HRA Declaration Form (Go. No. 97SE(B). dt 07-03-2001) - Summary

House Rent Allowance (HRA) is a vital part of a salaried person’s income, making it easier to manage housing costs. Unlike basic salary, HRA is not fully taxable, which is a big relief for many. According to Section 10 (13A) of the Income-tax Act, 1961, a portion of HRA can be exempted, reducing the total income before calculating the taxable amount.

Understanding HRA Calculation

To understand HRA calculation, it’s important to know what is included in salary. Salary consists of basic pay, dearness allowances, and any commissions you might earn. If commissions and dearness allowances are not part of your income, your HRA will usually be about 40% to 50% of your basic salary.

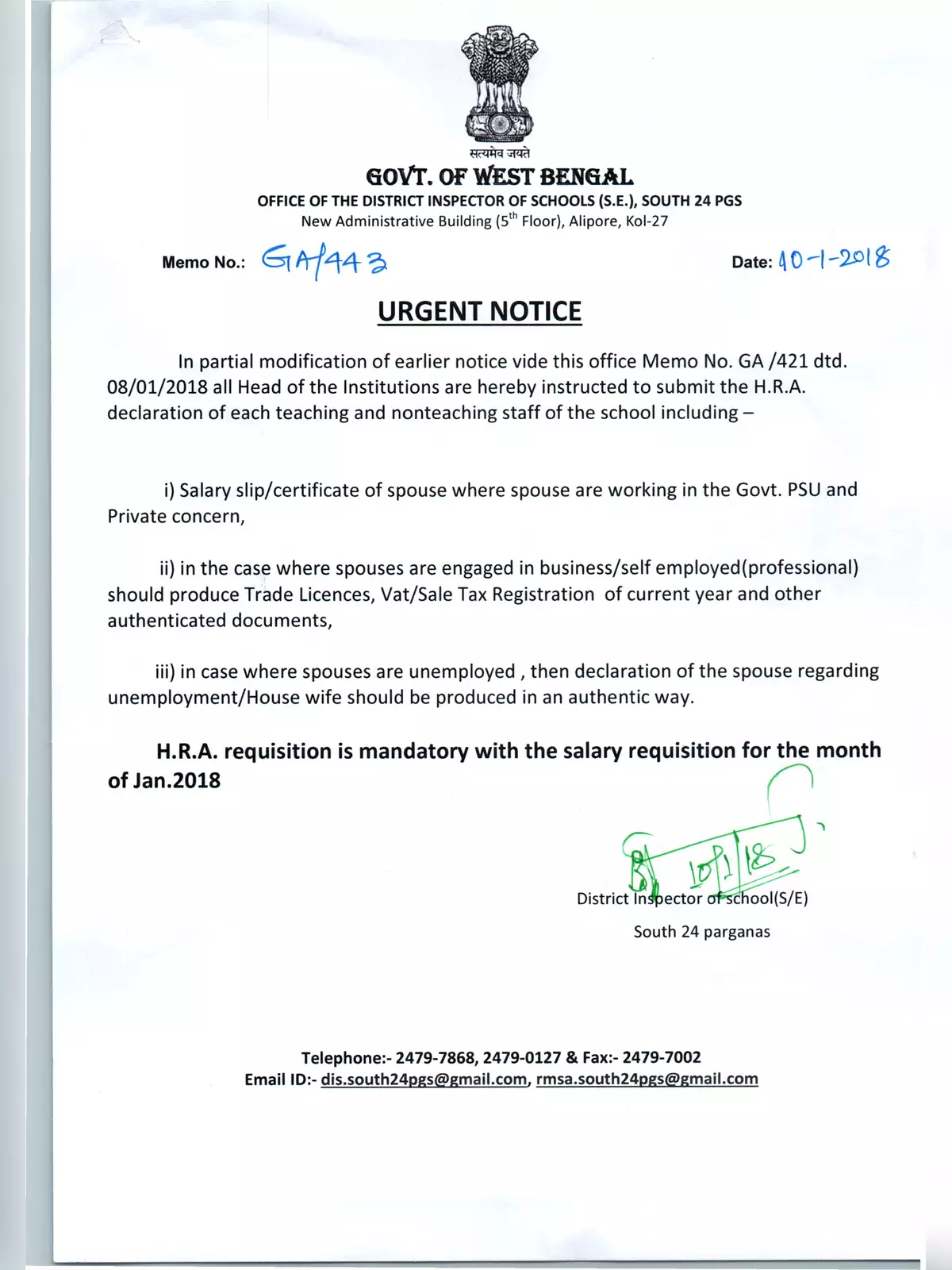

Access HRA Declaration Form

You can easily download the HRA Declaration Form (Go. No. 97SE(B). dt 07-03-2001) in PDF format from the link below. This form is required to efficiently claim your HRA exemptions and ensure you benefit from the tax relief available.