Tax Audit Under Section 44AB of Income Tax Act, 1961 - Summary

Understanding Tax Audit Under Section 44AB of Income Tax Act, 1961

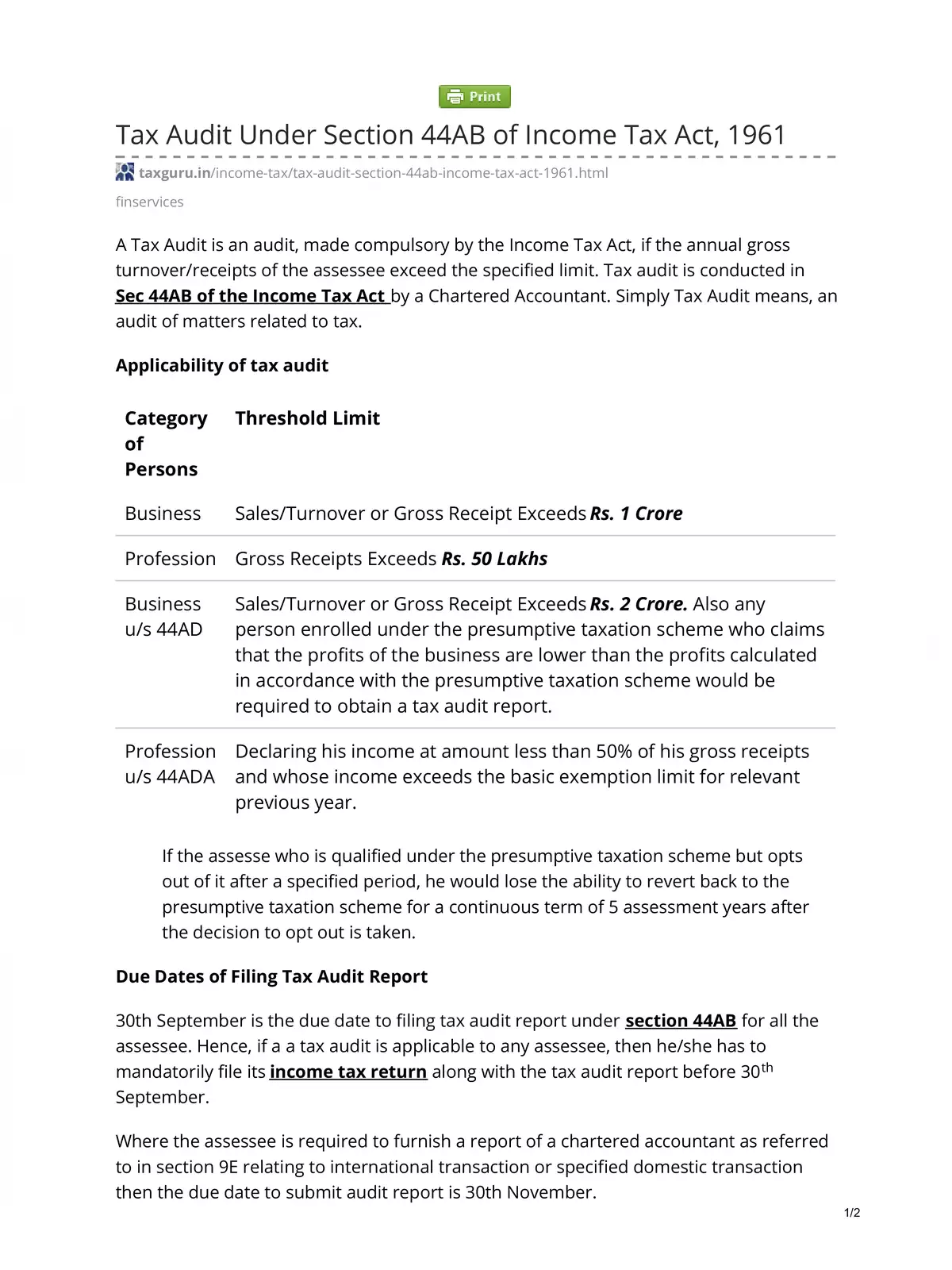

A Tax Audit under Section 44AB of the Income Tax Act, 1961 is an important process that becomes necessary when a taxpayer’s annual gross turnover or receipts surpass a certain threshold, which the government has defined. This kind of audit is done by a qualified Chartered Accountant who ensures that the financial records of the taxpayer are accurate and comply with the legal standards outlined in the Income Tax Act.

Importance of Tax Audit

Having a tax audit is essential as it helps maintain transparency and integrity in financial reporting. It assures the government that the documents presented are true and complete. Moreover, it provides a sense of security to taxpayers by verifying their accounts are in order.

During the tax audit process, the Chartered Accountant will review all financial statements, bills, and other essential documents. This detailed examination helps identify any discrepancies that may exist. If the turnover exceeds the limit specified in the act, it is mandatory to undergo this audit.

Remember, failure to comply with the Tax Audit requirement can lead to penalties and additional legal trouble for the taxpayer. Hence, it is crucial to be aware of when a tax audit applies and act accordingly.

For those interested in diving deeper into this subject, you can look for materials or guides on tax audits to help you understand the rules better. 많은 사람들이 이렇게 중요한 정보를 PDF format에서 다운로드 하기를 원합니다. By having this knowledge, you can ensure that you stay in good standing with the tax authorities and avoid any unexpected issues.

It’s always a good idea to consult with a Chartered Accountant who can guide you through this process. They have the expertise to help you manage your accounts effectively, ensuring compliance with all relevant tax laws.

If you are looking to gather more information regarding Tax Audit Under Section 44AB of the Income Tax Act, 1961, be sure to download our detailed PDF below. This resource will provide you with valuable insights and further clarify the requirements you need to fulfill.