GST HSN Code List 2026 - Summary

The GST HSN Code List is an essential tool for businesses in India. HSN, which stands for “Harmonized System of Nomenclature,” was created by the World Customs Organization (WCO). The main purpose of introducing HSN codes is to classify goods systematically. This system helps clear confusion and enables smooth domestic and international trade. With over 20,000 goods traded globally using HSN codes, they account for more than 90% of world trade, including in India, which has implemented these procedures.

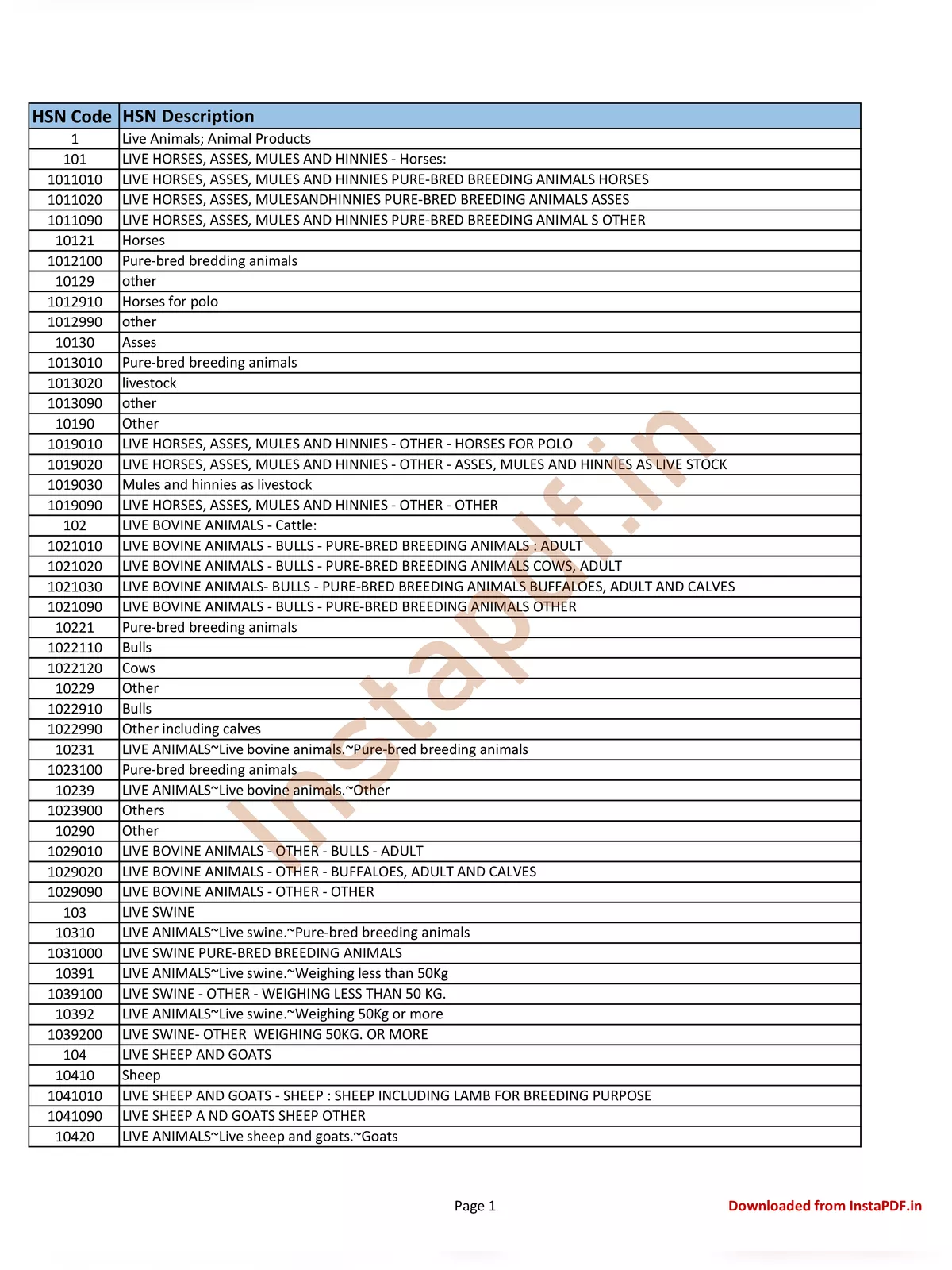

GST HSN Code Applicability Criteria

HSN codes are primarily used by dealers and traders. They must use 2-digit, 4-digit, or 8-digit HSN codes based on these criteria:

- If the business turnover is less than Rs. 1.5 crores, there is no requirement to adopt HSN codes.

- If the business turnover ranges from Rs. 1.5 crores to Rs. 5 crores, they must utilize 2-digit HSN codes for their transactions.

- If the business turnover exceeds Rs. 5 crores, 4-digit HSN codes are necessary.

- For import and export transactions, as well as international dealings, 8-digit HSN codes must be used.

How to Download the Latest GST HSN Code List

Follow these simple steps to easily search for the Latest HSN code:

Step 1: Visit the official Goods and Services Tax website at gst.gov.in.

Step 2: On the home page, click on the services category and select “Search HSN Code”.

Step 3: You can also use this direct link: Search HSN Code.

Step 4: Enter the HSN Chapter by name or code and click the “Search” button. The corresponding HSN code will then be displayed on your screen.

Get the Latest HSN Code List in Excel

You can easily download the GST HSN Code List in Excel format from the link provided below:

Download HSN Codes List in Excel

You can also download the GST HSN Code List as a PDF from the link provided below.