New GST Rate List with HSN Code - Summary

New GST Rate List with HSN Code provides details about the tax rates applied to different goods and services in India. GST (Goods and Services Tax) is a single tax system that replaced multiple indirect taxes to make trade easier and more transparent. The list is linked with HSN (Harmonized System of Nomenclature) codes, which are unique numbers used to classify products in a uniform way across the country.

The government said the changes were made on the recommendation of the GST Council, which on September 3 replaced the previous four-slab system (5%, 12%, 18%, and 28%) with a streamlined two-rate structure: a 5% rate for essential goods and an 18% standard rate for most goods and services.

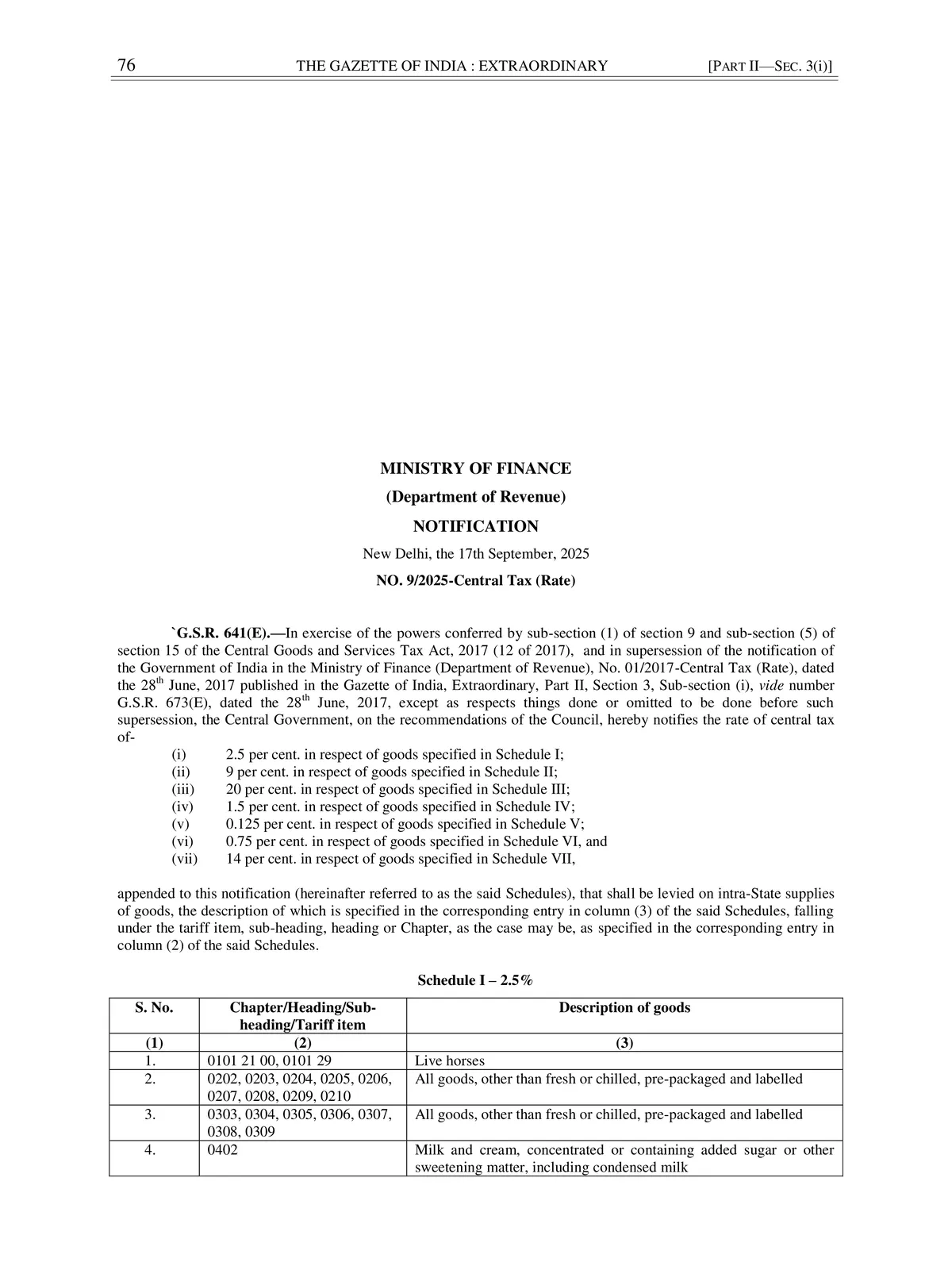

Under the revised structure, Goods are Grouped into Seven Schedules

- 2.5% on goods in Schedule I

- 9% on goods in Schedule II

- 20% on goods in Schedule III

- 1.5% on goods in Schedule IV

- 0.125% on goods in Schedule V

- 0.75% on goods in Schedule VI

- 14% on goods in Schedule VII