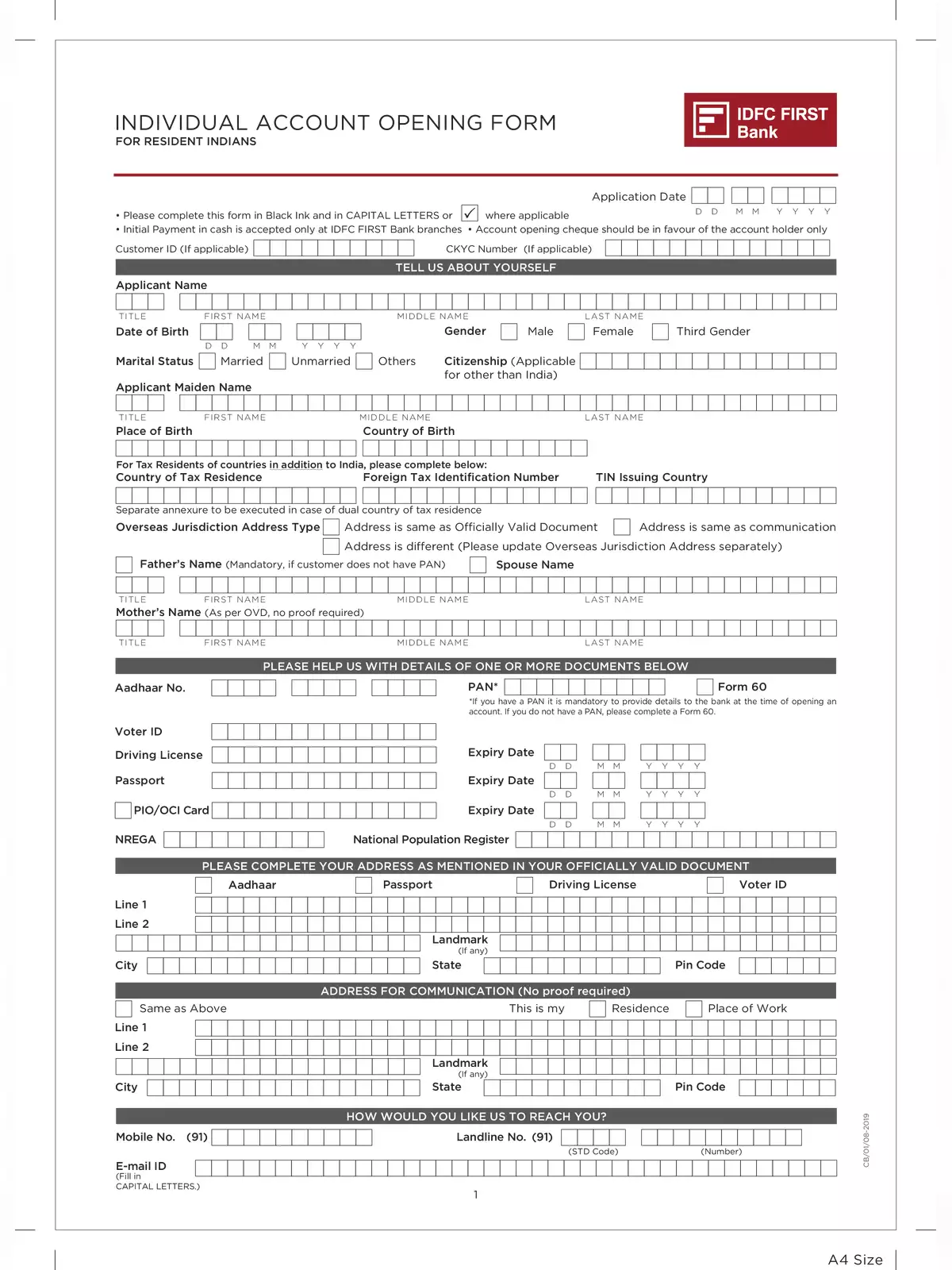

IDFC First Bank -Individual Account Opening Form - Summary

Banking has become more user-friendly over time, especially with the introduction of the IDFC First Bank – Individual Account Opening Form for a basic savings bank deposit account (BSBDA). This convenient account can be opened by any resident Indian national by providing just a few documents.

Explore More About BSBDA

If you’re eager to learn more about this banking innovation, you’ve come to the right place! A BSBDA account comes with essential features that you should know about, including balance limits, transaction limits, interest rates, and KYC documents. Keep reading to find out more.

Eligibility Requirements

Any resident Indian national can open a BSBDA small account, provided they meet certain conditions. It’s important to be aware of these guidelines to effectively manage your BSBDA account. First and foremost, the total balance in your BSBDA account must never exceed Rs 50,000. If your account balance goes beyond this limit, you won’t be able to make any more credit transactions until it drops below this amount.

Additionally, the total credits in your account during a financial year should not be more than Rs 1 lakh. Lastly, within a single month, the total withdrawals and transactions in your BSBDA small account should not go over Rs 10,000.

Fees and Charges

The good news is that there are no non-maintenance of balance fees for a basic savings bank deposit account. Plus, you can get a checkbook for free! However, there might be a fee for issuing duplicate or ad-hoc statements. Demand drafts typically come free as long as they are within a certain limit. There may also be fees for collecting checks from the local clearance zone, but inquiring about your balance at a bank branch is always free.

For more detailed information, you can download the PDF of the IDFC First Bank – Individual Account Opening Form available below. Don’t miss out on the chance to simplify your banking experience with easy access!