Income Tax Challan Form 284 - Summary

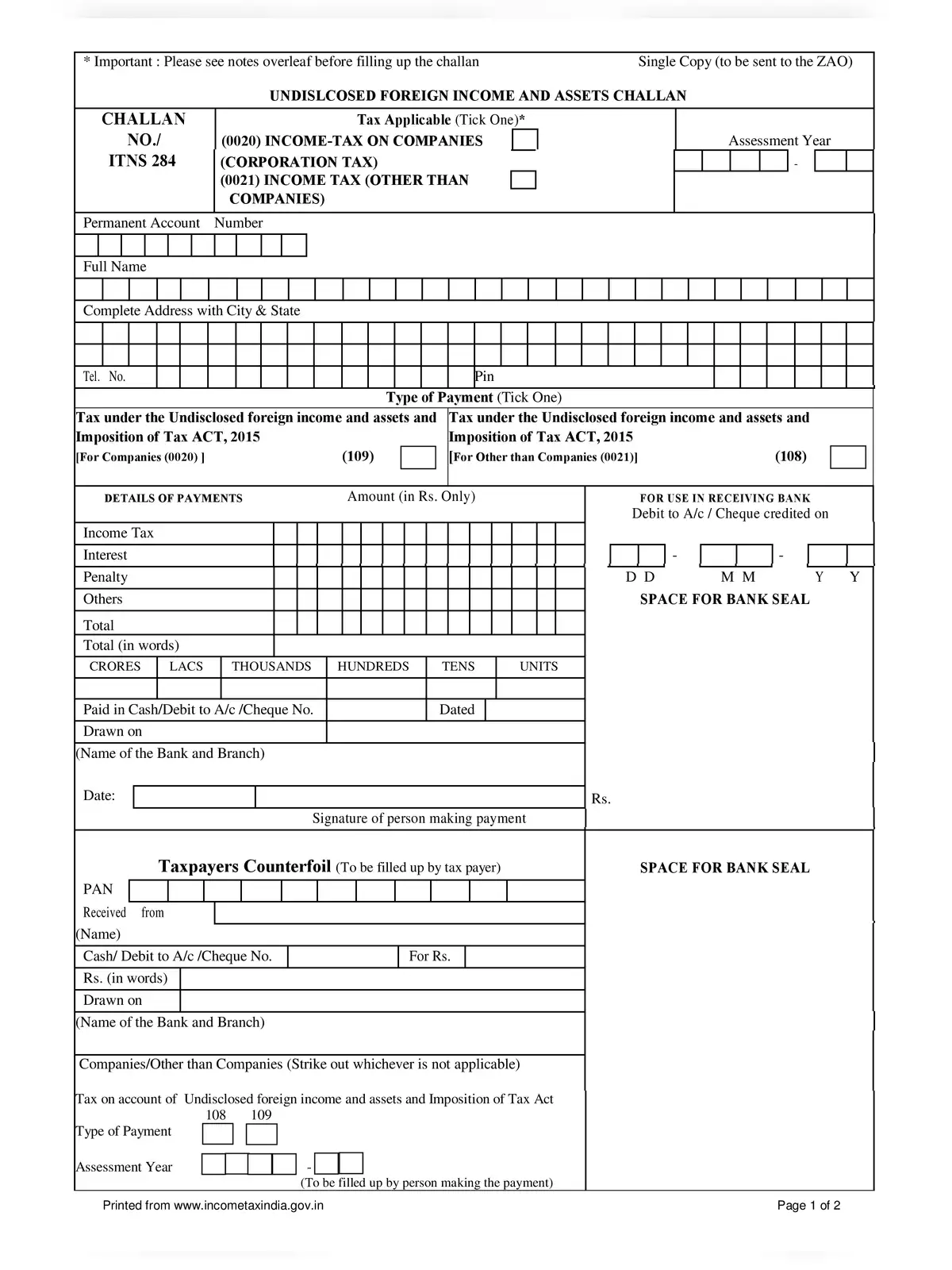

The Income Tax Challan Form 284 is very important for both corporate and non-corporate taxpayers in India. This form is especially used to pay taxes under the Undisclosed Foreign Income and Assets and Imposition of Tax Act, 2015. Knowing how to fill out this form correctly is essential to meet the tax laws in India.

What is the Income Tax Challan Form 284?

Income Tax Challan Form 284 is a payment form that helps taxpayers pay taxes on undisclosed foreign income and assets. Many people may not realize that there are specific penalties and rules under this act. Therefore, it is vital to understand this challan and use it properly to avoid complications.

How to Fill the Income Tax Challan Form 284

Filling out the Income Tax Challan Form 284 needs careful attention to details. Taxpayers should provide correct information about their income and assets. It is advisable to look at the official guidelines or ask a tax expert for assistance if necessary.

After you complete the Income Tax Challan Form 284, ensure that you check all details before submitting it. Errors or incomplete forms can cause delays or problems with tax payments. Always keep a copy of the submitted form for your personal records.

For more details about the procedures, rules, and regulations concerning the Income Tax Challan Form 284, you can download the PDF document available below. This document will give you more insights and a detailed guide on how to use the form effectively.

By understanding the Income Tax Challan Form 284 and following the correct steps, you can avoid possible penalties. Make sure to use the PDF for a complete grasp of the topic and ensure that your tax payments are both accurate and prompt. 📄