HDFC RTGS Form 2026 - Summary

HDFC RTGS Form is used when you want to transfer a large amount of money from your HDFC Bank account to another bank account anywhere in India. RTGS stands for Real Time Gross Settlement, which means the money is transferred immediately and securely, without any delay. This service is mostly used for payments above ₹2 lakh, and it ensures that the amount reaches the receiver’s account in real time.

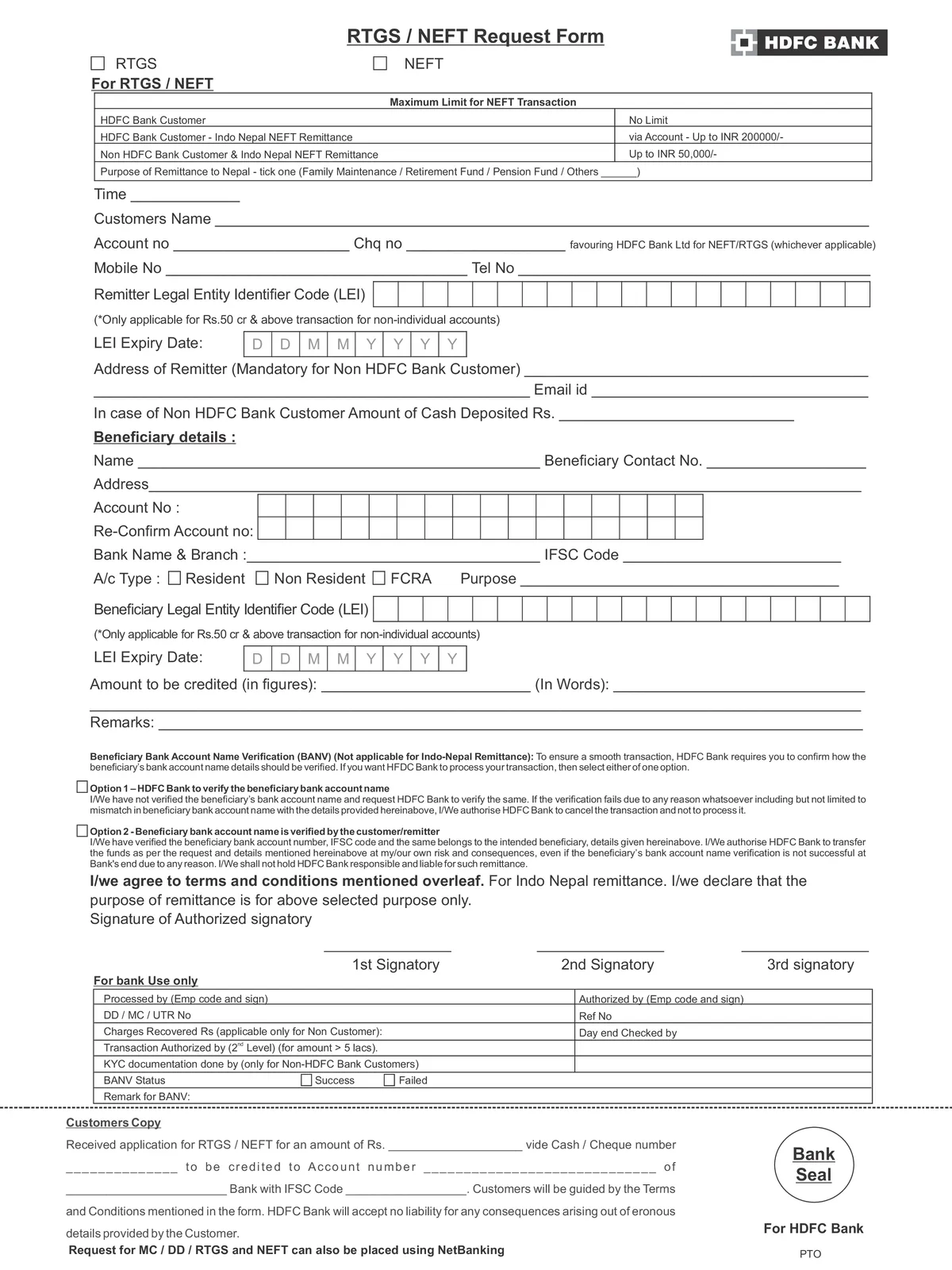

This form includes details like your name, account number, branch, beneficiary’s name, bank name, IFSC code, and the amount to be transferred. You can fill and submit this form at any HDFC Bank branch or through online banking. It helps make big payments quickly and safely, whether for business or personal use.

