while Long Term Capital Gains Tax can take a significant portion of your profits, the exemptions provided under these sections offer a valuable means to preserve your gains. Stay informed and make prudent investment choices to take full advantage of these tax benefits.