HRA Declaration Form Rajasthan - Summary

Salaried individuals living in rented houses can significantly benefit from the House Rent Allowance (HRA) to reduce their taxes—either partially or completely. This allowance helps cover expenses related to renting a home. However, if you do not occupy a rented accommodation, the entire allowance becomes taxable.

If you pay rent for any residential accommodation but do not receive HRA from your employer, you can still claim a deduction under Section 80GG of the Income Tax Act.

Eligibility Criteria for Claiming HRA & Section 80GG Deduction

Conditions that must be fulfilled to claim this deduction:

- You are either self-employed or salaried.

- You have not received HRA at any time during the year for which you are claiming 80GG.

- Neither you nor your spouse, your minor child, or the Hindu Undivided Family (HUF) to which you belong owns any residential accommodation at the location where you currently stay, work, or run your business.

In case you own a residential property elsewhere, you should not classify that property as self-occupied. Instead, it will be considered let out, allowing you to claim the 80GG deduction.

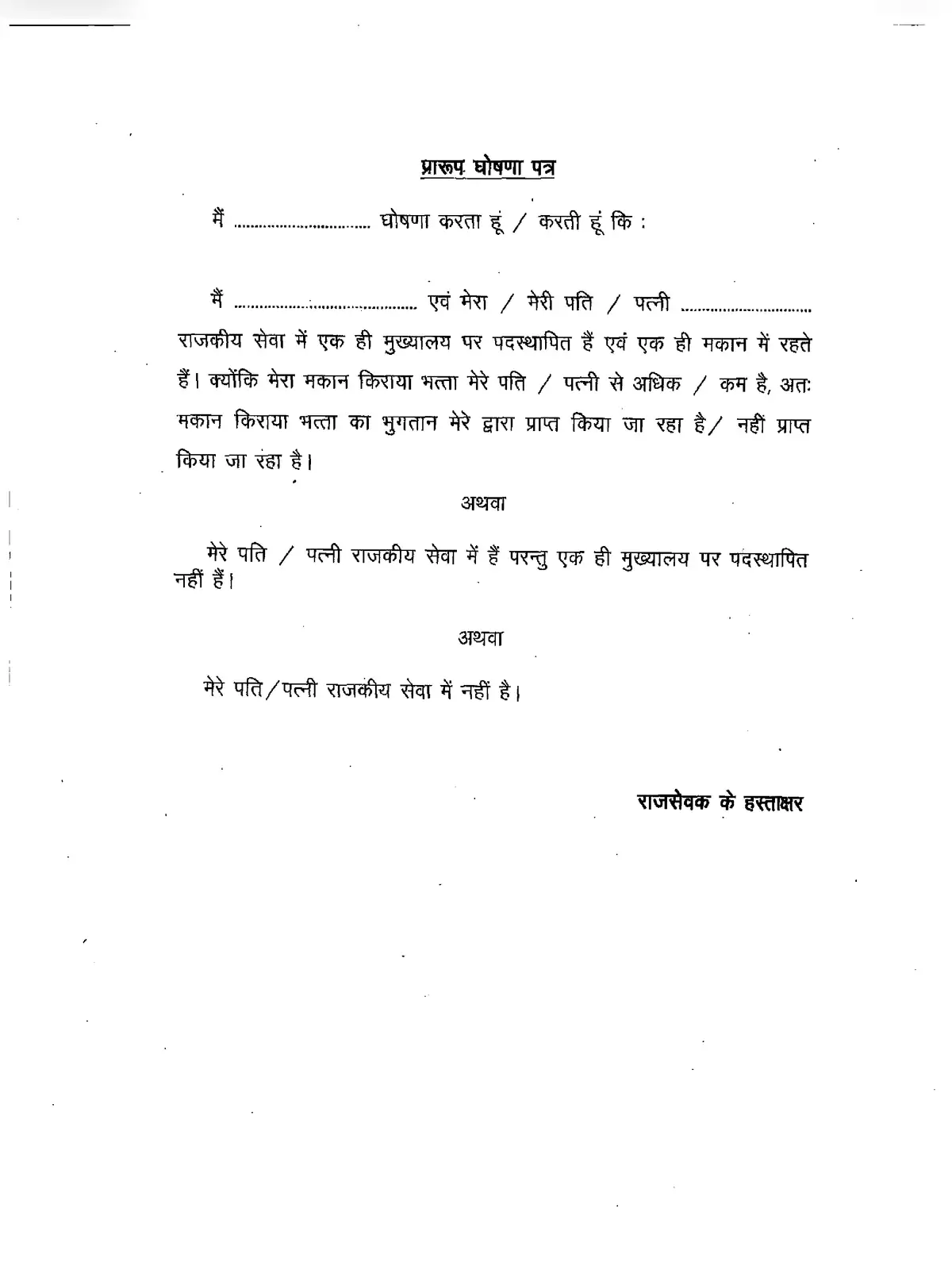

Download the HRA Declaration Form Rajasthan

To make the process easier, you can download the HRA Declaration Form Rajasthan in PDF format using the link provided below. This will help you in managing your HRA claims and maximizing your tax benefits. Don’t forget to download it for your reference!