Toll Tax Exemption List 2026 - Summary

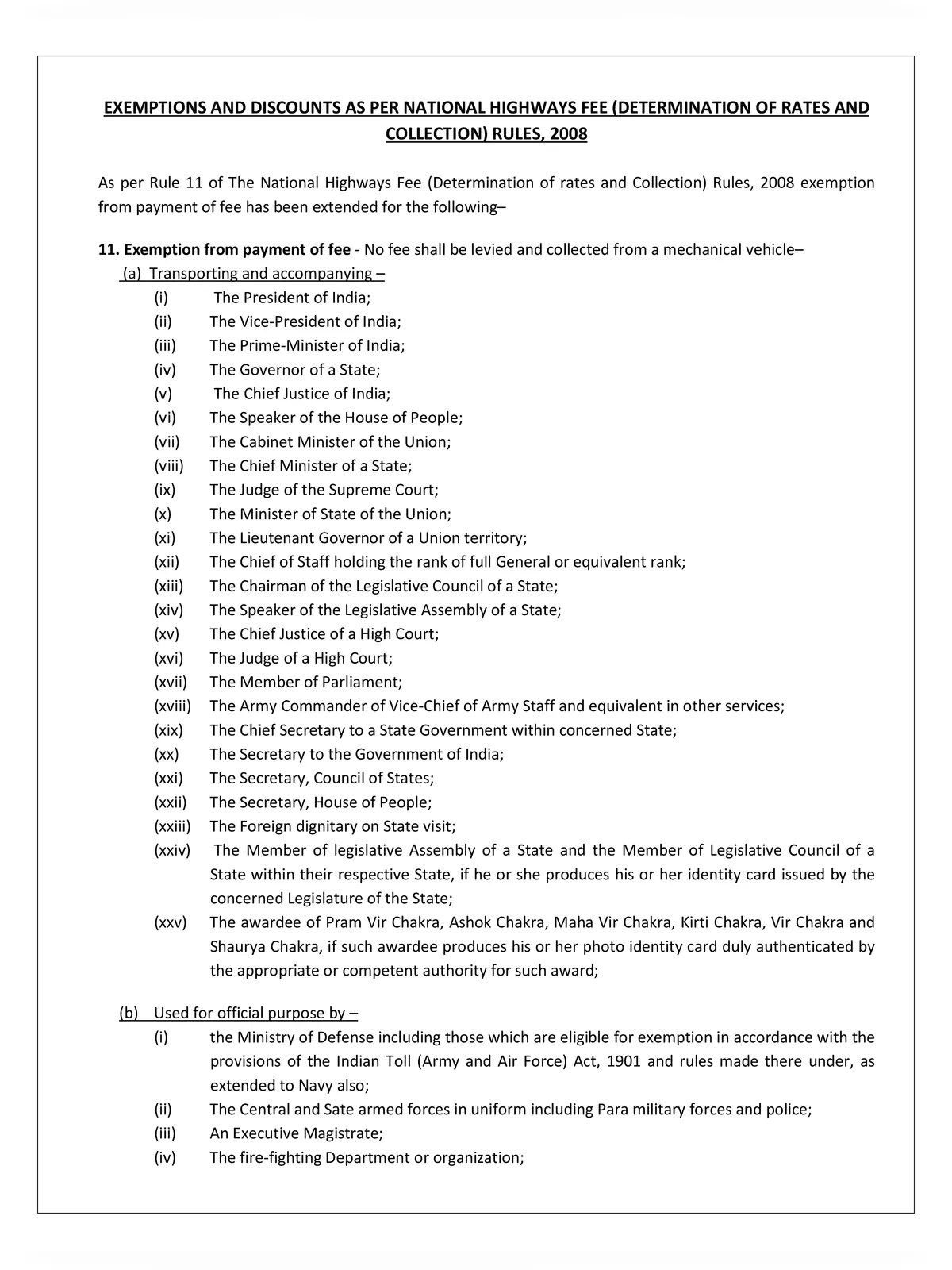

Ministry of Road Transport and Highways, under the National Highways Fee (Determination of Rates and Collection) Rules 2008, provides an important Toll Tax Exemption List. This list includes vehicles that are exempt from paying User Fee, as notified by the government through amendments on 03.12.2010 and 08.06.2016.

The User Fee (Toll) at a Toll plaza is collected from users of National Highway sections when they cross the fee plaza. The rates for the User Fee at a specific plaza are determined by the applicable NH Fee Rules announced by the Government of India and the conditions set out in the concession agreement related to that particular plaza for Build-Operate-Transfer (BOT) projects.

Understanding the Toll Tax Exemption List

a) Transporting and accompanying

- The President of India;

- The Vice-President of India;

- The Prime-Minister of India;

- The Governor of a State;

- The Chief Justice of India;

- The Speaker of the House of People;

- The Cabinet Minister of the Union;

- The Chief Minister of a State;

- The Judge of the Supreme Court;

- The Minister of State of the Union;

- The Lieutenant Governor of a Union territory;

- The Chief of Staff holding the rank of full General or equivalent;

- The Chairman of the Legislative Council of a State;

- The Speaker of the Legislative Assembly of a State;

- The Chief Justice of a High Court;

- The Judge of a High Court;

- The Member of Parliament;

- The Army Commander or Vice-Chief of Army Staff and equivalent in other services;

- The Chief Secretary to a State Government within the concerned State;

- The Secretary to the Government of India;

- The Secretary, Council of States;

- The Secretary, House of People;

- The Foreign dignitary on a State visit;

- The Member of the Legislative Assembly of a State and the Member of Legislative Councils of a State within their respective State, if he or she produces their identity card issued by the concerned Legislature of the State;

- The awardee of Param Vir Chakra, Ashok Chakra, Maha Vir Chakra, Kirti Chakra, Vir Chakra, and Shaurya Chakra, if such awardee produces a photo identity card authenticated by the appropriate authority.

b) Used for official purposes

- The Ministry of Defense vehicles eligible for exemption under the provisions of the Indian Toll (Army and Air Force) Act, 1901, and rules made thereunder, extended to the Navy;

- The Central and State armed forces in uniform, including Paramilitary forces and police;

- An Executive Magistrate;

- The fire-fighting Department or organization;

- The National Highway Authority of India or any other Government organization using such vehicles for inspection, survey, construction, or operation of national highways and maintenance;

- Vehicles used as ambulances;

- Vehicles used as funeral vans;

- Mechanical vehicles specially designed and constructed for use by a person with physical disabilities.

Access the Toll Tax Exemption List

You can also check out the latest toll exemption list at the official website of the Ministry of Road Transport and Highways at https://morth.nic.in.

You can download the Toll Tax Exemption List in PDF format by using the link provided below.