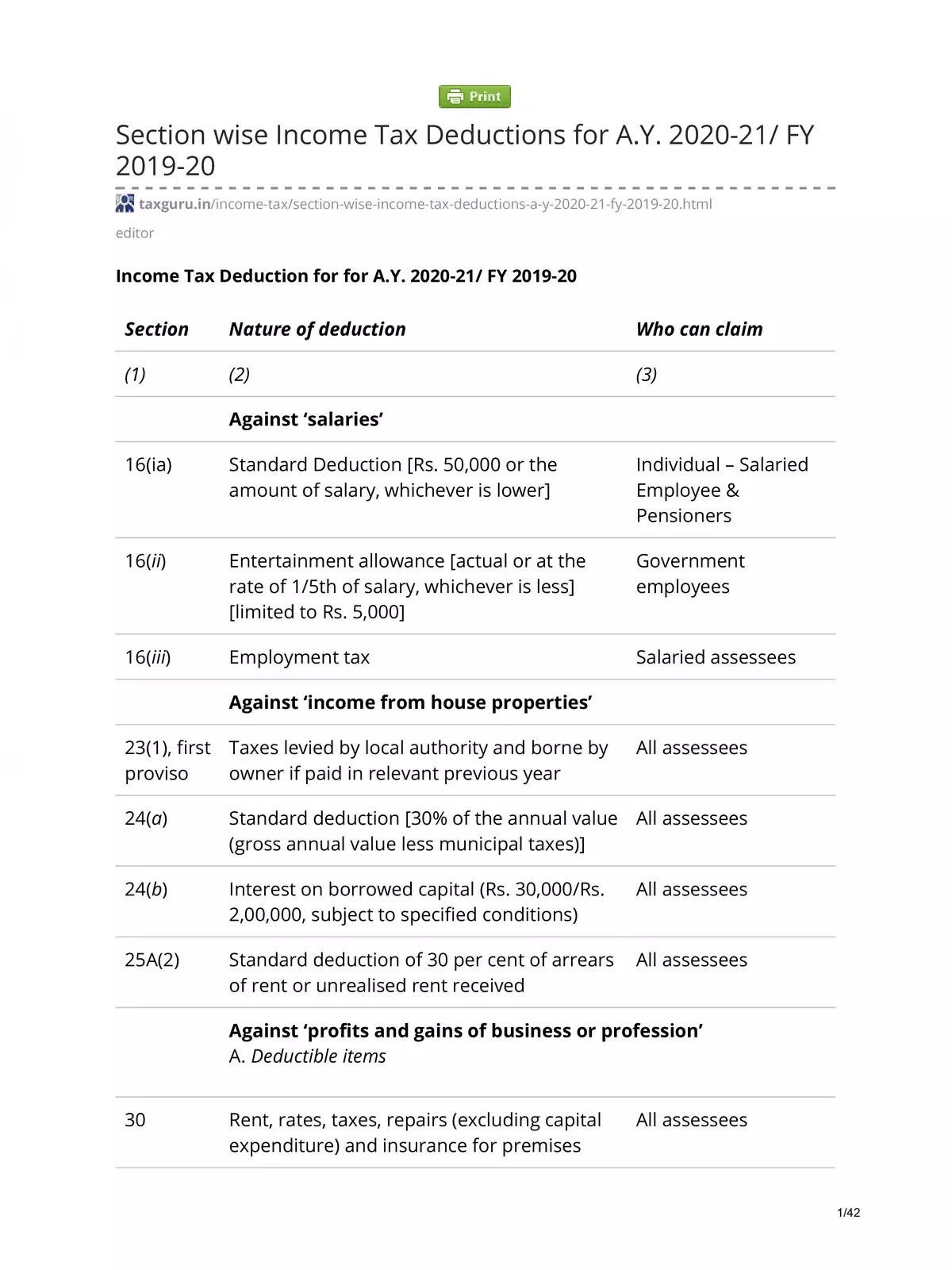

Income Tax Deductions for AY 2020-21 - Summary

A deduction from an Income Tax point of view is the investment/expenditure made by you that help you save taxes. So, the income tax deduction reduces your gross income (means the income on which, the tax has to be paid). Thereby, reducing your tax on your total income.

Section 80C

80C came into force with effect from 1st April 2006. Section 80C provides deductions for savings for deduction under income tax and their limits. Section 80C enables taxpayers to claim a deduction of Rs 1,50,000 from total income. Claimants can include individuals or a Hindu Undivided Family (HUF). For those who have paid excess taxes and made suitable investments in LIC, PPF, Mediclaim, and expenses incurred towards tuition fees, etc., filing Income Tax returns will enable people to get a refund.

Section 80CCC

Section 80CCC of the Income Tax Act provides an Income tax exemption for payments and deposits made for any annuity plan of LIC or any other insurer. The plan must enable the insured to receive a pension from a fund referred to in Section 10(23AAB), upon surrender of the annuity, including interest or bonus accrued on the annuity, taxable in the year of receipt.