PNB KYC Form 2026 - Summary

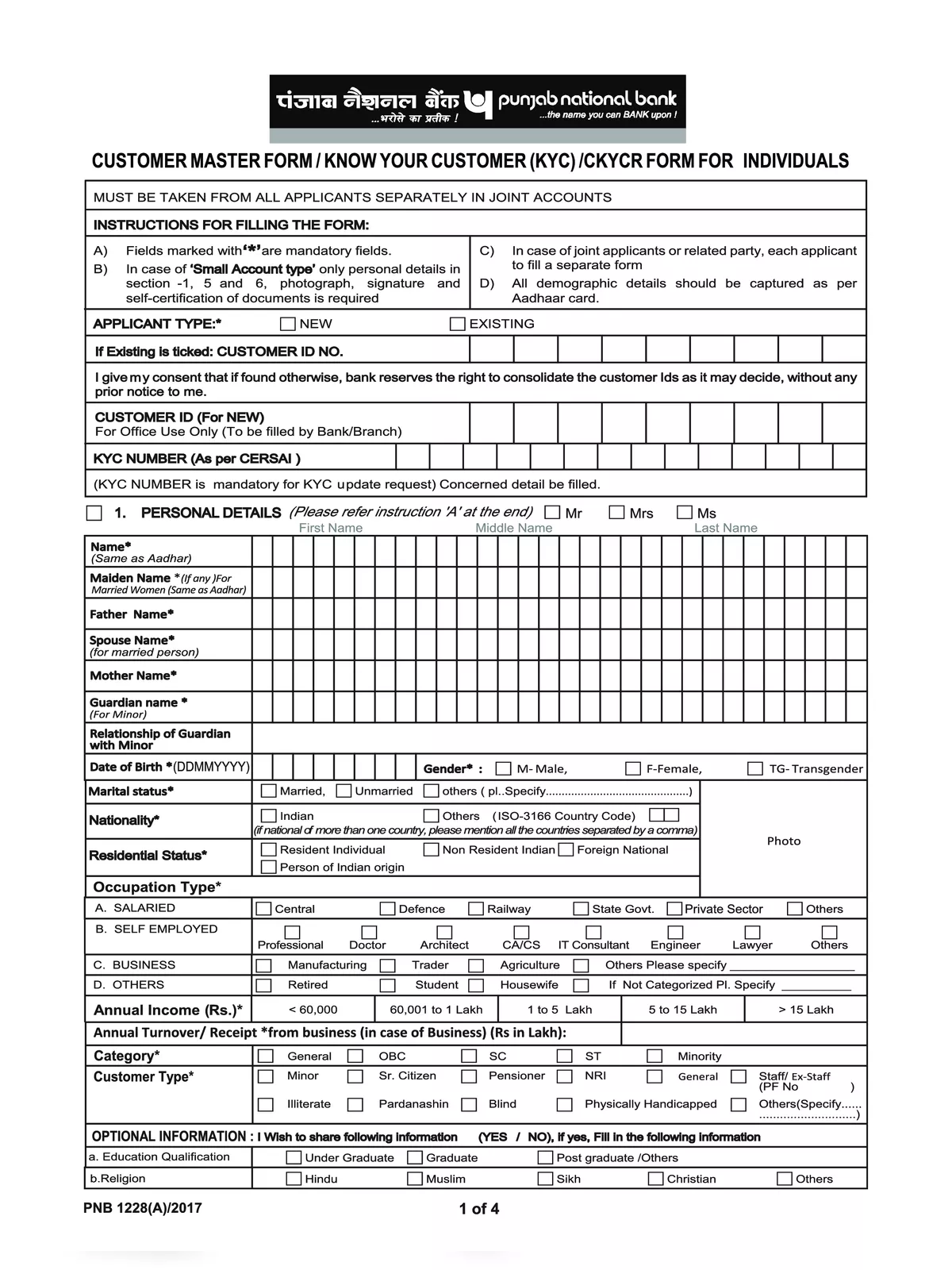

PNB KYC Form is used by customers of Punjab National Bank to update or verify their personal details with the bank. KYC stands for “Know Your Customer,” which helps the bank confirm the identity and address of its customers. By filling out this form, customers provide important information like their name, address, date of birth, ID proof, and contact details. This process helps keep the customer’s bank account safe and prevents misuse or fraud.

KYC form is important for every bank account holder because it ensures that their records are accurate and up to date. Customers may need to submit this form when opening a new account or updating old information. It can be submitted along with photocopies of identity proof and address proof, such as Aadhaar card, PAN card, or passport. Completing the PNB KYC form regularly helps maintain smooth banking services without any interruptions.

PNB KYC Form – Overview

| Bank Name | PNB Bank |

| Type of Form | KYC Form |

| Beneficiary | PNB Bank Account Holders |

| Form Use | To update the Account Holder’s details |

| Post Name | PNB KYC/CKYCR Form |

| Official Website/ Source of PDF | pnbindia.in |

| PNB KYC Form PDF | Download PDF |

What is PNB KYC Form?

The PNB KYC Form is an important document that helps banks gather information about the identity and address of their customers. This process is vital in preventing the misuse of banking services and ensuring safe transactions.

Importance of KYC in Banking

KYC, which stands for Know Your Customer, is required when opening new bank accounts or updating existing ones. Completing the KYC process helps banks keep their services safe and secure. Therefore, it’s very important to fill out the KYC form accurately and on time so that you can continue enjoying banking services without any issues.

How to Fill PNB KYC Form

- Start by providing your personal details such as your full name (as it appears on your official documents), date of birth, gender, and marital status.

- Provide identification details such as your PAN (Permanent Account Number), Aadhaar number (if applicable), passport number (if applicable), and Voter ID card number.

- Indicate your occupation (e.g., salaried, self-employed, business, student, etc.).

- If you’re opening a new account, specify the type of account you wish to open (e.g., savings account, current account).

- If you are filling out the form in person at a PNB branch, the bank staff may also verify your identity and witness your signature.

- Once you have completed the form and attached all necessary documents, submit it to the nearest Punjab National Bank branch.

PNB KYC Form – Documents Required

- Aadhaar Card

- PAN Card

- Voter Card

- Passport

- Job card issued by the NREGA duly signed by the officers of the State government

PNB Bank KYC Form – Uses

- Account Opening in the bank

- Mutual Fund Account

- Bank Lockers

- Purchasing Online Mutual Fund

- Investment in Gold

- Subsidy, etc.

For a simpler experience, remember that you can easily find the PDF of the PNB KYC Form to download from the link below and complete your KYC process today!