Interest & Penalty Under Income Tax Act - Summary

Understanding Interest and Penalty Under the Income Tax Act

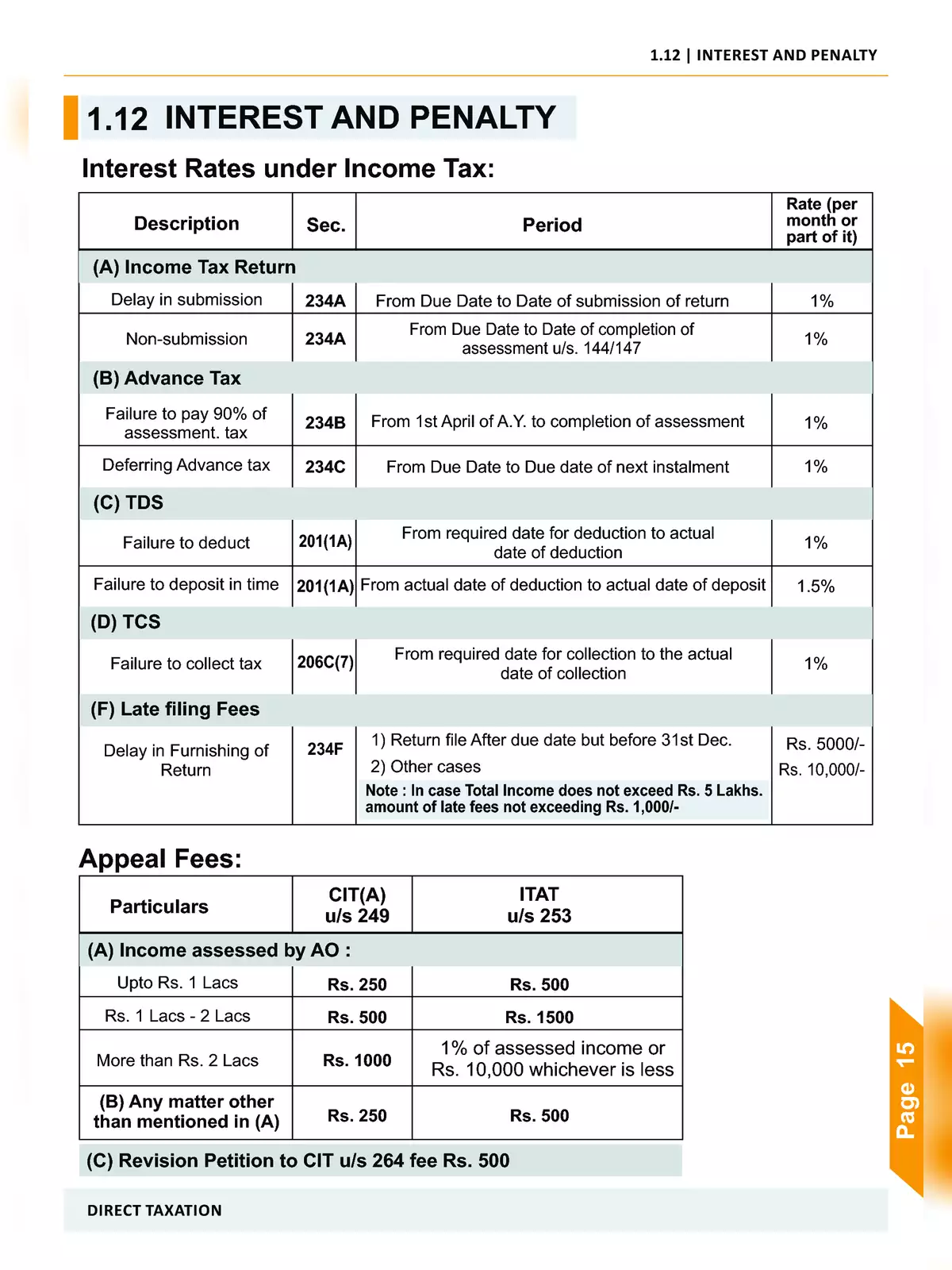

Interest and penalty under the Income Tax Act are crucial topics for every taxpayer in India. Knowing about the nature of interest, penalty, and fines under various sections of the Income Tax Act can help you manage your tax responsibilities more effectively.

It’s important for taxpayers to understand that the Income Tax Act has different rules regarding the types of interest and penalties that may apply. These can come into play due to late payments, underreporting of income, or mistakes in filing returns. By learning about these points, taxpayers can avoid unnecessary fines and stay compliant with the law.

Types of Interest and Penalties under the Income Tax Act

Interest may be charged under the Income Tax Act for delayed payments or late filing of returns. Specific sections such as 234A, 234B, and 234C detail the circumstances in which interest is applicable. Furthermore, penalties under Section 270A focus on underreporting of income, while Section 271F pertains to failing to file returns on time.

To steer clear of these fines, it is wise to keep up with tax payments and meet deadlines. Taking proactive steps, like consulting tax professionals, can support accurate reporting and filing.

If you’re seeking detailed insights on avoiding penalties and understanding the intricacies of the Income Tax Act, consider downloading our informative PDF guide. This resource provides essential information that will assist you in navigating the complexities of your tax duties.

By equipping yourself with knowledge about interest and penalties under the Income Tax Act, you can protect your finances and make wise choices. Remember, staying informed is essential for effective tax management. 📚