Tuition Fee Reimbursement Form for CG Employees - Summary

This is a Tuition Fee Reimbursement Form PDF for Central Government Employees, which you can easily download from the official website finance.delhigovt.nic.in or through the link provided below. The Children’s Education Allowance and Reimbursement of Tuition Fee, which were previously issued separately, have now been combined into one scheme known as the ‘Children Education Allowance Scheme.’

Understanding the Children Education Allowance Scheme

Under this scheme, government servants can claim reimbursement for the education of their children, covering up to a maximum of 2 children. This reimbursement is applicable only for the expenses related to the education of school-going children. It specifically includes children from nursery up to class twelve, which involves classes eleven and twelve conducted by junior colleges or schools affiliated with universities or boards of education.

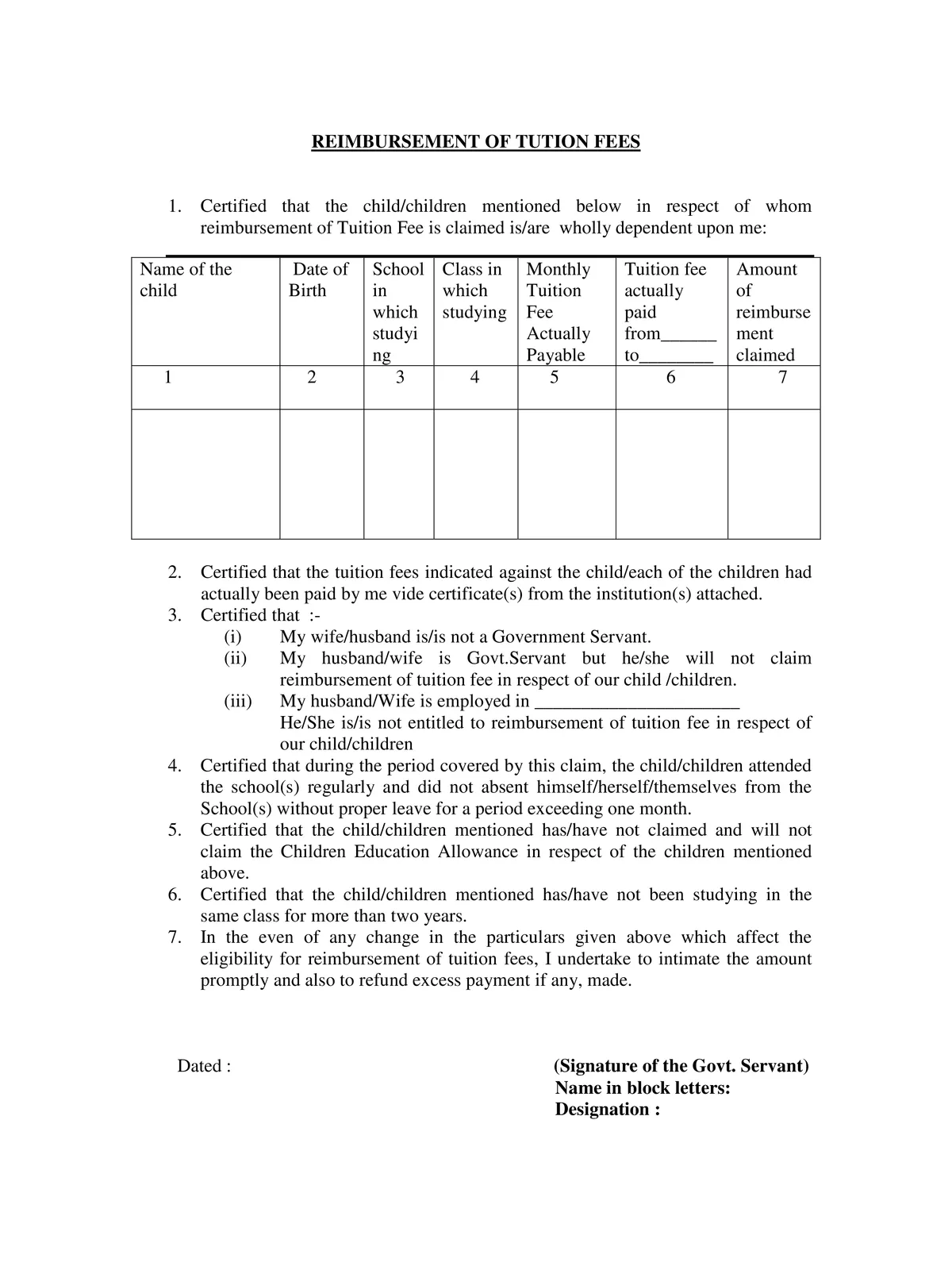

Details to be Mentioned in the Tuition Fee Reimbursement Form

- Name of Child

- School and Class in which students study

- Monthly Tuition Fees

- Amount of Reimbursement claimed

- And any other details.

You can download the Tuition Fee Reimbursement Form PDF for Central Government Employees using the link given below. 😊