Axis Bank Form 15G - Summary

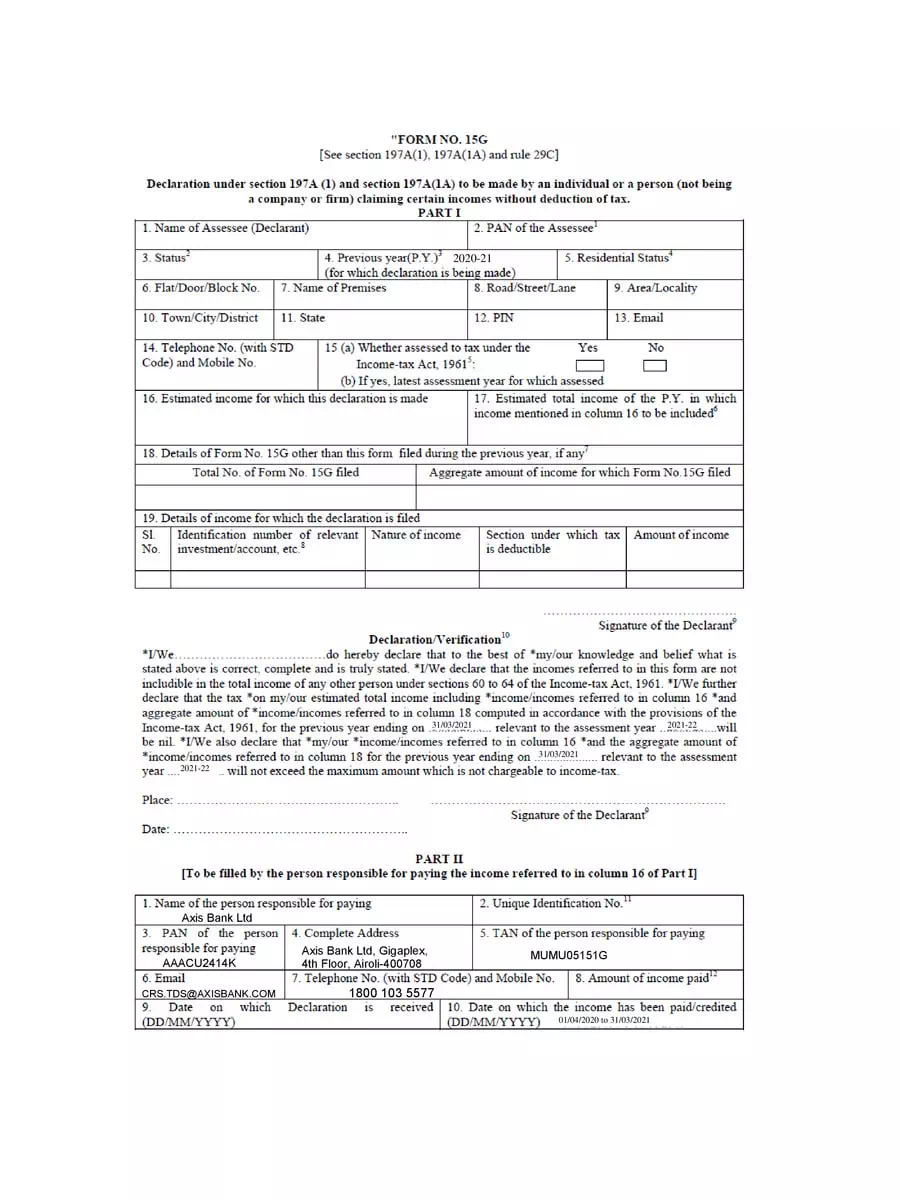

Axis Bank Form 15G is a crucial document for bank fixed deposit holders (individuals under 60 years of age and Hindu Undivided Families) that helps them ensure no TDS (tax deduction at source) is deducted from their interest income for the fiscal year. By filling out Form 15G, individuals can declare that their income is below the taxable limit, thereby preventing TDS deductions on their earnings.

What is Form 15G?

Form No. 15G, along with Form No. 15H, acts as a self-declaration for individuals. When you fill out this form, you confirm that your income does not exceed the taxable limit, ensuring that no TDS is deducted from your interest income.

Key Points to Consider

It’s important to remember that if you withdraw your provident fund before completing five years of service, TDS at a rate of 10 percent will be applicable, starting from June 1, 2015. Therefore, to avoid TDS on your interest income, make sure to submit the form promptly.

For your convenience, you can download the Axis Bank Form 15G PDF from the link below. This PDF will guide you in filling out the form accurately and ensure swift submission.

Be sure to download the Axis Bank Form 15G in PDF format using the link provided below or through an alternative link.