HDFC RTGS Form – Download, Fill & Submit

| Type of Form | RTGS / NEFT Form 2026 |

| Name of Bank | HDFC Bank |

| Official Website | https://v1.hdfcbank.com/ |

| Language | English |

| Uses of Form | Online Transfer of Funds |

| Minimum Limit | 2 Lacs |

| Maximum Limit | No limit |

| Beneficiary | Bank Customers |

| HDFC RTGS Form PDF | Download PDF |

How to Fill up RTGS Form of HDFC Bank

- You will find there are two sections in the NEFT/RTGS form. The top section is for Beneficiary Details and the below section is for Remitter details.

- Details of the Remitter: Name of the Account Holder, Account Number, Account Type, Amount, Cheque details, IFSC Code, Bank Branch address

- Details of the Beneficiary: Account Number, Bank Name, IFSC Code, Amount, Any other Details

- The bank will “Branch Use Only” Section after completing the transaction where they will mention the transaction ID etc.

After carefully filling the form submit this form to the nearest branch of HDFC Bank along with the necessary documents. Here are two benefits of making use of the RTGS payment facility:

- You will be able to send large sums of money to any bank account with the help of RTGS payment systems.

- Apart from this, all the RTGS payments are in real-time, meaning that you do not need to wait for the payment to be processed.

How to Make RTGS Payment Online in HDFC Bank

If you are making use of the online RTGS facility, then here are the steps you need to follow:

- You will need to have your user ID and password ready

- Go to your bank’s official website – https://v1.hdfcbank.com/

- Log in to the net banking account – Link

- Once you log in, add the details of the beneficiary if you have not added the details

- Once the details of the beneficiary are added, you will need to go to the option for RTGS transactions

- Enter the details of the beneficiary and the payment to be processed to make the transactions

- Submit the application and the funds will be transferred to the beneficiary instantly

Required Documents for HDFC RTGS Form

- RTGS/NEFT Application Form

- Cheque leaf

- And any other documents

RTGS Stands for Real-Time Gross Settlement while NEFT stands for National Electronic Fund Transfer. NEFT and RTGS form for HDFC banks can be used to transfer any allowed amount to any other bank account in the country.

HDFC Bank NEFT/RTGS Timings

- HDFC NEFT Timings: The time to transfer money through NEFT is Monday to Friday: Branch Working hours and for net banking up to 6 PM (Exclude Saturday and Sunday)

- HDFC RTGS Timings: The time to transfer money through RTGS is Monday to Friday: 10 AM To 3:30 PM and Saturday (excluding 2nd and 4th ): 10 AM To 3:30 PM.

HDFC Bank RTGS Form 2026 in All Languages

- HDFC RTGS/NEFT Form Hindi

- HDFC RTGS/NEFT Form Assamese

- HDFC RTGS/NEFT Form Bengali

- HDFC RTGS/NEFT Form Gujarati

- HDFC RTGS/NEFT Form Kannada

- HDFC RTGS/NEFT Form Malayalam

- HDFC RTGS/NEFT Form Marathi

- HDFC RTGS/NEFT Form Odia

- HDFC RTGS/NEFT Form Punjabi

- HDFC RTGS/NEFT Form Tamil

- HDFC RTGS/NEFT Form Telugu

If you’re interested in learning more about HDFC Bank RTGS (NEFT) and how to use it effectively, you can get the detailed information in the PDF available for download below.